In addition, battery EV sales are slowing. Early adopters largely already have purchased BEVs, and mainstream buyers are hesitant to invest in the technology for various reasons. This has created a gap that impacts automakers’ bottom lines, forcing them to rethink their BEV strategies by scaling back or even pausing production and delaying new-product launches.

The automotive supply chain bears the brunt of this disruption. Large Tier One suppliers have invested heavily to support the industry’s shift toward electrification, gearing up to meet automaker forecasts for 2023 and 2024 that never materialized. Combined with supply-chain constraints, high interest rates, foreign competition and rising operational costs, the marketplace has become exceedingly challenging for automotive manufacturers—particularly in the tool and die sector.

According to MEMA’s Q3 2024 OE Supplier Barometer, 54% of automotive-supplier respondents are somewhat or significantly more pessimistic about their 12-mo. outlook compared to Q2 2024. Poor vehicle sales and concerns over the U.S. economy are seen as the greatest threats to their businesses.

Automotive-Tooling Downturn

Today, the automotive-tooling industry encounters significant headwinds that threaten its overall health. Wipfli estimates that the industry has lost approximately $445 million in capacity due to bankruptcies and market exits, with an additional $250 million at immediate risk. Since the pandemic, die and mold imports from low-cost countries have surged. In 2023, the United States imported an estimated $3 billion in dies and molds—a figure expected to grow as manufacturers focus on profitability. In the September 2024 Harbour IQ Manufacturing Pulse Study, powered by Wipfli, 90% of toolmakers reported flat or declining revenue, and 86% reported flat or declining profit for 2024. Additionally, overall sentiment, quote activity and utilization are down. Key concerns include rising costs, reduced demand and wage pressures.

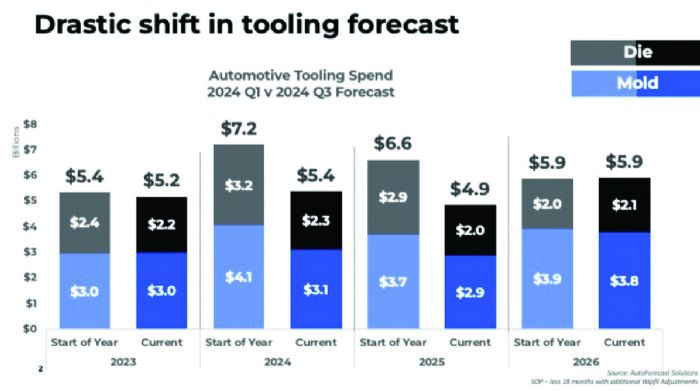

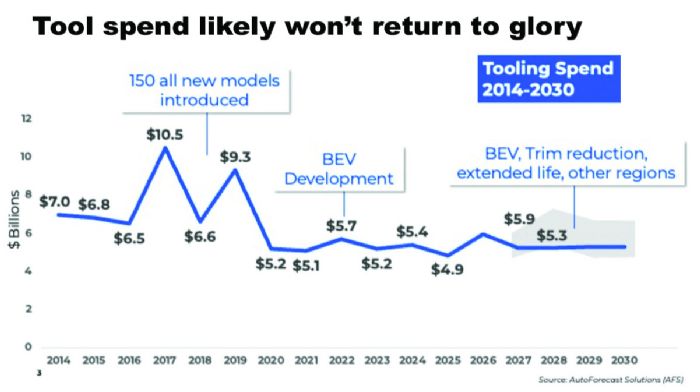

At the start of 2024, Harbour Results (now part of Wipfli) forecasted North American automotive tooling spend at $7.2 billion for 2024, $6.6 billion for 2025 and $5.9 billion for 2026. However, automakers have made drastic adjustments to their vehicle-launch schedules throughout the year.

Due to limited U.S. BEV adoption, the Detroit Three (Ford, GM and Stellantis) have delayed or canceled $4.64 billion in tooling expenditures for 2024–2026, while other automakers have adjusted their forecasts by $1.14 billion. To bridge the gap, automakers are extending current vehicle platforms with facelifts and using plug-in hybrid-electric technology, hoping that consumer demand for BEVs will increase later in the decade.

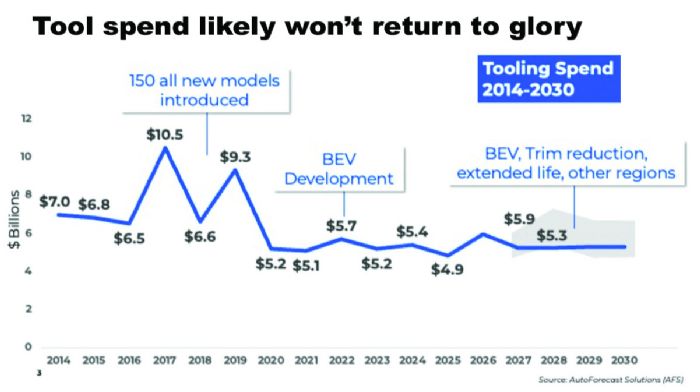

This shift in vehicle-launch strategies has impacted the tooling forecast substantially for the coming years (Figs. 2 and 3). Wipfli’s updated forecast estimates North American tooling spend at $5.4 billion in 2024, $4.9 billion in 2025, $5.9 billion in 2026 and $5.3 billion in 2027. The reality: The tooling industry may remain stuck at this $5 billion plateau beyond 2030, putting immense pressure on the U.S.-based tooling industry and threatening its survival.

This shift in vehicle-launch strategies has impacted the tooling forecast substantially for the coming years (Figs. 2 and 3). Wipfli’s updated forecast estimates North American tooling spend at $5.4 billion in 2024, $4.9 billion in 2025, $5.9 billion in 2026 and $5.3 billion in 2027. The reality: The tooling industry may remain stuck at this $5 billion plateau beyond 2030, putting immense pressure on the U.S.-based tooling industry and threatening its survival.

Facing a New Reality

The automotive industry always has been cyclical. Over the past 20 yr., automakers and suppliers have weathered the Great Recession, a global pandemic, supply-chain shortages and labor strikes. However, as noted earlier, the industry now faces an unprecedented turning point, and the supply chain in particular confronts a new reality.

Looking ahead, expect further changes in automakers’ vehicle-launch schedules. Regardless of tariffs, low-cost imports of tools and dies will continue to pressure U.S. manufacturers. Although economic conditions are improving, manufacturers still must contend with rising operational costs. The path forward is complex for the automotive supply chain, particularly for tooling suppliers.

The Untold Story

However, the Trump administration could provide relief to the U.S.-based tooling industry through its tax policies. Discussions suggest that President Trump may increase China Section 301 tariffs from today’s rate of 25% to 60-100%. This would make sourcing tools from China increasingly difficult and more costly for production companies, and create strong demand for U.S. die and mold makers. So, time will tell if the federal government uses taxes to force die- and mold-building back to the United States. MF

See also: Wipfli LLP

Technologies: Tooling, Management, Materials

Moreover, new market players, including startups, and new brands from established manufacturers as well as from Chinese automakers all contribute to increased competition. This industry shift has created significant challenges, with some even describing it as an “automotive recession” independent of the broader U.S. economy.

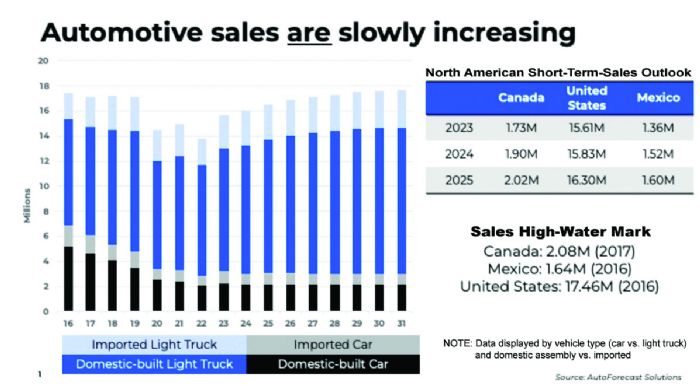

Moreover, new market players, including startups, and new brands from established manufacturers as well as from Chinese automakers all contribute to increased competition. This industry shift has created significant challenges, with some even describing it as an “automotive recession” independent of the broader U.S. economy. However, this momentum could be short-lived. Selling vehicles in the United States has become more challenging as the average new-car price reaches $48,400, and high interest rates push average monthly car payments above $730. This financial strain makes new cars unaffordable for many consumers, driving the average vehicle age to 14 yr.

However, this momentum could be short-lived. Selling vehicles in the United States has become more challenging as the average new-car price reaches $48,400, and high interest rates push average monthly car payments above $730. This financial strain makes new cars unaffordable for many consumers, driving the average vehicle age to 14 yr.

This shift in vehicle-launch strategies has impacted the tooling forecast substantially for the coming years (Figs. 2 and 3). Wipfli’s updated forecast estimates North American tooling spend at $5.4 billion in 2024, $4.9 billion in 2025, $5.9 billion in 2026 and $5.3 billion in 2027. The reality: The tooling industry may remain stuck at this $5 billion plateau beyond 2030, putting immense pressure on the U.S.-based tooling industry and threatening its survival.

This shift in vehicle-launch strategies has impacted the tooling forecast substantially for the coming years (Figs. 2 and 3). Wipfli’s updated forecast estimates North American tooling spend at $5.4 billion in 2024, $4.9 billion in 2025, $5.9 billion in 2026 and $5.3 billion in 2027. The reality: The tooling industry may remain stuck at this $5 billion plateau beyond 2030, putting immense pressure on the U.S.-based tooling industry and threatening its survival.