COVID-19 Study Reveals Significant Drop in Manufacturing Industry Utilization

April 29, 2020Comments

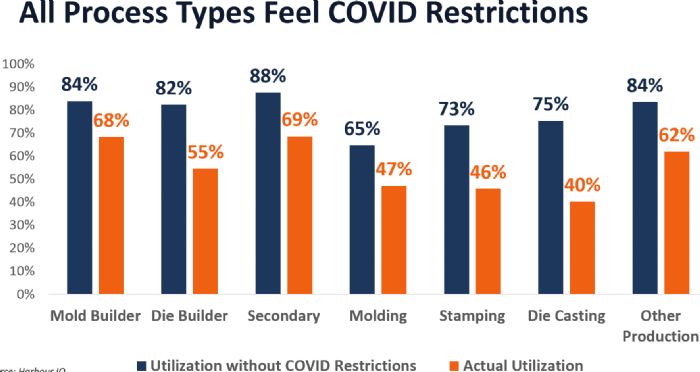

A study by Harbour Results, Inc. (HRI), Southfield, MI, gauging the impact of the COVID-19 pandemic on small- to medium-sized manufacturers in the production and tooling segments, reveals that nearly two-thirds of the shops surveyed are operating at some level of reduced capacity, or are closed. Utilization has dropped anywhere from 18 percentage points to 35 percentage points. Of the closed shops, some 70 percent expect to remain closed for more than one month.

A study by Harbour Results, Inc. (HRI), Southfield, MI, gauging the impact of the COVID-19 pandemic on small- to medium-sized manufacturers in the production and tooling segments, reveals that nearly two-thirds of the shops surveyed are operating at some level of reduced capacity, or are closed. Utilization has dropped anywhere from 18 percentage points to 35 percentage points. Of the closed shops, some 70 percent expect to remain closed for more than one month.

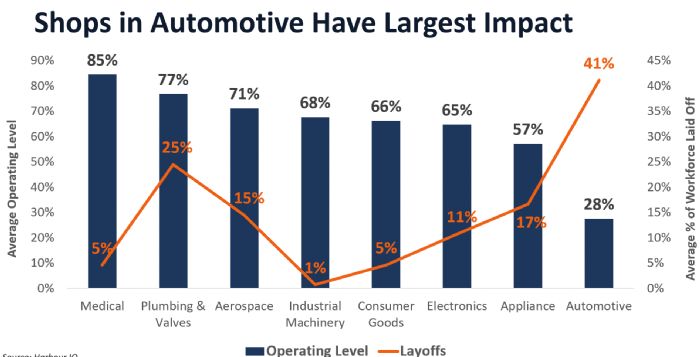

Hit the hardest: companies serving the automotive and home-appliance industries, with operating levels of 28 and 57 percent, respectively. On average, shops in the automotive industry have laid off 41 percent of their workforce.

“The manufacturing industry faces serious headwinds, as restrictions on public life remain in effect and will continue for some time,” says HRI president and CEO Laurie Harbour. “Although some manufacturing will ramp up in May, the marketplace will not return to normal until a COVID-19 vaccine is in place, which could take as long as 18 months. The industry has experienced a significant impact, causing ripples throughout the supply chain. And, if a business went into 2020 in a weakened state, it’s really going to show on the backside of this year.”

“The manufacturing industry faces serious headwinds, as restrictions on public life remain in effect and will continue for some time,” says HRI president and CEO Laurie Harbour. “Although some manufacturing will ramp up in May, the marketplace will not return to normal until a COVID-19 vaccine is in place, which could take as long as 18 months. The industry has experienced a significant impact, causing ripples throughout the supply chain. And, if a business went into 2020 in a weakened state, it’s really going to show on the backside of this year.”

The HRI study also indicates that shops underestimate the time it will take manufacturers to improve, with the majority of respondents stating they expect to recover in less than two weeks. “This is overly optimistic,” Harbour says. “The effects of this crisis have, in some cases, not even appeared for manufacturers, and will last through 2020 and into 2021."

Operating cash has been a critical component for companies to maintain viability, as nearly half of the shops have less than six weeks of cash on hand, and all of them are experiencing some level of reduced accounts-receivable payments.

“We have never experienced a recession or marketplace like this,” adds Harbour. “Companies with strong leadership, who have reacted quickly to reduce costs and manage cash flow, likely will have a better chance to survive this crisis.”

Event

Event