The big unknown with BEVs is what work OEMs will keep inhouse vs. outsourcing to suppliers. As noted in a late-2020 industry survey by Boston Consulting Group (BCG), General Motors is outsourcing most of the Chevy Bolt powertrain and power electronic components, and has earmarked its Lordstown, OH, joint venture with LG to produce its Ultium battery packs, while Tesla plans to produce battery cells inhouse.

That said, BCG consultants predict that most OEMs will outsource production of battery cells and power electronics, but will use their supply networks to produce battery modules, battery packs and electric motors. Tier One suppliers likely will continue to produce larger body-in-white and structural parts and assemblies, provided that they’re able to work with newer lighter-weight steels and aluminum alloys.

That said, BCG consultants predict that most OEMs will outsource production of battery cells and power electronics, but will use their supply networks to produce battery modules, battery packs and electric motors. Tier One suppliers likely will continue to produce larger body-in-white and structural parts and assemblies, provided that they’re able to work with newer lighter-weight steels and aluminum alloys.

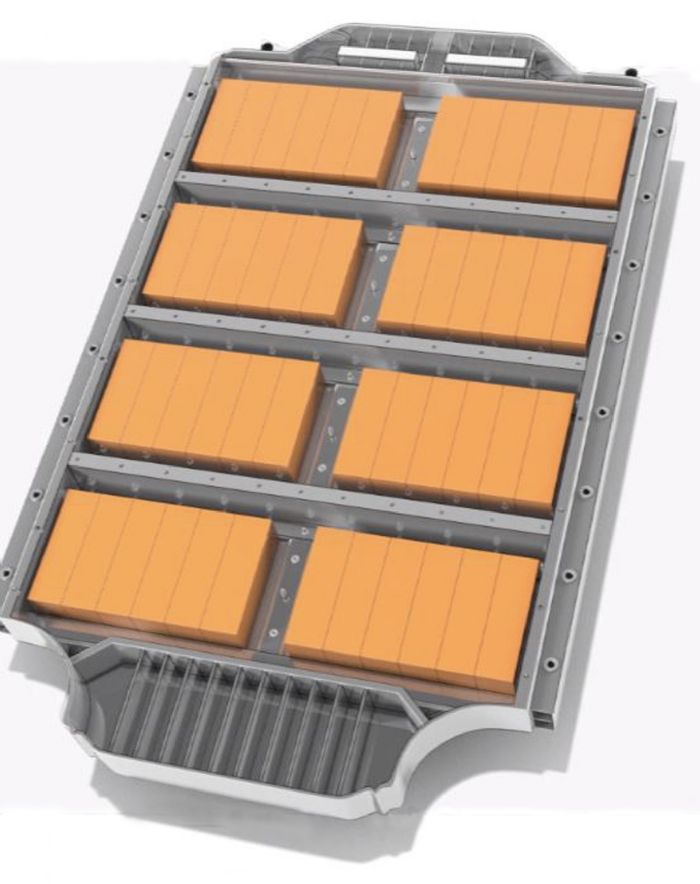

The Ingredients of a Battery Pack

A BEV’s power comes from a battery pack, comprising a cluster of several modules with each module assembled from individual battery cells. For example, as noted in a white paper from battery-cell, module and pack manufacturer Samsung, the battery pack in the BMW i3 comprises 96 cells separated into eight 12-cell modules. Included with each module is a structural frame designed and built to protect the modules and its cells from heat and vibration, and the complex electronic battery-management system.

A BEV’s power comes from a battery pack, comprising a cluster of several modules with each module assembled from individual battery cells. For example, as noted in a white paper from battery-cell, module and pack manufacturer Samsung, the battery pack in the BMW i3 comprises 96 cells separated into eight 12-cell modules. Included with each module is a structural frame designed and built to protect the modules and its cells from heat and vibration, and the complex electronic battery-management system.

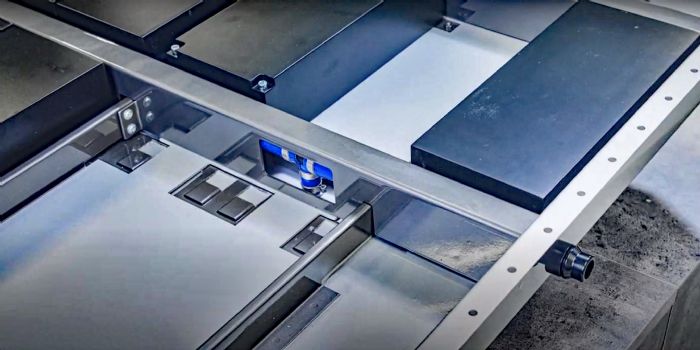

Among the stamped-metal components common to the battery pack and its associated elements: the module frame, the enclosure housing the battery pack and the charger box. In addition, the uptick in the number of electrical components—battery contacts, heat sinks, etc.—promises to create opportunities for suppliers in those niche areas.

Battery cases and cell covers may require blanking, forming, bending, embossing and drawing operations, to increasingly tight dimensional tolerances. Some suppliers have chosen (for now) to manufacture cases from aluminum extrusions (Constellium) or deep-drawn stampings (Novelis); others from fabricated sheet metal (Benteler); or a combination of stampings and castings (Audi). Still others have developed one-piece aluminum castings, and the Chevy Bolt’s battery enclosure is made from a thermoset vinyl hybrid resin with a woven-glass reinforcement.

Other BEV opportunities include aluminum rear underbody components, motor housings, gear boxes and main transmission parts, engine cradles and cross members, dashboard components, flooring, fender aprons, and the rear axle housing.

A Buzz of Activity

Late last year, Simpac presented a pair of webinars with MetalForming magazine to discuss how it expects BEVs to change the landscape for OEMs and their stamping suppliers. From Simpac general manager/VP of sales and operations Stephan Robertson, we learned that the BEV market is expected to grow at a compound annual growth rate of 22.6 percent through 2026. Annual BEV sales are projected to grow from 3 million units in 2021 to nearly 4.5 million in 2023, with a total of 26 million BEVs produced by 2026.

Late last year, Simpac presented a pair of webinars with MetalForming magazine to discuss how it expects BEVs to change the landscape for OEMs and their stamping suppliers. From Simpac general manager/VP of sales and operations Stephan Robertson, we learned that the BEV market is expected to grow at a compound annual growth rate of 22.6 percent through 2026. Annual BEV sales are projected to grow from 3 million units in 2021 to nearly 4.5 million in 2023, with a total of 26 million BEVs produced by 2026.

Fueling much of the growth, Robertson explained, is the willingness of OEMs to collaborate on vehicle and engine development. GM, for example, recently has forged partnerships with truck manufacturer Nikola and with Honda, while Ford has partnered with Rivian Automotive and Volkswagen.

Among the specific OEMs discussed by Robertson:

- Volkswagen plans to have 50 BEV models on the streets by 2025, with an annual production target of 3 million units.

- GM has plans for 30 BEV models and an annual sales target of 1 million vehicles by 2025, including production of the Cadillac Lyriq crossover vehicle at its facility in Spring Hill, TN, and next-gen Acadia at the Lansing Delta Township plant.

- Ford’s production target is 40 BEV models by 2025, including production of the all-electric F-150 at its Rouge (Dearborn, MI) complex, and a plug-in hybrid Escape at its Louisville, KY plant.

- And, of course, there’s Tesla, which grew its 2020 BEV sales to half a million units in 2020, an increase from 367,000 in 2019, with 2021 projections hovering near 800,000 units.

Among the latest developments at Tesla, discussed by Robertson: use of a new huge die-casting machine (64 ft. long by 17 ft. tall) to produce the entire rear underbody structure for the Model Y crossover in a single-piece casting, replacing 70 stamped parts, much as the expanded use of hydroforming has done, albeit in a smaller way, for engine cradles and subframes, Robertson noted.

Among the latest developments at Tesla, discussed by Robertson: use of a new huge die-casting machine (64 ft. long by 17 ft. tall) to produce the entire rear underbody structure for the Model Y crossover in a single-piece casting, replacing 70 stamped parts, much as the expanded use of hydroforming has done, albeit in a smaller way, for engine cradles and subframes, Robertson noted.

Pressroom Needs

Robertson then turned his attention to press technology needed to meet some of the new requirements for producing EV parts, first and foremost: “Stamping presses with excellent ram parallelism, minimum bed deflection and perpendicularity within 0.05 mm.”

For other perspectives, Robertson, in his second webinar with MetalForming, shared quotes from three industry experts, to gain their unique perspectives on the EV market. First, Rama Jayaweera, president of Linear Transfer Automation, tells Robertson and MetalForming readers:

For other perspectives, Robertson, in his second webinar with MetalForming, shared quotes from three industry experts, to gain their unique perspectives on the EV market. First, Rama Jayaweera, president of Linear Transfer Automation, tells Robertson and MetalForming readers:

“The EV revolution will be viewed by historians as a major positive tipping point in technology and manufacturing techniques, utilizing advanced automation solutions to create premium products at consistent quality and higher production rates. Advancements in materials, manufacturing methods and targets to ensure mass adaption of EVs at lower price points is driving a march toward automation.”

And, from Tim McCaughey, global sales director at Lincoln Electric Automation:

“The EV market has provided some new excitement to the automotive industry for integrated systems. With all of the new automobile manufacturers coming to market, we also are processing many new types of structures including and surrounding larger battery tray structures. These new structures utilize many of our core processes such as laser hybrid welding, adhesive dispensing and other types of mechanical joining processes.”

And, lastly, commenting on the continuing move to lighter, higher-strength materials, Michael Stout, president of D&S Machine Repair, offers that stampers operating older presses designed with greater gear backlash and bushing clearances will experience more press maintenance and other production challenges.

“As modern machine tools have increased in accuracy, especially in gear cutting and grinding,” Stout says, “the need for these additional clearances has decreased dramatically. There is no comparison in the flexibility of slide motion in a servo press versus a (traditional) mechanical press. As more components transition to aluminum, this flexibility may be crucial for production.”

How Important is Lightweighting?

For perspective on the material mix for BEVs compared to ICE vehicles, in particular the body in white (BIW), we spoke with Michael Davenport, executive director of the Auto/Steel Partnership (A/SP). Davenport, formerly director of engineering—applications at United States Steel Corp., and BIW manager, upperbody systems at Chrysler and FCA, points first and foremost to what Tesla has done with the Model S and then the Model 3.

“Everybody’s intuitive opinion would be that when you go to an electric vehicle, you need to drop the weight dramatically,” Davenport says. “What we see, however, especially when you look at the more affordable price range for BEVs, not the $180,000 luxury vehicles, is that once you design-in and pay for all of the nice interior features and, of course, the new powertrains and battery systems, there’s not a lot of money left over for the BIW.

“Take, for example, Tesla,” he continues, “which at first came out with the all-aluminum Model S, but then for the higher-volume Model 3 went primarily with steel for the BIW, much of it hot stamped. It’s using aluminum only for the closures—pretty much on par with what you see on a lot of standard ICE vehicles. So, as the industry transitions to more and more BEVs, the OEMs will shift more focus to minimizing the cost of the body structure so that they can invest more into the powertrain and interior features.”

When it comes to lightweighting of BEVs, Davenport says that while still a critical material-selection consideration, “if you had a list of all technical solutions and ranked them in order by how much they improve either fuel economy or driving range and battery life, the lightweighting option drops a few pegs.

“Generally,” he continues, “we expect about 100 kg of mass savings will get you somewhere between 5 and 8 km extended range. So, if you, for example, invest in more expensive materials and remove 200 lb. from the vehicle, you gain about 10 miles per battery charge, but there’s a huge cost there. The OEMs will look closely at where it makes the most sense to add cost to the vehicles—in the powertrain and interior features, or for lightweighting. It’s not that lightweighting is not important with BEVs, it’s just not as big of a lever as with ICE vehicles.”

Davenport, who’s been at A/SP for about a year now, shared a lot more information with us on the role steel continues to play in vehicles, in particular Gen 3 steels, why they’re poised to grow in use and what stampers need to know in order to take them on. We’ll share the full interview with you, including his take on the application of 3D roll forming, in the April issue of MetalForming, which also highlights the virtual 2021 edition of Great Designs in Steel conference, slated for Wednesday, May 19. MF

View Glossary of Metalforming Terms

See also: D & S Manufacturing Co. Inc., Linear Transfer Automation Inc., Lincoln Electric Automation, SIMPAC America Co. Ltd.

Technologies: Stamping Presses

Example: a PwC report, Does Electrification Have Suppliers on a Collision Course?, predicts that “the share of a car’s value attributable to the powertrain and electronics will rise significantly by 2025, to a combined 52 percent from 44 percent in 2015, at the expense of the chassis, body and interior components.”

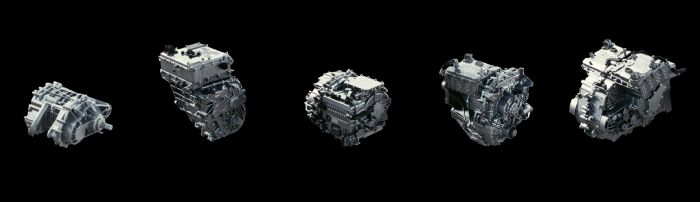

Example: a PwC report, Does Electrification Have Suppliers on a Collision Course?, predicts that “the share of a car’s value attributable to the powertrain and electronics will rise significantly by 2025, to a combined 52 percent from 44 percent in 2015, at the expense of the chassis, body and interior components.”  What disappears with the move from ICE to BEV is dozens if not hundreds of engine and transmission parts. For example, the average four-cylinder ICE has 113 moving parts, compared to three in a Chevy Bolt EV, say PwC researchers. “And most EVs have single-speed transmissions,” adds the PwC report, “with no need for turbo- or superchargers… or exhaust systems.”

What disappears with the move from ICE to BEV is dozens if not hundreds of engine and transmission parts. For example, the average four-cylinder ICE has 113 moving parts, compared to three in a Chevy Bolt EV, say PwC researchers. “And most EVs have single-speed transmissions,” adds the PwC report, “with no need for turbo- or superchargers… or exhaust systems.”