Also, Ricoh and Siemens have begun collaborating to develop the means for aluminum-part mass production via binder jetting. To accomplish this, Ricoh is leveraging Siemens’ Additive Manufacturing Network (AMN) capabilities to maximize process efficiency. An online order-to-delivery collaboration platform for the industrial AM community, AMN connects the AM ecosystem, simplifies collaboration and streamlines the AM production process, according to Siemens officials. They explain that the network digitalizes and consistently improves processes to, ultimately, accelerate the value in using AM.

Also, Ricoh and Siemens have begun collaborating to develop the means for aluminum-part mass production via binder jetting. To accomplish this, Ricoh is leveraging Siemens’ Additive Manufacturing Network (AMN) capabilities to maximize process efficiency. An online order-to-delivery collaboration platform for the industrial AM community, AMN connects the AM ecosystem, simplifies collaboration and streamlines the AM production process, according to Siemens officials. They explain that the network digitalizes and consistently improves processes to, ultimately, accelerate the value in using AM.

Ricoh is implementing Siemens’ AMN to optimize aluminum binder-jetting workflow for production preparation, planning, scheduling and production management. Ricoh also has implemented Siemens' Brownfield Connectivity product to acquire machine data from controllers and automation technology and transfer such data in a controlled manner. Via Brownfield Connectivity, Ricoh has begun collecting and storing information on each process necessary for quality stabilization and production control. Both companies aim for early commercialization of these technologies.

“Ricoh will enable the manufacture of innovative aluminum components and will work with users to realize new value in the area of electrification of electric vehicles and other forms of mobility,” says Tokutaro Fukushima, general manager of AM business center for Ricoh Futures Business Unit. “By combining Siemens' powerful solutions and knowledge with Ricoh's aluminum binder-jetting technology, we will be able to provide highly reliable and practical systems for mass-production applications. We hope to promote electrification together with our customers and contribute to solving social issues such as realizing a zero-carbon society.”

Another effort to tie AM into the full manufacturing

sequence and gain throughput, machine and materials provider EOS and AM

Solutions, which offers post-processing technology, have partnered to bring

automated post-processing into the AM production process. Higher AM-machine

output requires more efficient subsequent steps to maintain throughput, such as

the depowdering process, which removes powder from LPBF parts. They key,

according to the partnership team, lies in automated, economical and highly

efficient post-processing. In this way, quantities can be scaled up as required

without compromising quality and reproducibility. Increased automation is also

an important factor in addressing the growing shortage of skilled labor. Proper

and efficient depowdering also enables improved powder recycling, a key

sustainability objective, and improves worker safety.

Bigger and Faster Builds

Machine makers also are targeting build volumes and other AM

technology to print more parts in less time.

Machine makers also are targeting build volumes and other AM

technology to print more parts in less time.

Desktop Metal recently announced the first commercial shipments of the Figur

G15, a Digital Sheet Forming (DSF) machine tool, to Saltworks Fab, a

Florida-based automotive restoration and hot rod company. The Figur G15

reportedly is the first commercially available machine tool platform to shape

sheet metal on demand without custom tooling.

Satworks is installing two Figur G15 platforms at its

Sarasota, FL, facility to accelerate its auto-restoration business and expand

access to metal forming services for new customers. The company often creates

metal body panels that no longer are commercially available with manual

hammering and laborious forming processes.

Investing in the Figur G15, the company expects to reduce

production times dramatically while using the flexibility of digital

manufacturing to create complex shapes and efficient one-offs, or produce short

runs of designs. Saltworks recently demonstrated the capabilities of the Figur

G15 at the SEMA Show in Las Vegas, where the team exhibited the entire side

body of a Mercedes Gullwing created of type-6061 aluminum panels formed on the

G15 in under 10 hr. for the entire 15-piece assembly.

“The Figur G15 buys us time,” says David Jacobsen, chief executive officer of Saltworks Fab. “It allows us to bring vintage vehicles back to their former glory while also enabling us to enter a whole new level of business helping customers that currently don't have the ability or resources to form metal. Figur G15 allows us to expand access to metal-shaping services to a broader variety of small businesses, design shops and self-builders.”

The Figur G15 uses patent-pending DSF technology in which a

software-driven ceramic toolhead on a gantry shapes standard sheet metal into

parts with as much as 2000 lb. of forming force without tooling, with software

that simplifies the creation of sheet metal part production.

“The response to Figur G15 from the market across a wide variety of sectors has been exciting,” says Justin Nardone, CEO of Figur, a Desktop Metal brand. “The G15 eliminates a lot of the work required when forming metal, such as the design and manufacturing of tools and dies. Our system produces designs quickly, accurately and repeatedly, allowing manufacturers to focus on the craftsmanship of design while moving their products to market faster and more efficiently.”

Saltworks is planning to purchase two additional G15

systems, for a total of four, to join its initial fleet in the near future with

plans to run all four machines over three shifts to keep up with demand.

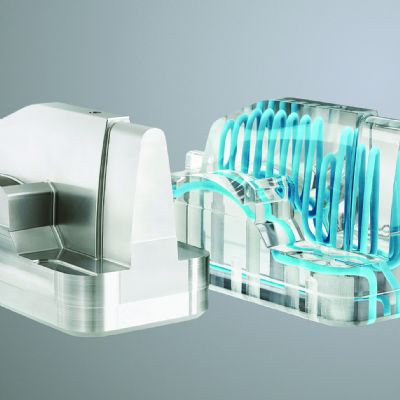

At Formnext 2023, held late last year in Frankfurt, Germany, 3D Systems introduced the DMP Flex 350 Triple, a three-laser configuration on its DMP Flex 350 LPBF platform. The compact AM machine includes a unique vacuum chamber design and extends 3D Systems’ Removable Print Module (RPM) concept by supporting two distinct RPM modules with different build volumes, thus offering flexibility for users. A new RPM for the machine enables a larger build of 350 by 350 by 350 mm (reportedly the most compact machine to support a build area of this size), and the machine also accommodates the standard RPM with a build volume of 275 by 275 by 420 mm. A larger build area makes the machine ideal for cost-effective processing of a variety of parts, including impellers and cooling plates. The RPMs can be swapped for increased application flexibility. The three-laser configuration, while boosting productivity, also reportedly results in no seams or changes in roughness in zones where multiple lasers work together. Alloys available for the machine include aluminums, stainless steel and nickel-based alloys. Expect availability of the DMP Flex 350 Triple with the larger build-box RPM in July 2024.

At Formnext 2023, held late last year in Frankfurt, Germany, 3D Systems introduced the DMP Flex 350 Triple, a three-laser configuration on its DMP Flex 350 LPBF platform. The compact AM machine includes a unique vacuum chamber design and extends 3D Systems’ Removable Print Module (RPM) concept by supporting two distinct RPM modules with different build volumes, thus offering flexibility for users. A new RPM for the machine enables a larger build of 350 by 350 by 350 mm (reportedly the most compact machine to support a build area of this size), and the machine also accommodates the standard RPM with a build volume of 275 by 275 by 420 mm. A larger build area makes the machine ideal for cost-effective processing of a variety of parts, including impellers and cooling plates. The RPMs can be swapped for increased application flexibility. The three-laser configuration, while boosting productivity, also reportedly results in no seams or changes in roughness in zones where multiple lasers work together. Alloys available for the machine include aluminums, stainless steel and nickel-based alloys. Expect availability of the DMP Flex 350 Triple with the larger build-box RPM in July 2024.

And, Renishaw has introduced its Tempus technology, designed

to achieve reductions to 50% in build times.

Tempus, reportedly using advanced scanning algorithms that sequence build-layer data in a way that maximizes productivity while maintaining part quality, is found in the company’s RenAM 500-series LPBF machines. The optimization suits some part geometries more than others, but all geometries can see some productivity benefits, according to Renishaw officials, who point out that parts with thin, vertical features, for example, are likely to experience proportionally higher productivity savings. How does Tempus accomplish greater build speed? While traditional LPBF systems require the powder recoater to fully distribute powder before the layer can be consolidated, this technology fires the lasers as the recoater is moving, courtesy of advances that employ seamless communication between advanced software and hardware components to synchronize the system lasers with the powder recoater. This reportedly removes as much as 9 sec. of build time from each layer. With builds frequently containing thousands of layers, this can reduce total build times by tens of hours—with no reduction in part quality.

“Reducing cost per part is critical to the wider adoption of AM technology,” says Louise Callanan, AM director at Renishaw. “The dominant contributing factor to part cost for most components today is the time spent building the part on the machine itself. We believe the time and cost savings that both Tempus technology and the RenAM 500 Ultra system bring will open AM to mass-production applications where the technology previously had been unviable. Meanwhile, these innovations will deliver crucial productivity gains for AM users that want full-scale production at the lowest cost per part.”

Also at Formnext, EOS introduced the newest addition to its M

300 AM-machine family, the EOS M 300-4 1kW. The LPBF machine features four 1-kW

lasers and is designed to meet the production requirements of aluminum and

copper AM applications.

“We need to meet the growing market demand of challenging materials such as copper and high-productivity processes,” says Sebatian Becker, EOS metal systems lead. “The EOS M 300-4 1kW delivers power and productivity at the highest level of reliability to achieve the lowest cost-per-part in the industry.”

Says Manja Franke, chief strategy officer at AMEXCI, a Nordic AM company: “AM offers transformative potential, especially for products such as aluminum cylinder heads that traditionally were made by diecasting. The speed and power of new AM platforms, such as the EOS M 300-4 1kW, allow us to manufacture complex components, while ensuring enhanced design flexibility, weight reduction and readiness for future emission standards. To rival conventional methods, AM’s cost-effectiveness is vital and systems such as this offer the possibility to achieve this. Thus, our partnership with EOS aims to maximize productivity and push AM’s competitive boundaries.”

Machine manufacturers have taken note of the need for

greater volumes in dental and medical applications. Case in point: The TruPrint

2000 from Trumpf Inc., now featuring 500-W lasers and a square build plate.

This version enables as much as a 36% increase in partial dentures per build as

compared to the base 300-W laser configuration with round build plate.

"The updated TruPrint 2000 is further optimized for mass production,” says Miguel Verdejo, AM product and project manager at Trumpf’s Laser Technology Center in Michigan. “Users from all industries benefit from the machine's high productivity."

As a multi-laser version, the TruPrint 2000 offers two

lasers, and both can process the entire build plate simultaneously, resulting

in optimized throughput for production.

Markforged, creator of the Digital Forge integrated metal and carbon-fiber AM platform that offers quick printing of tools, jigs, inserts and more, has released Performance Advisor, a new feature that is accessible to all users who have a registered Markforged printer with its Eiger software. Performance Advisor uses machine learning to provide recommended print settings vs. default settings for those who don't have access to advancements or specific use cases provided by the company’s Simulation software, used for simulating the performance of Markforged printed parts in Eiger. Performance Advisor, according to company officials, serves as a guiding path to determine if a part is strong enough without the need-to-know advanced analysis. It represents, note the officials, the next step to simplicity in understanding the strength of a printed part in a short amount of time and at minimal cost.

Also, Markforged has unveiled its FX10 3D carbon-fiber printer, reportedly enabling users to print the parts when and where they’re needed, reducing costs and cutting lead times from months to days compared to traditional manufacturing methods.

Also, Markforged has unveiled its FX10 3D carbon-fiber printer, reportedly enabling users to print the parts when and where they’re needed, reducing costs and cutting lead times from months to days compared to traditional manufacturing methods.

The printer's modular systems are engineered to be expanded

and upgraded with additional capabilities. Its fifth-generation Continuous

Fiber Reinforcement print system delivers high print quality in a heated print

chamber, allowing for print speeds that are nearly twice as fast and print

sizes to twice as large as previous Markforged industrial series printers,

enabling the replacement of metal parts with advanced composites. Such systems

reportedly are ideal for quick printing of spare parts, fixtures and more.

The AM industry also has progressed in capabilities for

producing large parts for military, aerospace, marine, construction and

industrial applications. For production of large metal parts, wire-arc AM (WAAM)

has proved beneficial, offering high deposition rates with layers added via

welding processes. As an example, MX3D, a Dutch company, recently introduced

the MX Metal AM system. Reportedly able to print parts weighing in excess of 5

tons from any weldable alloy, it offers a build volume of 6 x 1.5 x 3.5 m using

an eight-axis robot and special software. Lincoln Electric and other companies

also offer WAAM, which has been studied as a method to produce tooling for hot

stamping, with layer-by-layer construction inherent in AM an ideal method to

produce cooling channels in dies.

For smaller tool builds, metal AM also offers hope. Last year, Mantle announced the commercial launch and availability of its technology for toolmaking, designed to simplify how mold-tool components are made and accelerating how manufacturers make molded parts—from product idea to launch. Mantle’s hybrid technology, additive and subtractive machining with sintering, works together with its proprietary Flowable Metal Paste in creating high-precision inserts. This singular application focus on toolmaking solutions enables Mantle to optimize the value of its technology for toolmakers, company officials report. Mantle’s technology, they note, reduces the time needed to create tooling components by eliminating or reducing many operations traditionally required to make precise, durable steel tool components.

Powder Progress

In North America, spring means two major AM events: RAPID + TCT, North America’s largest annual AM event, and the Additive Manufacturing Users Group (AMUG) Conference.

AMUG, March 10-14 in Chicago, IL, offers professional AM education and technology via solid conference tracks and exhibits; networking; and recognition of AM excellence. March 10-14 Hilton Chicago Chicago, IL For details and to register, visit www.amug.com RAPID + TCT RAPID + TCT, June 25-27 in Los Angeles, CA, offers hundreds of exhibitors showcasing metal- and nonmetal-AM technology and services, backed by conference and seminar sessions.

June 25-27

Los Angeles Convention Center

Los Angeles, CA Event Hours Tuesday, June 25: 9 a.m.-5 p.m. Wednesday, June 26: 9 a.m.-5 p.m. Thursday, June 27: 9 a.m.-3 p.m. Exhibit Hall Hours Tuesday, June 25: 10 a.m.- 5 p.m. Wednesday, June 26: 10 a.m.- 5 p.m. Thursday, June 27: 10 a.m.-3 p.m. Price to attend exhibit hall is $125, with added costs for conference sessions. For details, visit www.rapid3devent.com.

|

Every day, more materials become available for AM use. And,

innovation on the powder-provider side is paying dividends.

In another industry partnership designed to improve

throughput, powder provider Equispheres and

machine maker Aconity3D, via laser-beam shaping and high-performance powder,

have achieved build rates reportedly nine times greater than industry norms for

aluminum powder in the single-laser LPBF process. Using Aconity3D printing

equipment with laser-beam shaping and Equispheres' NExP-1 AlSi10Mg powder, the

two companies have achieved production speeds in excess of 430 cm3/hr. for a

single laser.

Laser-beam shaping finds use in other industries and has

gained attention in AM due to its potential to improve processing speeds. In LPBF,

beam shaping modifies how energy is deposited on the powder bed, altering the

power density and thermal gradient.

The resulting build speed in this project outpaces current

production rates for aluminum AM by a large margin and provides a path forward

to commercialization of such capability.

In other powder news that has ramifications in the

electric-vehicle sector, 6K has

earned a place on the 2024 Global Cleantech 100 list for sustainability efforts

in supplying materials for AM via its UniMelt microwave plasma-production platform.

This marks the second consecutive year that the company has made the list. The

Global Cleantech 100 is a comprehensive showcase of the most promising private

companies in the cleantech ecosystem.

UniMelt, a fully sustainable production-scale microwave

plasma process, reportedly produces metal-AM powders and battery materials via

a significantly faster and cleaner process than other methods.

“When we first introduced the UniMelt platform, one of our goals was to transform manufacturing of critical materials,” says Bruce Bradshaw, 6K chief marketing officer. “Our UniMelt solution takes a sustainability-first approach, replacing outdated, dirty processes with clean and efficient production—dramatically reducing production times from days to seconds at significantly lower carbon emissions than legacy processes.”

This recognition builds on the company’s recent execution of a $50 million award with the U.S. Department of Energy’s Office of Manufacturing and Energy Supply Chains for 6K Energy’s PlusCam battery material production plant in Jackson, TN. The facility will leverage UniMelt technology for cathode active material (CAM) production at an appreciably lower cost than available through overseas suppliers, and with significantly lower energy consumption and CO2 emissions, while eliminating any solid or liquid waste, according to company officials. The PlusCam facility reportedly will be the model for supplying battery material to major automotive OEMs and suppliers such as 6K investors Albermarle and Stellantis. UniMelt technology already is operating at full-scale production at 6K Energy’s sister company, 6K Additive, producing titanium and other powders for AM in Burgettstown, PA.

6K Energy also has been named a winner in the 2024 BIG

Innovation Awards presented by the Business Intelligence Group.

The Future of AM

Various industry providers have provided insight into the future of this burgeoning technology. Here are their takes.

Gaining Momentum Across Markets

In 2024, expect to see AM generating greater momentum in semiconductors, durable consumer goods, aerospace and defense, medical devices, and dental, according to Dr. Jeffrey Graves, 3D Systems president and CEO.

“Across industries, I anticipate that the integration of AM for production applications will continue to make important strides in helping to mitigate supply-chain disruption,” he offers. “Industry-leading manufacturers continue to realize that AM enables them to take control of their supply chains by manufacturing locally. This, in turn, helps reduce costs by reducing the number of suppliers and removing the need for costly logistics providers to move components across geographies. This also has the potential to positively impact the environment by minimizing manufacturers’ carbon footprints.”

Supply-chain control holds true in healthcare, “especially in the production of medical devices at the point of care,” Graves says. “Leading providers are investing in AM solutions housed within hospitals and surgical centers to produce personalized devices such as implants and surgical tools. As we move through the coming year, I believe that we’ll see the adoption of AM by healthcare institutions accelerate as surgeons and providers strive to produce devices that positively impact patient care and the patient experience.”

He sees AM’s ability to enable not only the production of patient-specific devices but also mass customization for everything from custom surgical guides and implants to dentures and orthodontic appliances.

On the industrial side, Graves notes that the semiconductor industry continues to face significant challenges in its ability to address the ongoing chip shortage brought on by the pandemic.

“While AM has demonstrated advantages in semiconductor capital (semicap) equipment for more than 10 yr.,” he says, “I anticipate that it will play a growing role for its ability to accelerate time-to-market and enable the production of parts with improved performance. This will be possible due to additive’s ability to deliver incredibly complex parts with exacting accuracy that would not be possible to achieve using traditional methods. Additionally, these unique parts can improve how semicap equipment operates, thus enabling faster production and reducing the time to market for the much-needed chips.”

Graves also cites AM’s ability to accelerate innovation as playing a key role in consumer goods.

“As the barriers to entry have become lower, the adoption of AM as a production technology continues to accelerate,” he explains. “This is becoming abundantly apparent in the durable-consumer goods industry where AM once was viewed only as an enabler for prototyping which could shorten product development. I anticipate that many consumer-goods manufacturers will continue integrating AM into production workflows for many applications, especially in the electronics industry. AM’s ability to catalyze the pace at which companies innovate will not only enable faster product development times but also enable the development of products that push the possibility of what can be delivered to give consumers never-before-imagined capabilities.”

And, expect accelerated adoption of AM in aerospace and defense sectors, according to Dr. Michael Shepard, VP of 3D Systems’ aerospace & defense segment, as global geopolitical tensions “create particular pressure on aerospace and defense supply chains with a level of urgency unprecedented in recent history.

“Many aerospace and defense goods are either in limited production or are out of production, in the sustainment phase of their lifecycle,” he continues. “Supply chains relying on conventional manufacturing techniques are struggling to increase capacity or reconstitute. AM solutions are attractive options to rapidly increase production capacity, and the technical barriers to entry are lower now that these solutions have been successfully proven for many materials and applications. These applications are not limited to finished parts made using AM, rather we also are seeing AM as a widely adopted technology for indirect methods using AM molds and patterns. Further, any modern manufacturing enterprise can benefit from AM capabilities to produce jigs, tools, fixtures, and other job and productivity aids. These mature AM solutions span a large range of technologies and materials, including metals, polymers, elastomers and composites.”

As more mature methods find their ways into routine production applications, new AM technologies are being fielded, Shepard reports.

“Of particular note are new families of materials,” he says. “With metals technologies such as LPBF, computational metallurgy and other techniques, we are seeing the advent of new solutions for long-standing materials challenges such as the capability to operate at very high temperatures or improved compatibility with AM processes. Innovation continues with polymer additive technologies as well, with improved printing techniques for challenging materials. Resin-based polymers are advancing, too, with tough, durable materials that are resistant to environmental degradation from UV and common chemicals.

Shifting AM Approaches

Beyond technology developments and market penetrations, the AM industry itself is shifting, in terms of paths to adoption; classes of users; a new emphasis past why use AM to how to best use AM; and growth of mass manufacturing. That’s how a team of experts from Materialise summarize new AM trends. (See a full roundtable of this Materialise discussion here.)

“AM adoption increasingly is going into two clearly defined and coexisting approaches: 3D printing as a service, and integration of AM into production processes,” says Janet Kar, Materialise business development manager. “Companies are starting to rely on external expertise to help support their additive journey (i.e., service bureaus). A lot of service bureaus will ask, ‘What do you want to print? I'll deliver it to you.’ It's a quick, affordable way to get one-off parts, as well as prototype parts. It’s an easy and affordable way for organizations to access AM technology.”

The second approach, integration of AM into production processes, shows how successful that AM has become, according to Kar.

“AM no longer is an afterthought when we're talking about mass manufacturing, and companies are finding ways to integrate it into their production process in many ways,” she says. “(Perhaps this involves) printing specific components for large-series end-use parts, or mass manufacturing customized parts for individuals or even patients, such as insoles and eyewear.

“There's a clear demand for application specific AM machines and workflows,” Kar continues. “Innovation isn't exclusive to machines, but it goes far beyond 3D printing to post-processing, finishing, quality control and software. As the wall between traditional manufacturing and 3D printing disappears, companies are looking for ways to merge these two technologies in an effort to optimize their overall manufacturing process.”

Note, too, the rise of an AM “middle class,” according to Peter Vos, Materialise marketing director.

“Traditionally 3D printing has offered two choices: low-budget or top-end machines, and quality always came at a premium,” he says. “Machine manufacturers now have started to offer mid-price machines aimed at this mid-range market that reach high quality levels. Manufacturers now get the quality they need at a lower price than ever before, and in essentially any type of material that they might require.”

Online marketplaces that typically rely on price to win business gain a competitive advantage by keeping their costs at that accessible level, but promising a better quality, according to Vos. Another AM user group, inhouse AM companies—companies ona budget--seek higher quality but not necessarily for a higher cost.

“Think of what's already happening in automotive manufacturing where OEMs are using 3D printing on the line to create shapes, fixtures and tools,” he says.

Application-specific 3D printing also benefits from the rise of the AM-machine middle class. This manufacturing model previously required high-maintenance, high-cost machine setups, Vos offers.

“But by fine-tuning a mid-range machine for this one specific application,” he explains, “these types of manufacturers can scale manufacturing of quality parts at a much lower entry cost.”

Also, as AM knowledge permeates the manufacturing world, the question no longer is “Why use AM?,” but “How can I integrate AM to scale up production?”

"(Manufacturers) now view 3D printing as a complementary technology, not as a competitive technology,” says Mathieu Cornelis, innovation manager at Materialise. “They know that AM can be used alongside traditional manufacturing techniques.”

Companies know the “why” of AM, but they continue struggling to find answers to how to integrate AM for production gains.

“That’s due to the lack of necessary expertise and knowledge inside of organizations—they’re struggling to recruit an expert workforce, for example,” says Cornelis. “While they see the need to bring in people with the right knowledge and skills, that’s easier said than done. The AM industry as a whole can help with addressing these challenges through training, workforce development, identifying new business models, or providing new and easier to use software and hardware.”

With so many trends identified, the question remains: Can 3D printing become a mass manufacturing technology? That depends, according to Vivien Kilian, Materialise senior director of marketing excellence and software marketing.

“To become viable, AM costs must be as desirable as its benefits,” she says. “Many doubted that this ever would be possible, but it's happening right now (all over the world).”

In China, new machines provide quality and efficiency at scale, and affordable materials make much larger orders feasible.

“We see in China, for instance, razor-thin titanium hinges for affordable phones and mass production of smartwatch cases,” says Kilian. “We are talking millions of parts/yr. Look at markets such as Germany and the United States. They're accelerating this process, too. By focusing on multi-laser printers, they're helping driving down the cost of machines. It will still be difficult to match other costs such as on materials, but the growth is inspiring because it shows what's possible when we integrate 3D printing's design capabilities into industrial-skill production processes at industrial costs. That's exciting.” MF

Industry-Related Terms: Alloys,

Bed,

Case,

Cathode,

Center,

Form,

Forming,

Hardware,

LASER,

Layer,

Model,

Plate,

Prototype,

Reproducibility,

Run,

Scale,

Stainless Steel,

TransferView Glossary of Metalforming Terms

See also: TRUMPF Inc., Renishaw Inc., Siemens Industry, Inc., Nikon Metrology, Inc., 3D Systems

Technologies: Additive Manufacturing

Also, Ricoh and Siemens have begun collaborating to develop the means for aluminum-part mass production via binder jetting. To accomplish this, Ricoh is leveraging Siemens’ Additive Manufacturing Network (AMN) capabilities to maximize process efficiency. An online order-to-delivery collaboration platform for the industrial AM community, AMN connects the AM ecosystem, simplifies collaboration and streamlines the AM production process, according to Siemens officials. They explain that the network digitalizes and consistently improves processes to, ultimately, accelerate the value in using AM.

Also, Ricoh and Siemens have begun collaborating to develop the means for aluminum-part mass production via binder jetting. To accomplish this, Ricoh is leveraging Siemens’ Additive Manufacturing Network (AMN) capabilities to maximize process efficiency. An online order-to-delivery collaboration platform for the industrial AM community, AMN connects the AM ecosystem, simplifies collaboration and streamlines the AM production process, according to Siemens officials. They explain that the network digitalizes and consistently improves processes to, ultimately, accelerate the value in using AM.  Machine makers also are targeting build volumes and other AM

technology to print more parts in less time.

Machine makers also are targeting build volumes and other AM

technology to print more parts in less time.  At Formnext 2023, held late last year in Frankfurt, Germany, 3D Systems introduced the DMP Flex 350 Triple, a three-laser configuration on its DMP Flex 350 LPBF platform. The compact AM machine includes a unique vacuum chamber design and extends 3D Systems’ Removable Print Module (RPM) concept by supporting two distinct RPM modules with different build volumes, thus offering flexibility for users. A new RPM for the machine enables a larger build of 350 by 350 by 350 mm (reportedly the most compact machine to support a build area of this size), and the machine also accommodates the standard RPM with a build volume of 275 by 275 by 420 mm. A larger build area makes the machine ideal for cost-effective processing of a variety of parts, including impellers and cooling plates. The RPMs can be swapped for increased application flexibility. The three-laser configuration, while boosting productivity, also reportedly results in no seams or changes in roughness in zones where multiple lasers work together. Alloys available for the machine include aluminums, stainless steel and nickel-based alloys. Expect availability of the DMP Flex 350 Triple with the larger build-box RPM in July 2024.

At Formnext 2023, held late last year in Frankfurt, Germany, 3D Systems introduced the DMP Flex 350 Triple, a three-laser configuration on its DMP Flex 350 LPBF platform. The compact AM machine includes a unique vacuum chamber design and extends 3D Systems’ Removable Print Module (RPM) concept by supporting two distinct RPM modules with different build volumes, thus offering flexibility for users. A new RPM for the machine enables a larger build of 350 by 350 by 350 mm (reportedly the most compact machine to support a build area of this size), and the machine also accommodates the standard RPM with a build volume of 275 by 275 by 420 mm. A larger build area makes the machine ideal for cost-effective processing of a variety of parts, including impellers and cooling plates. The RPMs can be swapped for increased application flexibility. The three-laser configuration, while boosting productivity, also reportedly results in no seams or changes in roughness in zones where multiple lasers work together. Alloys available for the machine include aluminums, stainless steel and nickel-based alloys. Expect availability of the DMP Flex 350 Triple with the larger build-box RPM in July 2024. Also, Markforged has unveiled its FX10 3D carbon-fiber printer, reportedly enabling users to print the parts when and where they’re needed, reducing costs and cutting lead times from months to days compared to traditional manufacturing methods.

Also, Markforged has unveiled its FX10 3D carbon-fiber printer, reportedly enabling users to print the parts when and where they’re needed, reducing costs and cutting lead times from months to days compared to traditional manufacturing methods.