China and The Rest of Us

The issues related to steel prices are about as global as

they can get, with China at the epicenter. "Everyone should realize that

what happens in the China metals market affects companies throughout the world,"

says Andy Pappas, managing director and head of metals asset-based lending at BMO

Harris Bank.

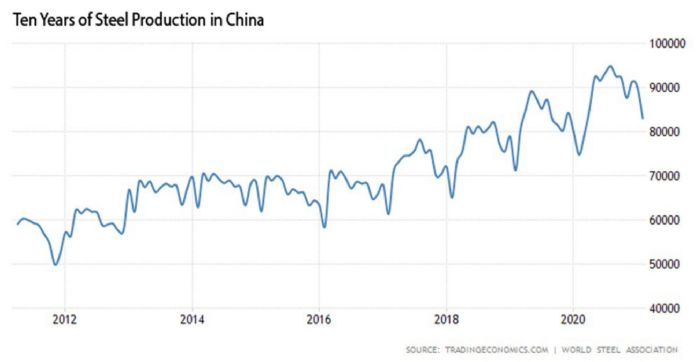

Worldwide, most steel-producing regions reported a decline in crude steel output in February 2021 compared to a year ago, led by North America (down 8.9 percent), the European Union (down 7.1 percent), and Africa (down 6.4 percent). By contrast, according to worldsteel.org, China produced about 83 million metric tons in February 2021, an increase of 10.9 percent from February 2020, while production the rest of the world, combined, totaled about 73 million metric tons.

Throughout the pandemic, China continued to crank out steel and

maintain its world-leadership position. Indeed, China's 2020 production showed hardly

any sign of a downturn.

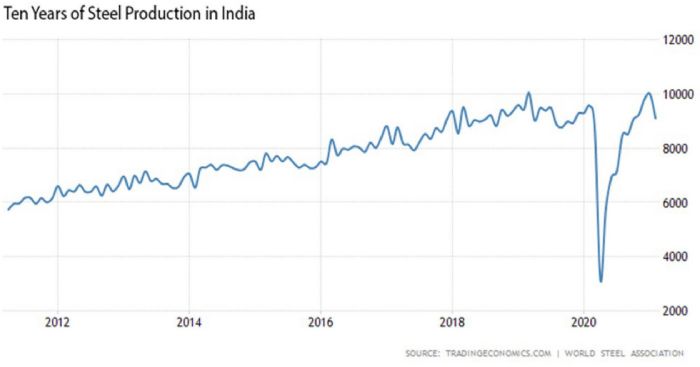

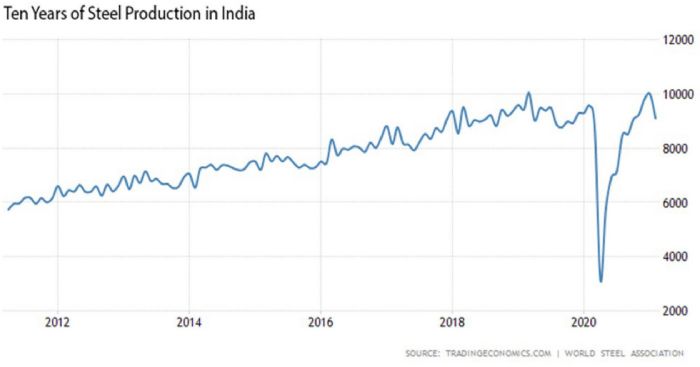

India, a distant second in steel production, applied a nationwide

lockdown effective March 25, 2020. Within days, India's steel mills began to

slash output. However, its steel ministry quickly labeled the steel sector an

essential service, removing most restrictions.

That move made little difference, however, as India's steel production

plunged by 70 percent in April, due to shrunken demand and absent workers. India's

steel production got back on track quickly, though: The country churned out steel

at a near-record rate of 10 million metric tons in January, and followed up by

producing 9.1 million metric tons in February.

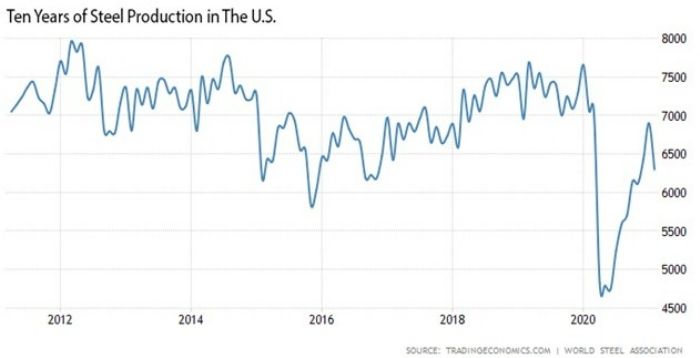

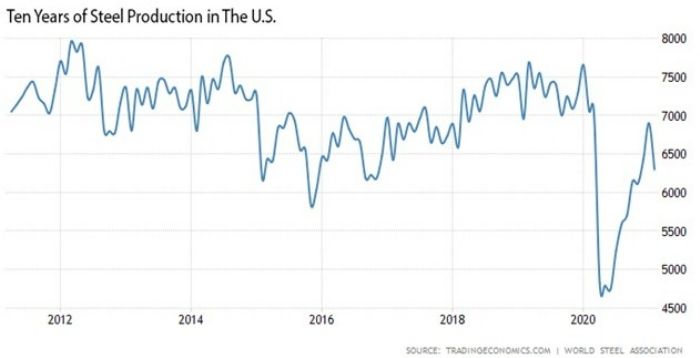

Here in the United States, mills have recovered at a much slower rate, and production still remains shy of pre-pandemic levels.

In all, 15 U.S. mills representing more than 22 million metric tons of steelmaking capacity were idled in 2020. Eight have come back online, while seven others, worth about 10 million metric tons of annual capacity, remain dormant. One such operation, U.S. Steel's Great Lakes Works, will remain closed indefinitely, being too old and inefficient to justify a re-start.

"The mills are stepping back and realizing that prices are good, and there’s no need to reopen all of their mills," says Pappas. "(Mills) are reevaluating and trying to understand if steel prices are going to remain high."

Cleveland-Cliffs president and CEO Lourenco Goncalves confirms that viewpoint. "We are not going to produce more tons just to create a situation that we will have more out there in the marketplace, and we will start to see prices deteriorating," Goncalves said during a February earnings call. "We will do our part to protect prices, and that is the right thing to do from a return-on-capital-investment standpoint."

U.S. steel producers are making some investment in capacity,

but not enough to meet the growing appetite for steel. Nearly 10 million metric

tons of steelmaking capacity, representing new-mill additions as well as

existing mill expansions, are scheduled to come online by the end of 2022.

"These (mill) expansions and additions are significant,"

Pappas says. "But, I also think there's a vaccine effect coming in this

country. If you look at any GDP-growth

expectation in the United States, I think you're going to see exceptional

growth this year. There's enough pent-up demand where there's going to be

increased spending as soon as vaccines are fully rolled out."

Pappas warns, however, that some mills will be taking blast

furnaces offline for maintenance in the coming months, largely negating the

anticipated new output. "Anything that comes online is offset by something

going offline," he says.

Another issue impacting offline capacity is the pressure to

reduce carbon emissions. Because this

pressure originates from several sources, including green-minded consumers, environmental-action

groups, government regulators and even some investors, it's unlikely to ease. Sooner or later, U.S. mills must invest big

to replace old plants with cleaner, more energy-efficient production methods

and facilities. Those investment costs eventually

will flow downstream to metal formers and their customers.

Reducing the amount of energy needed to produce steel has been the industry’s biggest environmental success story. Since 1960, energy consumption per ton of steel produced has decreased by 61 percent—a rare win-win with reduced carbon emissions on one hand and steel-production cost savings on the other. The industry will no doubt continue to pursue this particular strategy, because, according to a World Steel Association report, energy accounts for as much as 40 percent of the cost of making steel.

Demand Stays Strong

Meanwhile, steel demand will remain strong, as evidenced by the March 2021 Institute for Supply Management Purchasing Managers' Index, which showed an impressive gain of 3.9 percentage points compared to February, to 64.7 percent. That’s well above forecasts and the highest since December of 1983. Note: Any PMI above 50 represents an expansion when compared with the previous month. Numbers representing new orders, production and employment also continued their upward trend and fast rate of change. This impressive pattern of growth is now in its 10th month.

Clearly, the U.S. economy is growing quickly. The big question, then, is how long will this growth trend last? That depends, in part, on how the public responds to the recent $1.9-trillion coronavirus-relief package and $1400-per-person stimulus checks. Will most people spend their stimulus checks freely on local goods and services to give businesses a boost—as the government hopes? Or, will they bank the cash or pay down debt? The more that choose to spend, the higher the demand boost for consumer hard goods made with steel, such as vehicles, appliances, recreational products and home-improvement materials.

And, an additional and even larger spending package, the $2.3-trillion

American Jobs Plan, has begun to weave its way through Congress. Those dollars,

as noted in a recent Whitehouse briefing, would be invested in infrastructure

projects including roads and bridges, 5G networking, electric-vehicle charging

stations, the electric grid and other projects that require steel, further inciting

demand.

Meanwhile, Tariffs Remain in Place

On March 8, 2018, almost exactly two years before he declared COVID-19 a national emergency, President Trump announced a 25-percent value-based tariff on imported steel. He cited Section 232 of the Trade Expansion act of 1962, concluding that the United States’ national security became threatened by high quantities of imported steel. In addition, U.S. anti-dumping and countervailing duties on more than 170 products have combined to create another layer of costs for steel entering the United States.

The steel tariffs apply only to raw steel, meaning no tariff

protection against global competition for the products manufactured by PMA

members and other metal formers. This places U.S. steel-using manufacturers at

a competitive disadvantage with overseas firms that pay lower global prices for

steel.

Pressure from U.S. steel-using manufacturers to reduce or eliminate tariffs has been persistent and continues to build. Steel-using manufacturing jobs outnumber steel-production jobs in the United States by as much as 80 to 1, according to researchers at Harvard University and the University of California, Davis, cited in an EconoFact article.

That push hasn't yet worked. U.S. Commerce Secretary Gina Raimondo said recently in an MSNBC interview that the tariffs have been effective, although she indicated that the Biden Administration is reviewing all of the previous administration’s trade actions. In addition, the European Union and United Kingdom plan to double retaliatory tariffs on U.S. whiskey exports by 50 percent beginning on June 1, 2021, unless the steel tariffs are terminated. However, steelmakers and steelworker unions are using their significant lobbying strength in Washington, D.C., to preserve the tariffs.

In response to the steel tariffs, PMA became a founding

member of the Coalition of American Metal Manufacturers & Users (CAMMU), a

group whose members include trade associations representing more than 30,000 U.S.

steel-using manufacturers. CAMMU is

working in Washington, D.C., to convince the Biden Administration to terminate

the steel tariffs as quickly as possible.

Fuel on the Fire: Shipping Costs and Backlogs

Another issue related to steel supply and pricing recently has

snuck up on metal formers: shipping and logistics. Steel is heavy stuff, and when trucking rates

rise or backlogs que up, metal formers take a big hit.

Last year, in particular, yielded significant freight

backlogs and cost increases as the pandemic rattled through the economy. As stay-at-home orders took effect and more

employees worked from home, Americans shopped online for their essentials and

the freight burden increased exponentially. By the start of 2021, the online shopping

binge was in full swing. A study by communications software maker Adobe found

that during the first two months of 2021, consumers spent $121 billion online,

34 percent more than the same period in 2020.

Industry analysts say that an extreme shortage of qualified

drivers has kept trucking companies from hauling enough freight to meet demand.

And, unfortunately, the pool of new driver applicants is not nearly deep enough

to keep up with driver retirements and attrition. That means more overtime and,

in many cases, weeks away from home for remaining drivers. Some have had enough

and have decided to retire, while others chose to ride out the pandemic and

collect unemployment.

To keep their drivers behind the wheel, carriers have upped

the ante on wages and benefits. An

experienced driver with a good safety record and hazardous-materials

qualifications now can earn a six-figure salary. Larger freight carriers with deep pockets have

offered hiring bonuses of $8000 or more. Freight rates have increased accordingly.

Another line item on the rise: carrier insurance rates. Arlington Virginia-based American Transportation Research Institute reports that "nuclear" verdicts–jury awards in excess of $10 million–now are commonly held against carriers with trucks involved in deadly crashes. As a result, annual insurance-rate growth for most carriers, on a per-mile basis, has averaged 18 percent during the past 5 yr.

Diesel-fuel prices also have increased. One gallon of on-highway diesel fuel in the United

States now averages $3.12 per gallon, up 64 cents from this time last year.

Shop Smart and Stay Informed

As the U.S. economy recovers, demand for steel will remain

robust throughout 2021 and likely well into 2022. The Biden Administration clearly is determined

to spend big to rekindle economic growth. If the $2.3-trillion infrastructure

bill becomes law, federal buy-American procurement rules requiring steel used

in government projects be sourced from domestic mills will make the steel

supply situation even worse.

Other steel-supply dampeners, including freight backlogs,

U.S. blast-furnace maintenance shutdowns and labor actions likely will remain, and

there is no certainty as to when the steel tariffs will be terminated. Environmental-compliance issues, lingering

coronavirus concerns and scarce skilled workers challenge U.S. mills to produce

enough steel to meet demand. And, with

the current demand/supply equation so favorable to steel producers, their

boards and investors seem poised to pump the brakes on any effort to increase output.

As a result, smart steel-purchasing choices will be the name of the game for metal formers in 2021. The most successful companies will be those that stay informed, communicate transparently with their customers and work together with customers as a team. That winning formula will give purchasing managers the information they need to plan effectively and avoid expensive mistakes. MF

See also: Precision Metalforming Association, Ajax Metal Forming Solutions, LLC

Technologies: Management, Materials