| Welcome to the newest monthly newsletter offering from MetalForming magazine and PMA. We hope you find it useful and interesting; please feel free to share your thoughts with us. |

| |

|

This regular column from MetalForming magazine provides an inside look at the management styles and techniques of metal forming and fabricating company executives. We’ll share some of their philosophies, their daily challenges and how they face them, and offer additional insights. We hope that you find these interviews useful and can take away some ideas to use at your own company.

Want to be interviewed for this column? E-mail editorial director Brad Kuvin. |

| |

|

|

| Perspectives on Business Management with Mary Fitzgerald, President and CEO, Acme Wire Products |

Acme Wire provides custom formed and welded wire components for customers in the premise wiring, safety, sporting goods, food-service equipment, lawn and garden, medical and lab equipment, HVAC and other industries. A key takeaway from my interview with the company’s leader, Mary Fitzgerald, is her emphasis on creating a company culture of “we” rather than “me.”

“I value integrity, problem-solving skills, creativity and persistence,” she says. “As a contract manufacturer, a lot of different and unique jobs pass through here. We often see things that we’ve never seen before, so we value creative thinking. We want our teams to thoroughly understand the capabilities of our equipment and processes, and then provide input to the managers to help improve throughput and productivity, and control costs. Then, when we identify the ‘idea people,’ we look for ways to promote them, and challenge them. I find that incredibly satisfying.” |

|

|

| |

|

| Avoid or Reduce Your Energy Tax Burden |

| Did

you know your organization may be able to avoid or reduce your current

tax burden, or in many cases even recoup past taxes paid in error on

energy usage? |

|

|

| |

|

| Love Letters to Manufacturers: Chaos Likely the Norm |

“After a very difficult 2020 the manufacturing industry rebounded quickly, and today, chaos seems to be the best word to describe what many businesses are experiencing.”

That’s the foundation laid out in this month’s Harbour results Inc. Love Letters to Manufacturers. At the same time, opportunities abound for metal formers, particularly those in the automotive industry. An explosion in new vehicle launches planned through 2023, and in new nameplates means that “best-in-class will need to have a clear strategic plan and understand what their company does well. Businesses will need to be able to quickly react to marketplace increases or decreases, so flexibility is the key.”

Check out the blog to get the rest of the story. |

|

|

| |

|

| EEOC COVID-19 Update Addresses Religious Objections to Workplace Vaccine Requirements |

The U.S. Equal Employment Opportunity Commission (EEOC) recently posted updated assistance related to the COVID-19 pandemic, specifically addressing questions regarding religious objections to employer COVID-19 vaccine requirements. The new information explains how Title VII of the Civil Rights Act of 1964 applies when someone requests an exception from an employer’s COVID-19 vaccination requirement that conflicts with their sincerely held religious beliefs, practices or observances.

“This update provides employers, employees and applicants with important assistance when navigating vaccine-related religious accommodation requests,” says EEOC hair Charlotte A. Burrows. “Title VII requires employers to accommodate employees’ sincerely held religious beliefs, practices and observances absent undue hardship.” |

| |

|

| Target on Safety: The Basics of Hazard Communication |

From

Ron Pitcher, president of Pitcher Insurance Agency, specialists in risk

management and insurance for the metal forming industry, comes this

primer on hazard communications, the importance of Safety Data Sheets

and the proper labeling of product containers.

“Supervisors should ensure that employees know where all SDS are located,” Pitcher says. “Employees should familiarize themselves with the SDS for any hazardous material they work with or may be exposed to in the workplace, to fully understand the risks and take appropriate precautions, and know how to find information quickly in the event of a spill or accident.”

Regarding labeling requirements, every container, says Pitcher, must include:

- Product identifier

- Supplier information

- Pictogram

- Precautionary statement

- Signal words

- Hazard statement.

|

| |

|

| Content Strategy Drives Lead Growth & New Business Opportunities |

| Since 2003, TopSpot has specialized in digital marketing and website development for industrial manufacturers, fabricators, CNC shops, OEMs and more. Learn more about how TopSpot’s data-driven content development increased the industrial website's online leads by 221% within the first year. |

|

|

| |

|

|

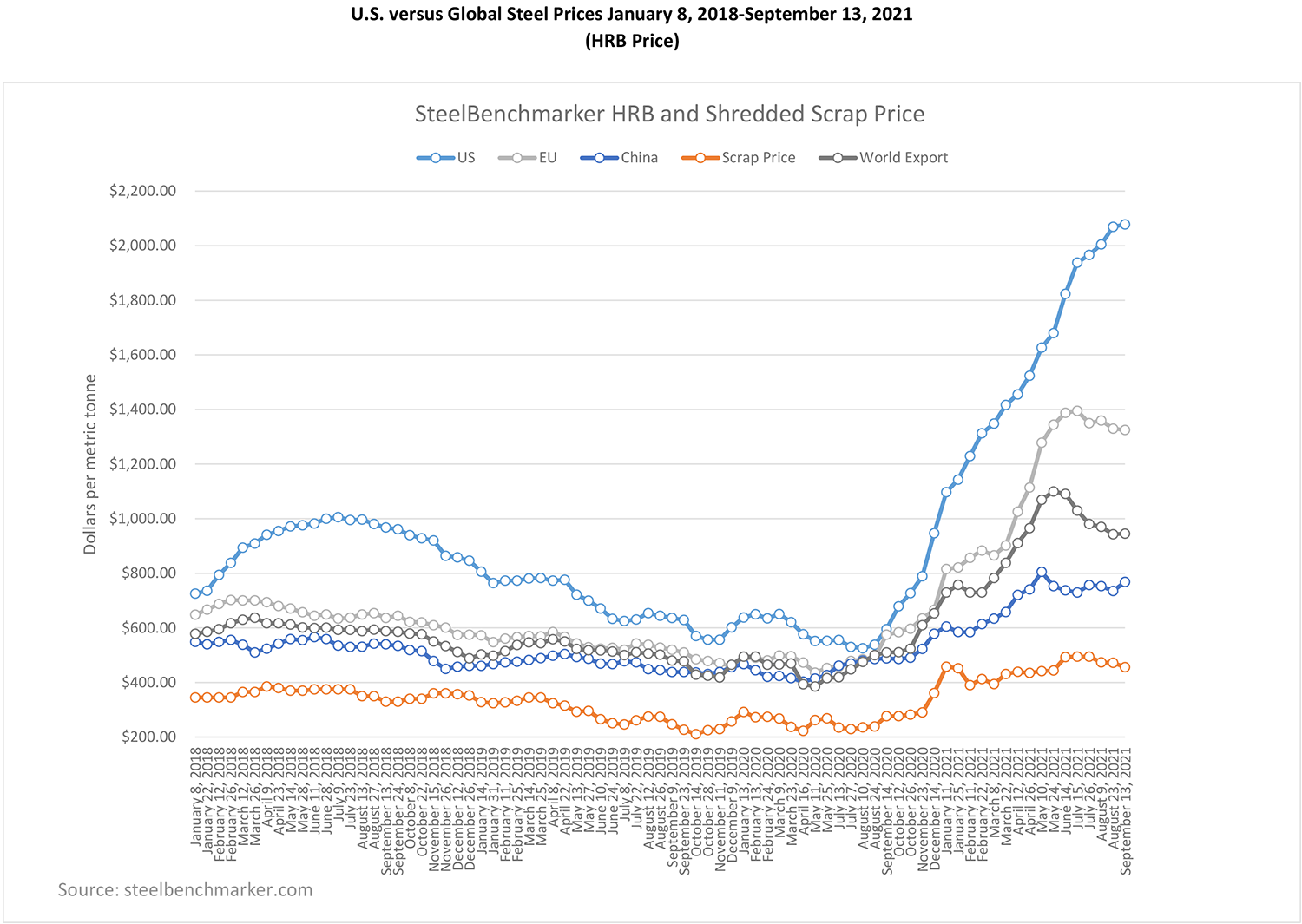

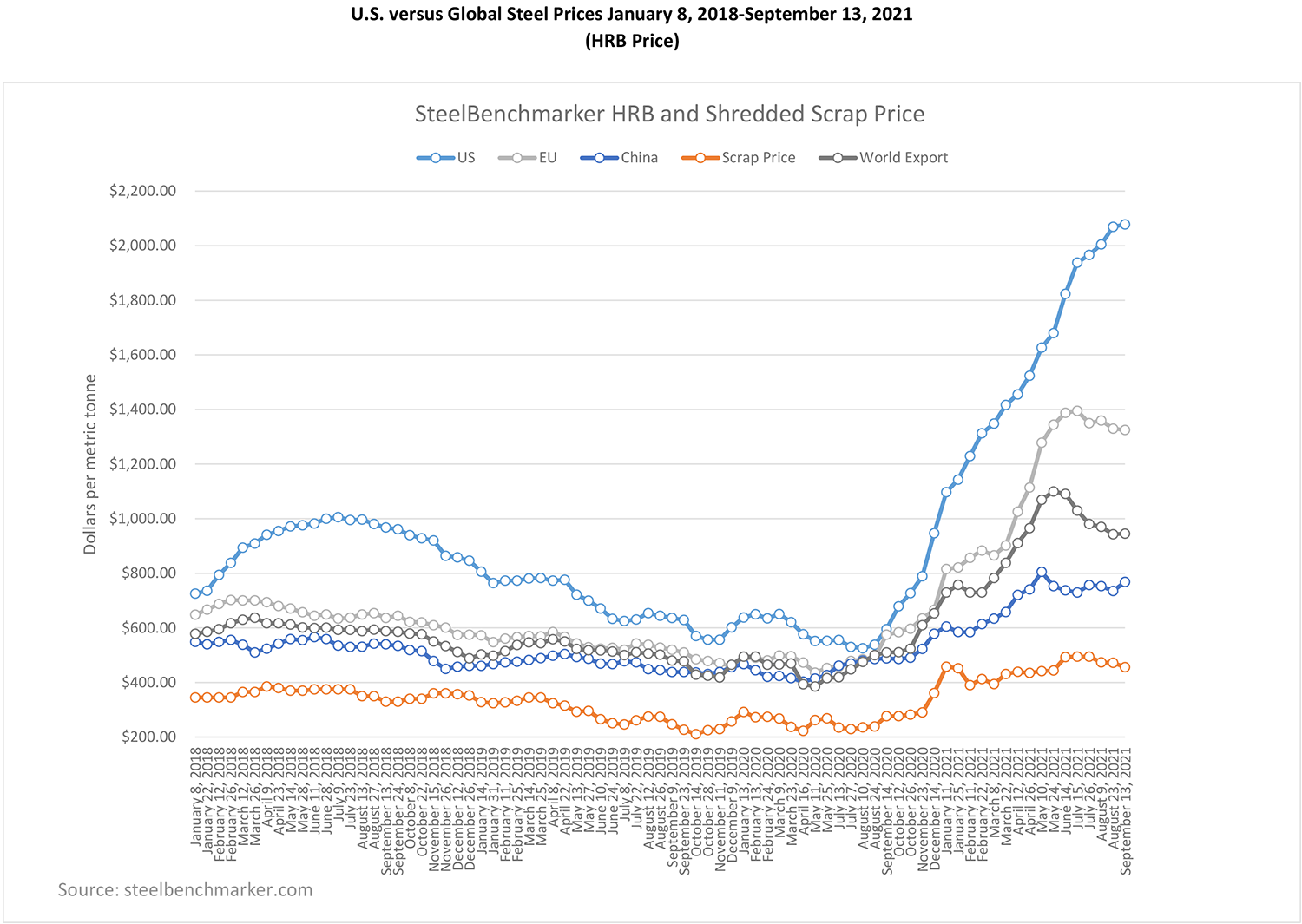

| Tracking U.S. vs. Global Steel Prices |

“The price difference between the United States and China for hot-rolled steel is now $1365,” says Paul Nathanson, senior principal, Policy Resolution Group at Bracewell LLP, “and with Europe it is $943. Both are the widest gap reported since the Coalition of American Metal Manufacturers and Users (CAMMU) started keeping track after the imposition of the Section 232 steel tariffs in 2018.”

Nathanson, who also serves as CAMMU executive director, continues: “For comparison, one year ago the difference in the price of hot-rolled steel between United States and China was $193, and with Europe it was $95. The domestic steel industry’s capacity-utilization rate remains at almost 85 percent. With domestic steel producers enjoying record profits and domestic steel-using manufacturers facing steel shortages, delays, and record prices, it makes no sense to protest the domestic steel industry with tariffs. U.S. steel producers and steel-using manufacturers should be competing on a level playing field. It is time to end the Section 232 steel tariffs.” |

|

|

| |

|

| NAM Pushes Back on Global Minimum Tax Hike |

The National Association of Manufacturers (NAM) has launched an attack on congressional efforts to increase the minimum tax on U.S. companies’ foreign earnings. The United States already has a global minimum tax, called the global intangible low-taxed income tax (GILTI), on the foreign earnings of U.S. multinational corporations. Now, the pending House reconciliation bill would increase the GILTI rate from the 13.125 percent to 17.4 percent.

This recent NAM survey presents the impact of such a tax hike. |

| |

|

| Deadline for Machine Tool Tax Write-off Approaching |

This

year, section 179 of the internal revenue code, How to Depreciate

Property, allows business owners to expense up to $1.05 million on

work-related equipment, including machine tools. The deduction is

applied to your tax return, and the amount generally increases annually

with inflation. It can save you more money at the outset, rather than

depreciating machinery over several years.

This article serves as a brief overview of section 179 and bonus depreciation. |

| |

|

|

| |

|

|

|

|

Stamping Presses

Stamping Presses

Event

Event