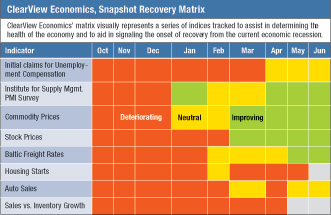

At last May’s PMA Marketing and Sales Roundtable, Dr. Ken Mayland, a respected economist with ClearView Economics, based in Ohio, presented arguments related to the state of the economy and his opinion that we may be in the crest of experiencing a robust recovery. Dr. Mayland reasons that the rapid decline of the economy and subsequent reduction in inventories across most industries is akin to a widely stretched rubber band, building up potential energy, which when released snaps back quickly.

Key to Dr. Mayland’s presentation included a detailed listing of metrics that deliver good insights on cyclical turning points, together with an assessment of our present situation. The overall picture is that we have passed the period of maximum stress and are starting to see early signs of a coming recovery. His remarks were punctuated a week later by, among other things, a continued stock market rally. Furthermore the Conference Board recently reported that consumer sentiment improved considerably in April, posted another large gain in May, and now stands at its highest level in eight months. Why is consumer confidence critical? It suggests that the 91 percent of the nation’s population who are employed may start reviving demand.

Being optimistic, I tend to accept Dr. Mayland’s conclusions that we will see marked growth by the end of 2009 with a return to near-2006 levels in 2010. Whether you share this optimism or not, it is prudent to prepare to capture the coming opportunity, whenever you believe it will come. The following lists some critical steps to consider in terms of spinning back up your ability to capture and convert opportunities into receivables.

• Do you have capital reserves or revolving credit sufficient to support your needs to turn on idle equipment, bring back laid-off employees and finance the purchase of raw goods to support rapid revenue growth?

• Do your HR professionals have leads on skilled labor, engineering and management to rapidly bring up your workforce levels as needed? Is the plan scalable and able to be implemented based on revenue triggers? Considering today’s job market, now is a good time to hire the best for less or to “park” hires at a reduced wage for near future activation at full pay.

• What opportunities are available to your purchasing professionals to lock in pricing based on today’s costs before demand drives up prices of raw materials?

• Which critical supply lines do you need to reestablish or replace in the event that your capacity exceeds that of your current sources?

• Are you prepared to relax travel restrictions to enable sales to reconnect with distant customers and accelerate efforts to cultivate newer, stronger relationships that advance new contract bids?

• Are you prepared to take advantage of new program releases even as you strive to capture the abundance of take-over work in tool and die, automotive and other industries?

• How quickly can you convert your workforce and facilities from a reduced workweek to an expanded one?

• What maintenance, recertification or other infrastructure needs do you need to prepare for, in the advent of production increases? For that matter, with the abundance of commercial and industrial space, should you move easy-to-relocate operations to less-expensive locations or renegotiate with landlords prior to your business seeing marked improvements?

• What is your opportunity to negotiate transportation rates that mitigate your exposure to rising fuel and transportation prices, as demand for goods and the cost of oil increase in step with the economy?

In answering these and other related questions, the need for assignments and planning becomes evident. Spinning up your operations to quickly and efficiently take advantage of an economic recovery needs to be a priority. Even if your specific industry segment might lag a bit behind the leaders, being prepared and having assigned actions that can be executed based on predetermined environmental triggers can provide a substantial and compelling competitive advantage.

Economic Indicators

Listed below are some sources of data that ClearView Economics recommends as a starting point to build your own means of tracking economic conditions. These give indications to the economy at large. You will benefit from tapping into some additional metrics that apply specifically to your industry. Trending can prove to be a valuable resource to your executives and planning team.

• Weekly initial claims for unemployment compensation: www.dol.gov

• Copper prices (sensitive raw materials): www.kitcometals.com/

• Stock prices, S&P500 (SPY); plot with Stockcharts or Yahoo/finance; is the current price above the 50d moving average? Is the 50d moving average RISING? www.stockcharts.com

• Baltic dry freight rates (reference the third chart down on this webpage): www.investmenttools.com

• Housing starts (Look at a 3-mo. moving average): www.census.gov

• Light vehicle sales: www.bea.gov

• Total business sales growth (year over year) versus inventory growth (year over year): www.census.gov. MF

Technologies: Management

Taking steps now to map your actions as revenues increase will, at the very least, smooth the ramp up and reduce stress, increase the opportunity for enhanced margins and improve your competitive position with buyers. I contend that this may improve your sales position because corporate purchasing agents have become averse to risk. They don’t have the time or resources to deal with problematic suppliers, so they want to know that they’re doing business with viable companies who are financially strong, and prepared to meet their production needs. Presenting a solid set of business fundamentals, with key financials, and a plan on how to scale production can be important selling points to prospects.

Taking steps now to map your actions as revenues increase will, at the very least, smooth the ramp up and reduce stress, increase the opportunity for enhanced margins and improve your competitive position with buyers. I contend that this may improve your sales position because corporate purchasing agents have become averse to risk. They don’t have the time or resources to deal with problematic suppliers, so they want to know that they’re doing business with viable companies who are financially strong, and prepared to meet their production needs. Presenting a solid set of business fundamentals, with key financials, and a plan on how to scale production can be important selling points to prospects.