Manufacturers Optimistic Despite Uncertainty Early in 2025

April 1, 2025Comments

Despite a sluggish start to the year,

manufacturers across North America are expressing cautious optimism about the

future, according to the most recent Metalforming Insight study completed in

collaboration with Harbour IQ powered by Wipfli. The report, which gathered

insights from nearly 300 manufacturing leaders in the U.S., Canada, and Mexico,

offers a PMA member who participate a snapshot of current trends, concerns, and

expectations within the sector.

Despite a sluggish start to the year,

manufacturers across North America are expressing cautious optimism about the

future, according to the most recent Metalforming Insight study completed in

collaboration with Harbour IQ powered by Wipfli. The report, which gathered

insights from nearly 300 manufacturing leaders in the U.S., Canada, and Mexico,

offers a PMA member who participate a snapshot of current trends, concerns, and

expectations within the sector.

Optimism on the Rise

While uncertainty defined the early months of 2025, 43% of metal formers expect profits to increase more than 5% in 2025 compared to 2024 which is slightly higher than other manufacturers. Manufacturers that participated in the study project an average revenue growth of 2.7%, reflecting renewed confidence in a gradually stabilizing market.

The HIQ Index—a measure of industry sentiment based on profit expectations, utilization, revenue, and backlog—rose from 52 at the end of 2024 to 57 in Q1 2025. However, key concerns of metal formers remain largely unchanged: trade and tariff policy, rising operational costs, continued inflation, and raw material pricing.

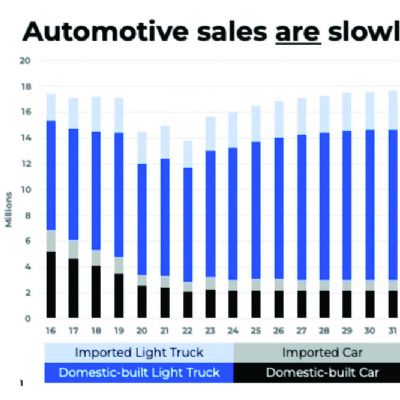

Most manufacturers appear to be starting the year slow, but Wipfli expects business to gain momentum across the board in the latter half of 2025 and into 2026. For metal formers, sectors like aerospace, defense and industrial machinery are better positioned for growth compared to agriculture and automotive. To stay competitive, we encourage manufacturers to base their forecasts on real data, drive efficiency, and sharpen their sales strategies.

Manufacturing utilization—defined by a 24-hr., five-day operational model—for metal formers is reported at 63% in Q1 2025. This is higher than other process types – plastics processors and die casters which are at 53% and 51% respectively. However, all process types anticipate increased utilization as demand picks up later in the year.