Outside of an official order, Trump continued to threaten to impose 25% tariffs on Canada and Mexico, beginning February 1, and 10% on China, also on February 1. This issue’s publishing schedule precedes Feb. 1; time will tell what occurs on that date, but it’s highly likely that tariffs in some form will be applied. Tariffs of 25% on steel and 10% aluminum from all countries except Canada and Mexico currently exist, as well as on a multitude of other imports, including solar panels.

Because tariffs are imposed on the company importing foreign-made goods, and then typically passed along to their consumers, the tariffs are expected to raise prices on metal formers and fabricators’ inputs—as the steel and aluminum tariffs have—and subsequently, on auto prices. However, if the tariffs favor demand for U.S. manufactured stampings, assemblies, and tool and die over imports as intended, metal formers and die makers certainly will benefit. On the other hand, Laurie Harbour, partner with Wipfli warns, “Regardless of tariffs, low-cost imports of tools and dies will continue to pressure U.S. manufacturers.”

EVs, Incentives, Manufacturer Funding. At times, the seismic shift from ICE vehicles to EVs has moved with the speed of a tectonic plate, it seems—especially in North America. At 8% of the 2024 new-vehicle fleet being pure electric, the United States trails Europe, at 23% and China, at 40%, according to Associated Press and other sources.

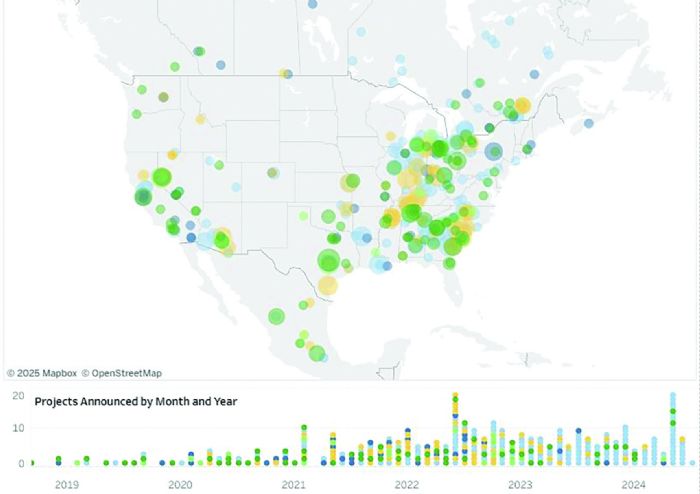

Just as the effects of the Inflation Reduction Act, passed in 2022, began to layer in, boosting EV sales and prompting automakers to build plants and shift production to North America, Trump expressed his intent to rescind it, and by executive order, he paused the distribution of remaining allocated funds not yet spent. The Act provided incentives to $7500 to consumers to buy EVs, including hybrids, as well as funding to automotive-industry manufacturers.

The Bipartisan Infrastructure Law included $7.5 billion funding to expand the EV charging network; Trump wants to claw back any unspent funding on that as well.

Because legislation cannot be undone by presidential executive order—rather, it must be done by an act of Congress—that may not occur, at least not in 2025, analysts say. “The Inflation Reduction Act (IRA) has been codified since 2022 and requires Congressional action to substantively change,” states Stephanie Brinley, associate director of AutoIntelligence for S&P Global Mobility. “Reducing IRA funding will need both House and Senate approval,” she states, conceding that because Republicans won majorities in both the House and Senate, Trump may have support in both chambers.

Because legislation cannot be undone by presidential executive order—rather, it must be done by an act of Congress—that may not occur, at least not in 2025, analysts say. “The Inflation Reduction Act (IRA) has been codified since 2022 and requires Congressional action to substantively change,” states Stephanie Brinley, associate director of AutoIntelligence for S&P Global Mobility. “Reducing IRA funding will need both House and Senate approval,” she states, conceding that because Republicans won majorities in both the House and Senate, Trump may have support in both chambers.

However, there are conflicts for Republicans, Brinley maintains. Part of the IRA includes funding for manufacturing investment, which has been a factor in new OEM and supplier factories and developments, and in building a more robust North American supply chain, she says. “Approximately 84% of the jobs supported by IRA funding are in Republican states,” Brinley notes. “Several Republican governors quickly expressed that they do not want the IRA to change, at least relative to manufacturing credits.”

However, by executive order, Trump paused the distribution of the remaining allocated funds.

Regardless of the status of tax incentives, Cox Automotive chief economist Jonathan Smoke projects that one in four vehicles sold in the United States will be electrified—including hybrids—bringing them into the mainstream in 2025. “We remain firm in our continued belief that EV sales in the United States will follow a long-term growth path,” he says. A record-breaking 1.3 million battery EVs were sold in the United States in 2024. “Another reason we remain bullish on growing EV sales,” Smoke adds, “is an ever-improving infrastructure to support charging. Significant government and industry money already is flowing into the nation to expand the network, and even new leadership in Washington won’t slow that down in the year ahead.”

Gartner agrees, reports Reuters. “Despite the challenges to electrification, Gartner expects shipments of electric buses, cars, vans and heavy trucks to grow overall by 17% in 2025.” It forecasts more than 50% of all vehicle models marketed by automakers to be EVs by 2030.

Emissions Standards. “Trump’s reelection brings forth the specter of a significantly different regulatory environment in the year to come,” says Larry Avila, editor, Automotive Dive. Trump signed an executive order that supports easing vehicle-emissions and fuel-economy regulations in addition to issuing an executive order to withdraw the United States from the Paris Climate Accord, which will change what environmental targets the United States sets for itself, S&P Global’s Brinley notes.

Emissions Standards. “Trump’s reelection brings forth the specter of a significantly different regulatory environment in the year to come,” says Larry Avila, editor, Automotive Dive. Trump signed an executive order that supports easing vehicle-emissions and fuel-economy regulations in addition to issuing an executive order to withdraw the United States from the Paris Climate Accord, which will change what environmental targets the United States sets for itself, S&P Global’s Brinley notes.

It cannot pivot on a dime, though, she remarks. “Though the Trump administration may push for a fast change to the emissions rules, changes and fuel economy requirements must be finalized 18 mo. prior to the model-year start. As a result, we do not expect changes to emissions or fuel-economy requirements to take effect before the 2028 model year,” she says.

The real wrinkle in emission standards compliance stems from misalignment of the EPA’s, NHTSA’s and California’s emissions board (CARB), Brinley continues. “Current EPA greenhouse-gas (GHG) emissions and NHTSA fuel-economy regulations for light vehicles run through 2032. However, these regulations are not aligned, making it difficult for automakers to meet both standards.” She adds, “S&P Global Mobility assumes that automakers will not be able to comply with the later years of the federal regulations as written today. Change is needed to realistically align regulations with what is technologically feasible, with consumer demand for electrification technology, and with what is profitable at a price point consumers are willing to pay.”

China: Market, Competitor, Security Risk. The perception of an existential threat from mainland Chinese automakers and technology companies will directly affect the auto industry, Brinley believes. “China’s rapidly emerging place in the global automotive industry has become a sticking point and a concern for its cost-competitive position, its expansion into non-Chinese markets, and its potential for national and personal security concerns.”

As a market, China continues to be the largest vehicle consumer, at a trajectory to buy 27.5 million units in 2025. China continues to offer EV subsidies to increase consumer demand. Competition for that market is said to be fierce, with Western automakers competing on price with Chinese OEMs.

As a competitor, China is gaining. Much speculation has stirred lately around the prospect of Chinese automaker BYD entering the U.S. market with lower-priced EVs. Right now, Chinese automakers face a “Not Welcome” sign in the United States, with the 100% tariff on Chinese-manufactured vehicles placed by former President Biden, and the recently imposed ban on China-sourced connected-technology vehicles—expected to remain in place under Trump. One week before former President Biden left office, the U.S. Department of Commerce issued a finalized rule banning the sale or import of connected-vehicle hardware and software originating from China or Russia on the basis that they present an unacceptable risk to U.S. national security. Those technologies include cameras, microphones and GPS tracking, which the Chinese vehicles are equipped with.

Indirect Effect

Tax Policy. Many manufacturers have expressed concern about Trump’s Tax Cuts and Jobs Act expiring. Because the legislation does not expire until the end of 2025, this falls into the “Indirect Effect” column. Many of the provisions impacting small businesses, including pass-through entities such as LLCs, partnerships, sole proprietorships and S corporations, are set to expire between 2025 and 2028. If extended in some form—and it’s likely that it will—the lower tax rate will continue to benefit metal formers. Under the act, owners of pass-through entities can claim a deduction to 20% of qualified business income.

The downside of those tax cuts, comprising roughly $4 trillion, is that they likely will raise the federal budget deficit, as they did in Trump’s first term, unless accompanied by budget cuts or additional revenue of equal value. Otherwise, the cuts will require Congress to raise the debt limit. House Speaker Mike Johnson says that Republicans intend to pass a budget outlining their plans by the end of February.

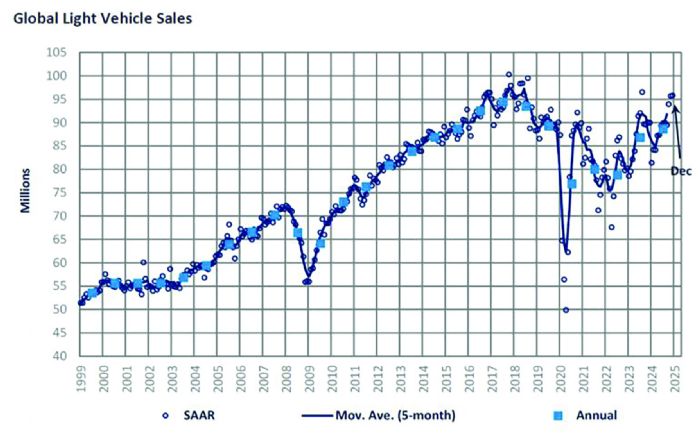

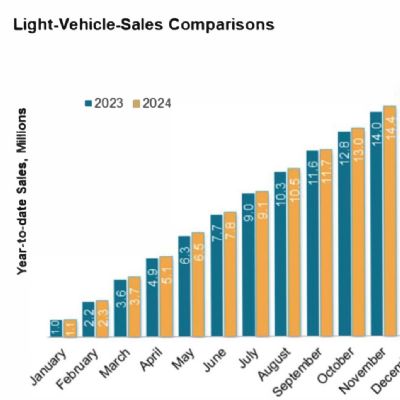

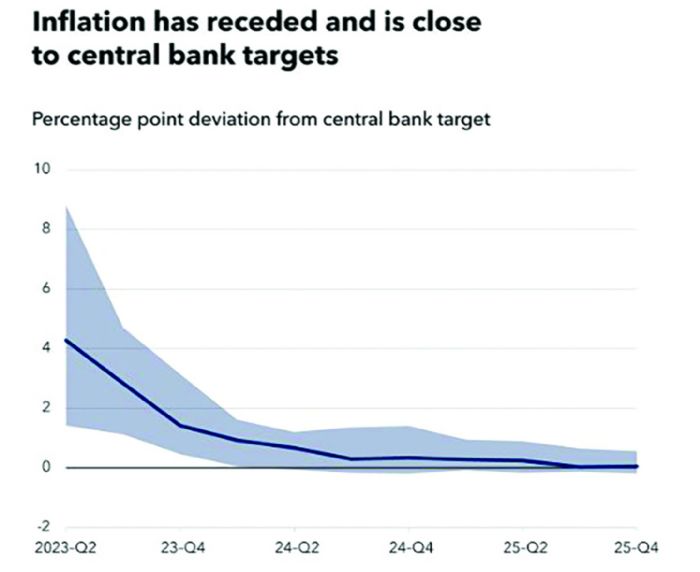

Inflation, Interest Rate, Incentives: Affordability. Vehicle affordability remains one of the industry’s biggest challenges, but is expected to improve in 2025, according to Smoke. The rate of inflation cooled globally for most of 2024, and even more so in the United States, at an average 2.95%, according to the U.S. Bureau of Labor Statistics. U.S. federal interest rates are on a downward trend, at 4.5% in January 2025, easing borrowing. Swelling inventories, reinvigorated by a restored supply chain, will prompt seller incentives. All of these trends will boost auto consumers’ spending power and tip the scale of vehicle affordability, hopefully resulting in boosted auto sales.

Mergers, Partnerships in EVs. Automakers have been partnering on EV battery development to share the cost burden and accelerate technical advancements.

In June, 2024, Volkswagen and Rivian announced a joint venture to build on Rivian’s software and electrical architecture “to create best-in-class software-defined vehicle technology platforms” to be used in both companies’ future EVs. Volkswagen Group committed to invest an initial $1 billion in Rivian, with as much as $4 billion in planned additional investment for a total expected deal size of $5 billion.

In December 2024, Honda and Nissan announced a potential merger, which would position the new company as the world’s third largest automaker with significant technology, manufacturing and supply-chain synergies. The move is said to be motivated by the need to compete with Tesla and Chinese EV manufacturers.

Maybe No Effect, But Interesting

Amazon Sells Cars. Prospective vehicle buyers now can add new Hyundai Motor Co. vehicles to their shopping carts on Amazon Autos, reports Automotive Dive. In January 2025, Amazon launched Amazon Autos, a retail platform that allows consumers to browse, order and finance any new Hyundai vehicle through participating dealers in 54 U.S. markets. This is the first time that an automaker has sold cars through the e-commerce company.

AI, Sensors, Autonomous Vehicles. 2025 also will see the automotive industry moving from Level 2 autonomy to Levels 2.5 and 3, representing a significant evolution in automotive, according to Forbes.

Persistence Market Research adds, “The automotive industry is undergoing a significant transformation, with electronic sensors being at the forefront of advancements in autonomous vehicles, driver-assistance systems and EVs. Sensors are vital for functions such as collision detection, lane-departure warning and adaptive cruise control, making driving safer and more efficient. As EVs continue to gain traction globally, the demand for advanced electronic sensors for battery-management systems and energy optimization is expected to rise.”

Closures. Several European and North American automaker factories are at risk of being closed or sold this year as automobile brands struggle with overcapacity and price competition, research and advisory firm Gartner reports, as they face emissions targets and tariffs, while China’s EV dominance will increase. Gartner VP Analyst Pedro Pacheco told Reuters, “This is a little bit like a pressure cooker. The pressure increases, increases and ... that will push the number of automakers to take more pragmatic decisions.”

Sustainability. As the world pushes toward sustainability, automakers are rethinking their manufacturing processes to minimize environmental impact. Beyond transitioning to EVs, companies are adopting more sustainable materials, renewable energy in production and recycling systems for vehicle components. By 2025, many automakers will have implemented carbon-neutral manufacturing practices and embraced circular economy principles. MF

View Glossary of Metalforming Terms

Technologies: Management

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Management

ManagementMetal Formers Turn the Page on the New Year with Optimism

Brad Kuvin, Lou Kren, Kate Bachman January 24, 2025

Additive Manufacturing

Additive ManufacturingPrecision Resource Launches New Website

Monday, July 14, 2025

Tariffs, Trade. In his first day in office, President Trump signed 42 executive orders and took more than 100 executive actions, but none of them was to impose 60% tariffs on China, and 25% tariffs on Mexico and Canada. Instead, he signed an executive order directing the secretaries of Commerce and Treasury and the United States Trade Representative to “investigate the causes of our country’s large and persistent annual trade deficits in goods … and recommend appropriate measures, such as a global supplemental tariff or other policies, to remedy such deficits.” He also directed them to determine the best methods of establishing an “External Revenue Service” to collect tariffs, duties and other foreign trade-related revenues. Currently tariffs and duties are collected by the U.S. Treasury from importers.

Tariffs, Trade. In his first day in office, President Trump signed 42 executive orders and took more than 100 executive actions, but none of them was to impose 60% tariffs on China, and 25% tariffs on Mexico and Canada. Instead, he signed an executive order directing the secretaries of Commerce and Treasury and the United States Trade Representative to “investigate the causes of our country’s large and persistent annual trade deficits in goods … and recommend appropriate measures, such as a global supplemental tariff or other policies, to remedy such deficits.” He also directed them to determine the best methods of establishing an “External Revenue Service” to collect tariffs, duties and other foreign trade-related revenues. Currently tariffs and duties are collected by the U.S. Treasury from importers.