| Welcome to the newest monthly newsletter offering from MetalForming magazine and PMA. We hope you find it useful and interesting; please feel free to share your thoughts with us. |

| |

|

This regular column from MetalForming magazine provides an inside look at the management styles and techniques of metal forming and fabricating company executives. We’ll share some of their philosophies, their daily challenges and how they face them, and offer additional insights. We hope that you find these interviews useful and can take away some ideas to use at your own company.

Want to be interviewed for this column? E-mail editorial director Brad Kuvin. |

| |

|

| Perspectives on Business Management with Larry Harrison, President, Conrex Steel |

When

we last spoke with Conrex Steel president Larry Harrison just a few

short months ago, the company, a Canadian fabricator of tank heads for

the oil and gas, hydrogen, cryogenics, and nuclear industries, among

others, had recently installed a new 3500-ton hydraulic press.

Inaugurated with a ribbon-cutting ceremony on November 19, 2021,

attended by Ontario, Canada, Premier Doug Ford, the press can form heads

to 7 in. thick and 196-in. dia.

“We’ve doubled our capabilities and capacity,” Harrison now says, “and now we’re working on building a company culture to allow us to reach our full potential. We know that can grow and we know what we need to do, now we just have to execute. That starts with evolving the company culture, and then maintaining it so that we all continue moving forward in one direction.” |

|

|

| |

|

| The right benefits can make a difference… |

| Chances

are, you have key employees that play important roles in your

organization. Having the right tools to recruit, reward, retain and

retire your top talent can help them and your business. Contact us today

to get started. |

|

|

| |

|

|

| |

| A Look Ahead—Prepared to Share Insights and Best Practices |

Laurie Harbour presents regularly at PMA events on a range of subjects critical to metal forming company management, and throughout 2022 she’s slated to speak at several PMA events. Her itinerary begins in January at the Metal Stamping and Lubrication Technology Conference where she’ll examine durable-goods demand and how it is driving unprecedented growth in many of the industries metal formers supply. Specifically, she will dig into the North American automotive-industry forecasts and the transition to and introduction of battery electric vehicles. Next, she will review the performance of the stamping and die industries in 2021 and look at what businesses must do to take advantage of the economic climate.

Read on to see what else Laurie has up her sleeve in 2022 to help metal formers stay informed and remain competitive. |

|

|

| |

|

| Advanced Controls Save Time, Optimize Feed Line Performance |

| Watch

our customer video to see how COE advanced controls cut press feed line

setup time in half. Loop and press simulations help test, debug, and

perform complete startup prior to shipping. User-friendly HMI guides

operators through setup; dynamic compensation optimizes equipment

performance. Watch our customer video. |

|

|

| |

|

| Tariff Rate Quotas Kicked Off on Jan. 1 |

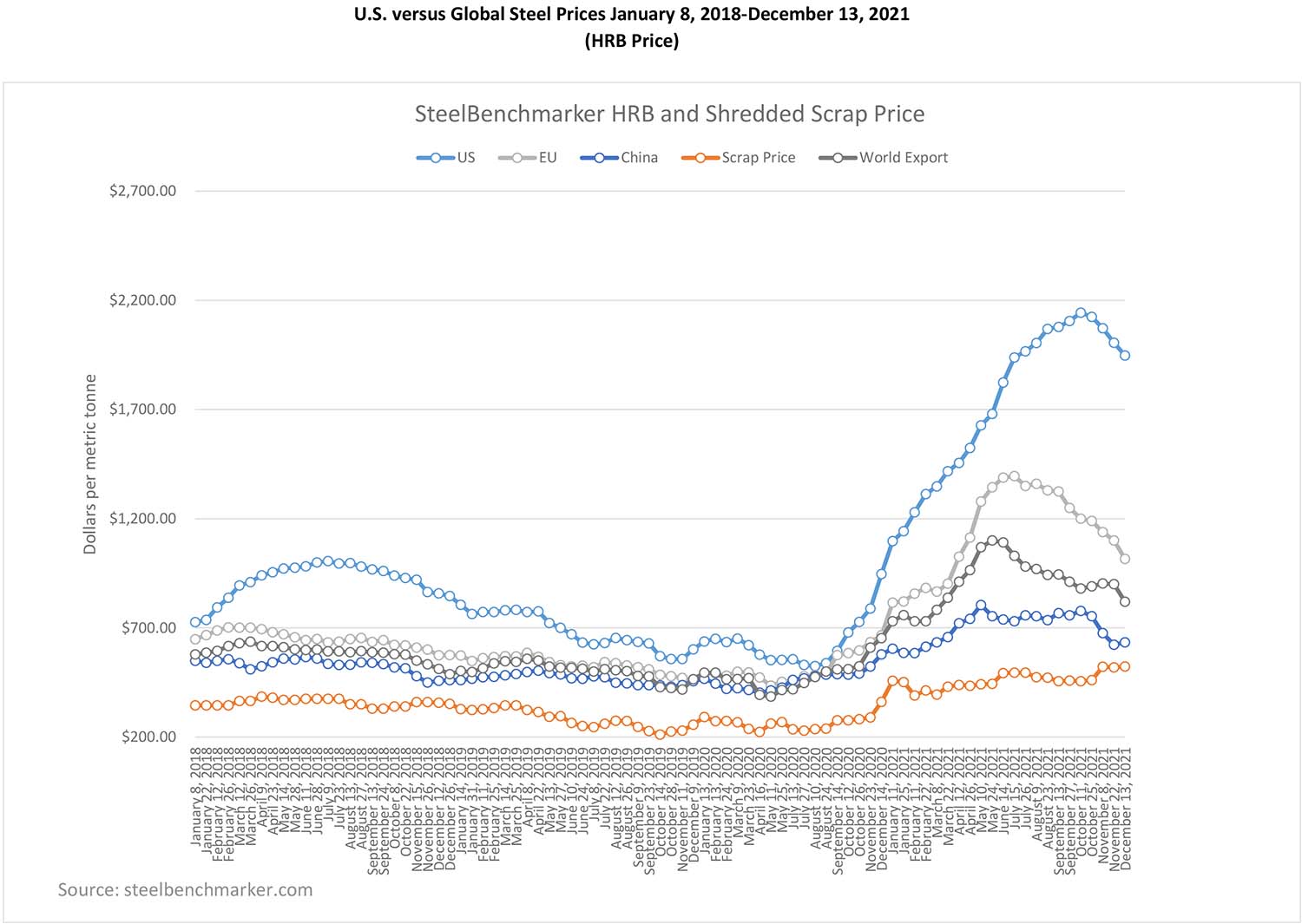

| “The U.S. price difference with China for hot-rolled steel is $1,313, and with Europe it is $931, while U.S. manufacturers continue to report challenges obtaining the steel they need to meet demand,” says Paul Nathanson, senior principal, Policy Resolution Group at Bracewell LLP and executive director, Coalition of American Metal Manufacturers and Users (CAMMU). “The new tariff rate quotas for the European Union that replace the Section 232 tariffs will start on January 1, 2022. This should help increase supply, but smaller manufacturers are concerned that they will be at the end of the line and likely will be the ones paying the 25-percent tariffs after the larger companies place their orders and fill the European Union quotas. It’s time to end the Section 232 steel tariffs so that U.S. steel users can compete on a level playing field with their global competitors.” |

|

|

| |

|

| Use of Alternative Methods to Control Hazardous Energy—In Lieu of Lockout of Press-Related Equipment |

In

our latest contribution from the expert safety team at White Horse

Safety, Inc., we learn how metal formers responsibly can use alternative

methods to control hazardous energy when performing stamping-related

tasks in the pressroom, in lieu of lockout. Referencing ANSI standards,

the article notes:

“Unfortunately, far too often the analogy of having the ‘cart before the horse’ occurs as the alternative method is implemented without following the requirements prescribed in ANSI Z244.1: - A practicability/justification analysis

- A risk assessment

- Other applicable evaluations as detailed in clauses in the standard.

“The above documentation, along with the properly designed and validated safety-control circuit, provides the defendable information to justify not following the hazardous-energy-control lockout methods. Only after completing this documentation and analysis should a stamper implement an alternative method.” |

| |

|

| Electrical Steel–Another Temporary Supply Chain Shortage or a Threat to OEMs’ Electrification Plans? |

The

Automotive Supply Chain and Technology team at IHS Markit has authored a

summary report on potential challenges within the electrical steel

market. Its researcher notes that while steel producers continue to

expand production capacity of electrical steel (silicon steel grades)

for use in motors, the rapid growth of the hybrid and electric vehicle

segment could potentially cause material demand to outpace supply from

2025 onward. The industry could face capacity constraints as early as

2023.

Among the report’s findings: The global gross demand for non-oriented electrical steel (the type used in motors and generators) required for the manufacturing of traction motors in hybrid and electric light vehicles is expected to grow from 320,000 tons in 2020 to just over 2.5 million tons by 2027, and in excess of 4.0 million tons by 2033. |

|

|

| |

|

| 4 Things to Think About as Fed Policy Changes |

As Federal Reserve policy reverts back a more normal state, returning from a lengthy period of overt stimulus in response to the COVID-19 crisis, it’s important to understand the potential impact on economic growth. That’s the subject of this new blog post from Brian Beaulieu, CEO and chief economist of ITR Economics:

“Growth will continue for GDP and Total Industrial Production,” writes Beaulieu, “albeit at a slower pace than in 2021. Also of note: Post-recession recoveries for Nondefense Capital Goods New Orders (excluding aircraft) continued to exhibit strong rising trends in the year following the withdrawal of stimulus.”

And regarding inflation, Beaulieu adds: “The current inflation rate will likely peak, with the rate-of-change then moving lower. That means less inflation (i.e., disinflation). However, if you have seen our inflation forecast, you know that we expect that the disinflation will be temporary, with a whole new round of high inflation waiting for us in concert with the next business cycle (post mid-2023).” |

| |

|

| Will 2022 Live up to the Hype Around Hyperautomation? |

Predictive process automation—dubbed “hyperautomation” by researchers at Gartner Inc.—take traditional automation technologies such as robotics to the next level, leveraging artificial intelligence and machine learning. While this movement may seem unlikely to impact small to midsized metal formers any time soon, consider that the market for hyperautomation-enabling technologies is projected to reach $596 billion in 2022, up nearly 24 percent from $482 billion in 2020. As noted in this QAD blog post:

“The pandemic quarantine…accelerated the adoption and implementation of hyperautomation and many other technologies that would have taken years to become mainstream. It won't be long before hyperautomation-enabling technologies…become a ‘condition of survival’ for manufacturing operations.” |

| |

|

|

| |

|

|

|

|

Stamping Presses

Stamping Presses

Event

Event