The Tariff Men: Biden Continues Trump’s China Tariffs

June 12, 2024Comments

Better late than never, is how one might describe the Biden administration’s release of its report on the effectiveness of former President Trump’s tariffs on Chinese imports. The report resulted in President Biden increasing tariffs on a targeted group of Chinese imports, including electric vehicles (EVs), steel and aluminum, and semiconductors.

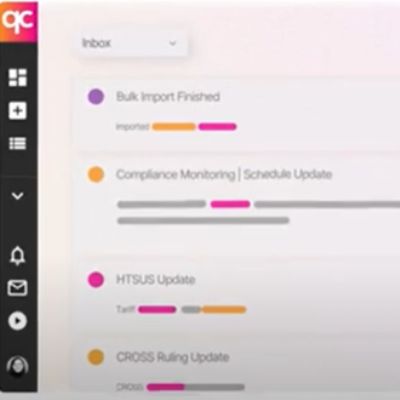

The report’s release also led the Office of the U.S. Trade Representative (USTR) to announce that it will retain the 25% tariffs on more than 6800 imports from China. USTR also is allowing importers to request an exclusion from paying the tax on a select list of shipments from China, which, if approved, suspends the tariff on that import through May 31, 2025.

The report’s release also led the Office of the U.S. Trade Representative (USTR) to announce that it will retain the 25% tariffs on more than 6800 imports from China. USTR also is allowing importers to request an exclusion from paying the tax on a select list of shipments from China, which, if approved, suspends the tariff on that import through May 31, 2025.

The legally required 4-yr. review concludes that China’s market share of U.S. imports decreased since the imposition of the tariffs starting in 2018, and that hundreds of companies moved production capacity out of China as a direct result of the Section 301 tariff actions.

However, China continues much of the illegal acts which prompted the Trump administration to impose the tariffs. The report finds that “many of the technology transfer-related acts, policies and practices described in the original Section 301 Report persist and increasingly burden or restrict U.S. commerce.”

In line with its efforts to boost renewable-energy industries, infrastructure and semiconductor manufacturing, the Biden administration will begin increasing tariffs in “strategic sectors.” Starting in August 2024, tariffs increase to 25% on Chinese imports of EV batteries, steel and aluminum, and ship-to-shore cranes. Also this year, the tariff on Chinese-made EVs quadruples to 100%, with solar cells, and needles and syringes increasing to 50%. Over the coming 2 yr., additional products imported from China face a 25% tariff rate, up from 7.5%, such as graphite, medical gloves and permanent magnets.

In the report, USTR specifies that the over-production of steel and aluminum in China distorts the global market and harms the domestic industry, adding that tariffs will reduce “opportunities for circumvention and help ensure the long-term viability of U.S. production.”