China Mission #4 Complete: Mission Accomplished

October 1, 2008Comments

Last May, metalforming executives participated in the fourth in a series of PMA China Study Missions, to benchmark against Chinese metalforming operations and develop strategies for forging partnerships.

|

| Participants in the PMA study mission to China spied this street market where manufacturers can purchase metal-alloy products in small quantities. |

To compete, any company must know its competitors’ operations as well as it knows its own. Wonder why your metalforming company loses work to others, whether they are domestic or foreign competitors? Wonder how a competitor can beat your price or delivery schedule so handily?

Seeking answers to these questions and others convinced a group of U.S. metalforming executives to participate in the Precision Metalforming Association 2008 China Study Mission, conducted last May 11-17. Delegates toured 12 plants in Shanghai, Suzhou, Wuhan and Beijing; attended workshops; spent a half-day at China’s largest tool-and-die exhibition; and, last but not least, enjoyed hours of intensive professional networking with their peers. Post-mission interviews reveal how importantly attendees viewed the opportunity to gain first-hand knowledge of the country, its people, its economy and manufacturing capabilities, and the potential of the Chinese market.

Small, Privately Held Metalformers Taking Control of the Market

|

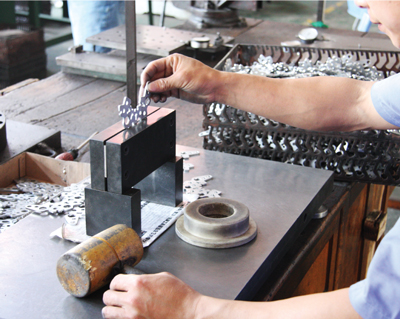

| An inspector at one of the Chinese

metalforming plants toured uses a gauge to check flatness.

Out-of-tolerance parts then were manually hammered flat. |

PMA worked with the China Business Network (CBN) to organize the trade mission. CBN manages marketing, sales and manufacturing activities in China for a consortium of metalworking companies. “The manufacturing picture in China has changed dramatically in the last few years,” says David Burch, CBN special projects director. “We have seen a lot of the larger government-supported manufacturing companies begin to disappear and in their place have sprouted a new and bigger secondary manufacturing market of smaller, niche and more entrepreneurial companies. These newer and typically privately owned companies offer real opportunities for Western manufacturing companies to form true partnerships—mutually beneficial relationships. Western companies gain non-capital-intensive capacity-on-demand, and access to the Chinese industrial market. Chinese partners gain management and technical skills and access to global markets to allow them to grow their companies.”As an example of one such Chinese

company toured by the PMA delegates, Burch points to Wuhan Huaxia Precision Mechanical Engineering Co. Ltd. A privately owned U.S. $2 million firm that specializes in fineblanking, it has 84 employees, 21 of which are engineers, and exports 25 percent of its stampings to Italy. “This company, we were told,” recalls Burch, “has made several proprietary upgrades to its fineblanking machinery. Clearly its management wants to go beyond just making parts; it’s developing metalforming expertise that it can take to the marketplace.”

On the Cusp of Major Technology Enhancements

Delegates agreed that China has developed a diverse range of metalforming capabilities. Says trade mission attendee Hale Foote, president of Scandic, a metalformer in San Leandro, CA: “While I did expect to see a lot of hand-fed stage tooling during the plant tours, I was surprised to see that a lot of companies are right on the cusp of developing sophisticated progressive-die stamping.” Foote points to high inflation and a new wage law being introduced in China as spurs to what he calls “a real sea change on the labor front.” “We learned during the visits that the Chinese have the smarts and the equipment to develop more automated stamping operations,” he says, “but to date have lacked the economic imperative to do so. But that is coming.”

|

| A Chinese worker inspects and sorts parts manually between press operations. |

Scandic manufactures coil springs, fourslide stampings, precision progressive stampings and CNC wireform products, and Foote has seen a lot of his stamping business move to China as so many of his Fortune 500 customers now assemble there. “A lot of our customers have told me that if Scandic can produce in Asia, we can keep the business,” he says. “We’re still doing all of the engineering, prototype development and soft-tooling development. And we still build hard tooling, but some of the more attractive stamping winds up being done in Asia.

“That migration of work is why I attended the study mission with PMA,” Foote continues. “I needed to see first-hand what I am up against, and to perhaps look for opportunities to partner with metalformers in China. As a result of the visits we made, I definitely came a with some partnership prospects. Since we’ve returned, I’ve had jobs quoted by my Chinese contacts, and we are placing orders with them. I’ll be going back to China soon to take these relationships to the next level.”

Rising Volumes Cause for Careful Business Planning

Scandic manufactures coil springs, fourslide stampings, precision progressive stampings and CNC wireform products, and Foote has seen a lot of his stamping business move to China as so many of his Fortune 500 customers now assemble there. “A lot of our customers have told me that if Scandic can produce in Not only do Western metalformers seek opportunities to partner with Chinese stampers to supply parts to Chinese plants of Fortune 500 companies, they also look for opportunities to open their own facilities in China. That’s why U.S. metalformer Pridgeon & Clay sent marketing-sales analyst Stephen Koets on the study mission. The firm, an automotive supplier of chassis and exhaust-system components based in Grand Rapids, MI, operates facilities in Europe and Mexico. Late in 2007 it opened a sales and engineering office in Shanghai and has begun conversing with prospective customers about stamping in China, perhaps beginning in 2010, shares Koets. Koets and the other delegates visited, in addition to privately owned Chinese metalforming and tool and die companies, a trio of U.S.-owned metalforming companies in Suzhou: Trans-Matic Precision Metal Forming Suzhou Co., SKD Tooling Co. and Connor Manufacturing Co. Trans-Matic specializes in deep drawing using eyelet transfer presses, and its Suzhou facility houses eight production presses as well as a small toolroom and quality laboratory. SKD Tooling operates a 7320-sq.-m facility in Suzhou with the capacity to manufacture 1800 die sets annually; 65 percent of its sets are exported to North America and Europe. And Connor manufactures precision metal stampings, wire forms, springs and assemblies to the electronics, semiconductor and heavy-truck markets.

|

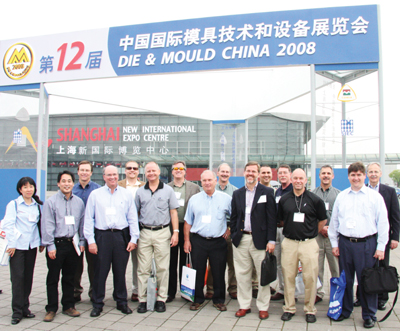

| Study-mission participants spent half a day walking the Die & Mould China 2008 trade show, an opportunity to meet with prospective suppliers. |

Scandic manufactures coil springs, fourslide stampings, precision progressive stampings and CNC wireform products, and Foote has seen a lot of his stamping business move to China as so many of his Fortune 500 customers now assemble there. “A lot of our customers have told me that if Scandic can produce in “Touring those plants proved very beneficial, but I also went on the study mission to research where are customers are in China, what the government requirements are, and to do some preliminary business planning,” Koets says. “I came a from the trip with the realization that there is real opportunity for us to manufacture parts and assemblies in China. The volumes there are increasing dramatically, which justifies a metal stamper of our size and scope getting into that market.

“In addition to the plant tours, several of which were to automotive-parts suppliers, I also received great insights from CBN and from my peers as we rode the bus throughout the country. All of that knowledge, advice and insight has allowed me, since returning, to develop a better business plan for China, with a legitimate timeline and goals we need to accomplish in the next couple of years.”

Koets envisions possibly setting up what he calls a hybrid stamping facility in China that combines some of what Pridgeon & Clay does in the United States with some of the Chinese metalforming ideals. “We have to keep an open mind, and not just try to do business there exactly as we do here,” he says.

Yet, Koets also described how his company might look to educate partners and suppliers in China on how to improve their operations, describing an encounter with a possible source for tooling and dies he met at the Die & Mould China 2008 tradeshow attended by the PMA delegation.

“Chinese shops are used to making tooling for relatively small and thin parts,” Koets says. “We need to show them how to make tooling for the types of parts we stamp—thicker, bigger and higher-strength components—and perhaps be prepared to share some of our knowledge in this area.”

Finding a Comfort Zone with Tooling Sources

Also coming a from the visit to the Die & Mould China 2008 show with leads for sourcing tooling was Robb McCoy, president of ART Technologies in Hamilton, OH. With expertise in coining as well as the production of assembled thrust bearings, McCoy says that the show was “by far the most useful part of the trip. We saw several die shops at the show that already supply U.S. metalforming companies, so I feel very comfortable letting them bid on jobs for us.”

McCoy’s comfort level with Asian tooling sources has not als been so high, as his first experience with Chinese tooling, in 2007, did not go so well. “We used a U.S. intermediary to oversee the project, and learned a valuable lesson, as things did not go too smoothly. The lesson: We will send our own people to China, once if not twice while the tooling is being built and tested, to observe what’s going on. And, we believe it’s best to source tool steels from Japan or Korea, rather than using Chinese tool steels.”

Not Ready, Yet, to Actively Sell in China

Another delegate who participated in the study mission to add to his knowledge base with the hope of one day setting up shop in China was Mark Symonds, CEO of Plexus Systems, Auburn Hills, MI, supplier of a comprehensive ERP system for manufacturers that is delivered via the Web. “Our global strategy,” Symonds says, “is to support our customers wherever they do business. While we support several customer operations in China, we are not actively selling in China, partly because the price point and support structure would have to be different than it is in North America. And, the visits we made with the PMA study mission just sharpened and confirmed our strategy. Within five years, I would expect to have two offices in China, likely in Suzhou and Wuhan.

“I think that there are a lot misunderstandings related to what is required by the Chinese government to operate there, and these requirements vary by where in China you are,” Symonds continues. “To get an accurate picture, you need to visit first-hand and investigate. For example, a common misconception is that you need to use a Chinese-based accounting system, but this is untrue. While manufacturers do need to report to the government using a certain format, they can use any system on the market. So we’re tweaking our software to fulfill those requirements.” MF

View Glossary of Metalforming Terms

See also: ART Metals Group, Inc., Pridgeon & Clay, Inc., Precision Metalforming Association, Plex, A Rockwell Automation Company

Technologies: Management, Materials