Computers and consumer electronics infiltrated society in the 1990s, with North American metalformers supplying cases, disk drives and various hardware. But by the end of the decade much of this part production had moved south and overseas.

Here to stay, however, are computers themselves, with the ’90s witnessing the “Internet Revolution,” dramatically increased computing power and huge software advancements. All of that meant instant communication worldwide, better machine control, nearly real-time management of metalforming operations, and the ability to quickly design stamped and fabricated parts and tooling and simulate the production process.

The 2000s

|

| “The Small-Lot Scenario,” an article published in our November 2001 issue, examined the trend toward just-in-time supply of smaller part runs and how short-run specialists made that happen. “More and more companies are trying to drive stampings down to a commodity where they are looking at price,” said Jeff Newmark, president of WLS Stamping Co. “We look to reduce our costs…work toward lean manufacturing and attack waste…The biggest non-value operation is setup time.” |

Challenges confront the industry from all sides.

How to compete? That’s what metalformers and fabricators asked themselves at the start of the new century. Customers demanded price givebacks while metalformers paid more for raw materials, energy, health care, etc., further eroding already thin profit margins. Competition from Asia, primarily China, essentially eliminated “commodity” tool and part producers in North America. And growing markets, especially in Asia, demanded that metalformers find s to stay close to customers serving those markets.

On the political scene, steel tariffs in the early 2000s tightened supply and helped push prices to record levels. Lawmakers heard from metalformers concerned with Chinese currency valuation, labor, taxes and other issues stressing the industry.

So where did that leave us? All of this forced the metalforming community to become leaner and meaner than ever before. Toward that end, MetalForming in the 2000s focused editorial coverage on providing methods for producing high-quality parts as quickly as possible, and delivering just what the customer wanted. That meant getting the most out of existing equipment or upgrading to get the job done; adding value within the line; employing sensors and controls so that machines and tooling worked optimally; and ensuring that shop-floor employees had the tools they needed, and the knowhow to get the most out of them.

Shorter Part Runs a Trend

“The Small-Lot Scenario,” an article published in our November 2001 issue of MetalForming, examined the trend toward just-in-time supply of smaller part runs and how short-run specialists made that happen.

“More and more companies are trying to drive stampings down to a commodity where they are looking at price,” said Jeff Newmark, president of WLS Stamping Co., Cleveland, OH. “We look to reduce our costs. One to do this is to tell people to work harder. The other is to make a change—work toward lean manufacturing and attack waste. We view the people making the parts as value-added and everything else as nonvalue-added. We won’t tell our value-added people to work harder. We will look at nonvalue-added and see how we can save there.

“The biggest nonvalue operation is setup time,” Newmark continued. “To reduce setup times, we invested in extra capital. We have two or three times as many presses as press operators. We looked at how we can eliminate setup time and take advantage of a progressive tool developed for quick setup, couple it with the economy of the short-run stamping tooling and come up with something that works.”

New Steels, and the Metalforming Technology Needed to Process Them

Steel products evolved dramatically through the early part of the century (and continue to do so today), as pointed out in “Advanced High-Strength Steels for Stamped Automotive Parts,” an article MetalForming published in March 2005.

|

| MetalForming covered the migration of manufacturing from the traditional rust belt to southern states in a January 2008 Special Report. It began: “The widespread use of air conditioning; increased mobility due to creation of the national high system and other modes of transportation; the weather. Any and all of these reasons, and many others, have contributed to steadily rising population in the Southeast United States over the last half century.” |

“Since 2000, the global automotive industry has seen rapid improvements in automotive steels, especially with the application of advanced high-strength steels (AHSS) including dual-phase (DP) alloys and transformation-induced-plasticity (TRIP) steels,” the article read. “Predictions by major OEMs throughout the world suggest that AHSS products will replace, in large percentages, the conventional mild and HSLA steels applied throughout body and chassis structures.

“When presented with making an AHSS part from DP or TRIP steel,” the article continued, “what should the metalformer know? The short answer is that whatever you know about high-strength steels compared to mild steels still applies when forming AHSS. AHSS materials usually will have higher yield strengths and much higher ultimate tensile strengths, so the metalformer must anticipate higher press loads and greater springback and die wear. Forming, as well as welding, is proportionally affected by higher material strength and different microstructures.”

Manufacturing’s Migration South

MetalForming covered the migration of manufacturing from the traditional rust belt to southern “right to work” states in a January 2008 Special Report. It began:

“The widespread use of air conditioning; increased mobility due to creation of the national high system and other modes of transportation; the weather. Any and all of these reasons, and many others, have contributed to steadily rising population in the Southeast United States over the last half century. Mirroring the population, economic fortunes also have risen in a region that at one time was the nation’s poorest. With city, county and state governments onboard, manufacturing has found a home in the Sunshine Belt, promising jobs, revenue and long-term economic stability for inhabitants.”

Following the upward trend, and also a major contributor, was the automotive industry, led by transplant OEMs setting up shop in Alabama, Mississippi and other nearby states.

Of course, with the OEMs came their suppliers—transplant and domestic.

Leaning on Lean and Green

|

| In February of 2008 we published an article on motivating the shop floor in a lean transition. “Becoming a lean, world-class company requires overcoming organizational inertia,” the article said. “Often overlooked are outdated cultures, ineffective management skills, untrained workers, bureaucratic red tape, and traditional pay-and-reward systems that do not fit. In transitioning to lean manufacturing, factories, systems and organizations must be streamlined.” |

Then the economy swooned, beginning in 2008, and in response many looked at lean manufacturing as a to reduce costs—and labor input. In February of 2008 we published an article on motivating the shop floor in a lean transition. What was needed was a fresh approach to company culture.

“Becoming a lean, world-class company requires overcoming organizational inertia,” the article said. “Often overlooked are outdated cultures, ineffective management skills, untrained workers, bureaucratic red tape, and traditional pay-and-reward systems that do not fit. In transitioning to lean manufacturing, factories, systems and organizations must be streamlined. Lines of communications must be opened and barriers between departments dismantled. Manufacturers must put an end to the ‘we’ve als done it that ’ argument. For the lean transition to be successful, employees must be highly involved in assuming new skills and responsibilities.”

Green manufacturing also surfaced to top of mind around this time, as part of a lean strategy as well as a to reduce costs. Along with the popular green strategies such as implementing more energy-efficient lighting, metalformers began to look closely at reusable packaging products. Reusable packaging, as an alternative to wooden pallets or corrugated-cardboard boxes, was seen as a to reduce waste and the nonvalue-added labor for setup and breakdown of the boxes, and to improve warehouse-space utilization as well as worker safety, since ergonomically designed containers can ease handling. Reusable packaging also can improve product flow in terms of safe and efficient transfer of parts and subassemblies to the customer.

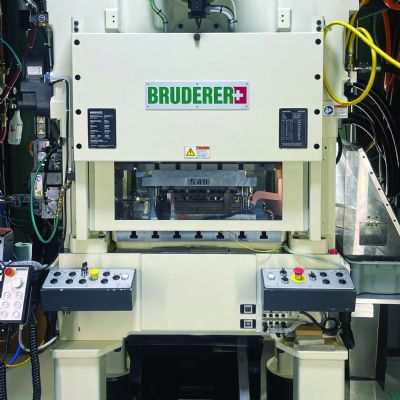

Smarter Motion Controls for Presses

The last half of the decade also was an exciting time in the controls industry, where, in particular for hydraulic presses, we welcomed improved positioning and force control that paved the to higher part quality and productivity, and reduced maintenance costs. Adding closed-loop electro-hydraulic motion controllers with position-pressure/force-control capabilities became popular for making new hydraulic presses excel or for enabling older machines to function like new. And, retrofitting open-loop control systems with these controls provided another dimension of control to increase productivity, improve quality and decrease maintenance costs.

New controls also improved the ability of metalformers to gather, track and analyze production data in real time. Metalformers began in a big to use this data-collection software to track running and idle time automatically as it polls the controllers, and also to automatically collect any unplanned downtime events initiated by the controllers. These events include tonnage and sensor faults. Stampers began to keep detailed event logs that provide a time- and date-stamped account of every event at every machine.

Also, the software knows where and when every tool runs, and how many parts the tools make. Therefore, metalformers now were able to keep an accurate total-hits count for each die—even as the die runs in multiple presses—eliminating tedious and sometimes inaccurate manual recordkeeping.

The unplanned-downtime information not only identifies problem equipment, but also objectively quantifies the severity of problems to allow efficient prioritizing of corrective actions. With objective information on machine utilization, metalformers now were able to justify delaying or cancelling some planned equipment purchases, while fast-tracking others. Data became king—collecting it, analyzing it and putting it in a form that metalformers could use to make informed, sound decisions about their businesses.

On the Die-Design Front

|

| An April 2009 article titled, “Forming Higher-Strength Steels,” notes that “stamping higher-strength steels can affect the size, strength, power and overall configuration of every major piece of the press line, including coil-handling equipment, coil-feed systems, straightening machines and presses.” |

During the mid to late part of the decade, many die shops, as well as stampers that built their own dies, began to take a close look at the rapidly advancing 3D design software. In fact, as detailed in a July 2008 MetalForming article on the move from 2D to 3D die design, we noted how the Applied Manufacturing Technology Center at Moraine Park Technical College (MPTC) ended its 2D die-design course in 2004, and replaced it with 3D design.

At the time, John Cawley, tool-design instructor at MPTC, told us that 3D design software allowed him to teach students more about die design in a shorter amount of time. One reason: It automates the mundane tasks of die designing, which speeds the overall process. In addition, the process proved to be much more visual than with 2D design.

Late in 2008, PMA welcomed ne Boeckman as its 2009 chairman, who at the time served as president of Quick- Stamping Inc. of Texas. Boeckman’s theme as chairman was, “Expanding Opportunities…new Ideas, Products and Markets,” and it struck a particularly harmonic chord with MetalForming magazine and PMA. It truly shone the spotlight on a key trend of the time. That was, the need for metalformers to look beyond existing core competencies and expand into new processes and customer markets.

“You can’t continue to do things the same you’ve been doing them,” Boeckman said. In his company’s case, that translated into acquisition of metal-fabrication equipment such as turret punch presses, press brakes and laser-cutting machines. Boeckman’s claim that “fabrication opens new doors for us,” became one oft-repeated by metalformers over the next several years, and in fact is still commonly heard around the industry; I expect it will continue to resonate for some time.

One catalyst that brought traditional stampers to the table for CNC fabricating equipment—notably turret punch presses—was the growing ability of these machines to perform forming operations, in addition to making holes and nibbling contours. This ability, due primarily to tooling innovation, allowed stampers to develop prototype parts on a turret press, then decide, based on production volumes, whether it made sense to tool up a stamping press to enter production of a new part, or to just soft-tool a turret press to satisfy relatively low-volume production runs. Flexibility—in every sense of the term—became the mantra, and still is.

A New Era in Metalforming-Equipment Capabilities

Meanwhile, on the stamping front—particularly the automotive-stamping front—we continued to experience rapid advancement in advanced high-strength steels. This trend helped to usher in a new era of metalforming-technology advancements. Thanks to lightweighting initiatives, steelmakers poured even more research and development resources into devising new steel grades with tensile strengths as much as three times greater than traditional mild steels, but also with significantly less formability. Forming AHSS grades in high volumes for the automotive industry now challenged the metalforming industry to develop new cleaner and more homogeneous tool steels, as well as beef-up presses and feed equipment.

As MetalForming columnists Stu Keeler and Pete Ulintz wrote in an April 2009 article titled, “Forming Higher-Strength Steels:”

“The increased forces needed to form, pierce and trim higher-strength steels creates significant problems for pressroom equipment and tooling, including excessive tooling defections, damaging tipping moments, and amplified vibrations and snapthrough forces that can shock and break dies—and sometimes presses. Stamping higher-strength steels can affect the size, strength, power and overall configuration of every major piece of the press line, including coil-handling equipment, coil-feed systems, straightening machines and presses.

“Nowhere in the coil-feeding system will higher-strength materials require more attention than in the coil straightener,” the article continued. “Straighteners are recognizable by their large roll diameters and relatively wide spacing. The roll diameters and center distances vary depending on material thickness and coil width. The rated capacity of most pressroom straighteners is based on processing mild steel with yield strengths below 340 MPa. Higher-strength steels, due to their higher yield strengths, have a greater tendency to retain their coil set. This requires greater horsepower to straighten the material within an acceptable level of flatness. Larger-diameter rolls and wider roll spacing also are required to work the material effectively. Increasing roll diameter and center distances on straighteners to accommodate higher-strength steels will limit the range (thickness and width) of materials that can be straightened effectively.”

Toward the end of their article, Keeler and Ulintz summarized the times, when they wrote:

“Working with higher-strength materials will require stamping companies and tool and die shops to work closely with higher-strength-material producers and tool-steel suppliers in order to select the proper tool steel, heattreatment and surface-coating application appropriate for the sheet-material type and strength levels being processed.”

The “R” Word

This brings us to late 2009, when the proverbial you-know-what really hit the fan. But while many used this economic disaster (call it a recession) to write the obituary for American manufacturing, I wrote in my September 2009 signed editorial:

“U.S. manufacturing is in fact not extinct, but merely hibernating. As it awakens, it will be hungry, for materials, equipment, automation and trained—perhaps retrained—workers…Feed your hibernating company by focusing on generating new business and extending your business offerings in s you might not have thought about before. Our newly restored U.S. factories will have fewer ‘routine’ jobs than ever before. In their place should be jobs conceived for people who innovate and create—designers and engineers, researchers and developers—for the people who advance and expand their skills to meet new challenges.”

And that’s where we’ve been for the last few years. We’ve seen an onslaught of productivity gainers hit our production floors, from software-based tools for paperless die design and development, to automation equipment that keeps presses, lasers and other processes humming after hours. We’re bringing in new high-powered ERP software platforms that are setting new standards for the flow of information through our plants, with capabilities like integrated quality, capacity and inventory management.

We’re welcoming a completely new type of machines into our factories, such as servo-mechanical stamping presses and hot-stamping lines, next-generation hybrid and electric press brakes and turret presses and fast-cutting and efficient fiber lasers. New programming software for these machines improves usability and accuracy, even featuring 3D simulation and modeling to simplify programming and operation.

Press controls have continued to evolve, pushing press uptimes higher than ever before, while bringing PPM levels to all-time lows. Changeover times have dwindled, machinery throughput has skyrocketed and overall costs related to safety and quality continue to shrink. All of this adds up to the unthinkable just a few years ago—that is, reshoring of work moved to China and other “low-cost countries” back to the United States. Our plants are leaner, greener and cleaner than ever before. We’re experts in optimizing measures like value-add per employee and inventory turns.

I can’t wait to see what the future holds for the metalforming industry and the technology on whose back it rides. In my January 2012 signed editorial I wrote:

“This is indeed a very exciting time for metalformers, as our industry undergoes a period of rapid and significant technology evolution.”

And that evolution continues, with no end in sight. As such, we remain committed, as we have been for the last 25 years as MetalForming magazine and the years before as Metal Stamping, to bringing forth the latest/ greatest technology to help our industry flourish—for the next 25 years, and beyond.

MFView Glossary of Metalforming Terms

See also: Signature Technologies, Inc.

Technologies: Coil and Sheet Handling, Fabrication, Lubrication