In the age of EASCY, mobility services, not just the product, will be at the heart of automotive-industry models. Manufacturers and suppliers continuing to focus solely on the production and sale of vehicles will find it especially difficult to manage the restructuring of the automotive sector. It will be essential to link the hardware (i.e. the vehicle) with the software (i.e. the services).

Fewer Cars on the Road, Yet Higher Sales

For the study leading to this report, PwC Autofacts devised a mathematical model to determine the effects of restructuring on key performance indicators of the automotive sector, namely existing car inventory and new car sales. Ultimately, these two variables determine the value chain of automotive production, and, therefore, are critical for the future business models of manufacturers and suppliers. The report focuses on impacts on the world’s three largest automotive markets: the United States, Europe and China.The study aimed to model the future development of the market, starting with the user. The report based on this study details reorientation of the industry and finds that:

- Consumer mobility habits will change, personal and overall vehicle mileage will increase, and vehicles will be used more intensively.

- Automotive inventory will decrease significantly, vehicle sales will rise regardless, and autonomous driving and electrification will be mutually beneficial.

From the manufacturer/supplier standpoint, the report predicts the following:

- Rapid redistribution of R&D investment.

- Decisions regarding the long-term structure will be made between 2020 and 2025.

- Future business models will include the sale and operation of vehicles.

|

| Attorney Dan Sharkey, who concentrates his practice in business contracts and litigation, with a special emphasis on supply-chain issues, will discuss whatever is on the minds of APSC 2020 attendees. “Essentially, the topics we cover include how contracts can hurt suppliers,” Sharkey says, “and how stampers can structure contracts to help themselves by minimizing or managing risk. We also discuss disputes and how to handle them—with customers as well as suppliers.” |

In addition, due to rising population figures and higher mobility demands, personal mileage will continue to increase, rising by nearly 25 percent in the United States and Europe by 2030, and a staggering 183 percent in China. With the combination of more shared and autonomous vehicles on the road, and more miles driven, automobiles will require replacement much sooner. This holds, according to the report, even though automobile active-lifetime mileage will increase due to expected lower maintenance and repair needs, and lower accident rates.

Vehicles used in traditional ways will remain in the inventory for a comparatively long time. By contrast, autonomous, and, in particular, shared autonomous vehicles will be changed out far more frequently. In-use inventories will drop, according to the report, as consumers take advantage of autonomous and shared vehicles. PwC Autofacts, in this report, envisions a U.S. inventory reduction of 22 percent, to 212 million vehicles, with Europe seeing a 25-plus-percent decrease to about 200 million. Unique to China, inventory may grow by as much as 50 percent to 276 million vehicles despite higher utilization.

Despite shrinking inventories, higher miles driven in short timeframes, in addition to requirements to constantly introduce new mobility capabilities, will result in rising sales figures. Given these expectations, U.S. automobile sales may grow by more than 20 percent to reach nearly 22 million units by 2030, with Europe seeing sales rise by 34 percent to 24 million units. In China, an expected rise of 30-plus percent will lift sales to 35 million units.

Reckoning for Manufacturers and Suppliers

Should expectations outlined in the PwC report hold, ramifications for manufacturers and their suppliers are immense. The time has arrived for decisions about the long-term automotive supply structure. Between 2020 and 2025, manufacturers and suppliers will battle against sinking margins while at the same time needing to invest in customer-oriented innovations.

Already clear today: The automotive industry has been reducing investment in product range, with another PwC report predicting an investment reduction of 20 percent by the end of 2020, if not sooner. It suggests that those companies investing R&D budgets in software solutions instead of product range show stronger growth than their competitors.

At the same time, the rising sales volume of new vehicles demands additional investment in production capacity for the necessary hardware, and companies implementing flexible and scalable concepts now will be positioned to play an active role in shaping the future of the industry. PwC’s future-business models covering the sale and operation of vehicles reveal that it no longer will be enough to focus purely on the production and sale of vehicles.

The automotive value chain no longer will finish at the factory door, but extend across all types of use over the entire lifetime of the vehicle through to its eventual recycling. Automotive customers and target groups no longer will comprise only direct buyers of vehicles, but all users of the products―in private and shared usage models. Software-based direct interaction with every user will lead to higher revenues over the lifecycle of the customer relationship.

|

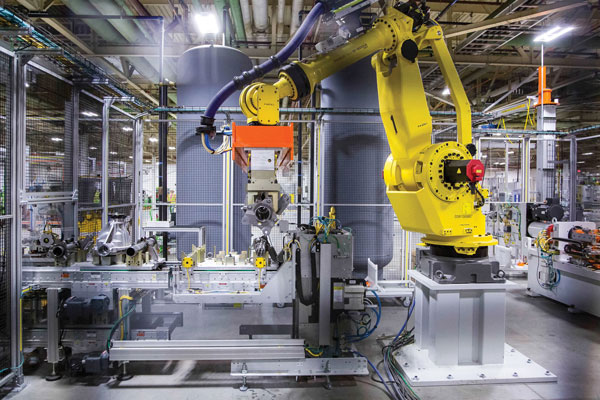

| At APSC 2020, GM manufacturing executive director Doreen McDowell will discuss the importance of innovation in GM’s manufacturing processes, including smart manufacturing. Example: 13,000 of GM’s 30,000 robots in plants worldwide feed operating data into the cloud, which the company uses to schedule predictive maintenance and improve uptime. |

Manufacturers and suppliers expanding their business models to cover operational elements will find that the classic target figures,―vehicle sales and vehicle inventory,―become less important. Younger, technically savvy generations will drive the trend toward mobility, bringing new expectations for their vehicles.

Rather than the more cosmetic exercise of model years, the automotive industry will have to deliver annual models using the latest technology,―in some cases including the option of retrofitting earlier annual models to bring them up to date.

To rise to the challenges posed by the restructuring of the automotive industry, manufacturers and suppliers must redistribute their budgets quickly and in a targeted manner. R&D must focus on software and services, and on manufacturing feasibility and the modularization of vehicles. Software must enhance product performance while services must offer the customer additional functionality and improved user-friendliness. This, in turn, must be integrated flexibly into the hardware.

“Again, automakers and suppliers must adjust to shorter development cycles and improved recycling methods,” the report summarizes. “New sales models will compete and converge with new operating models; autonomous-driving algorithms will communicate with central transport systems; and electricity suppliers will attract new customers by advertising traction current and battery capacity. Traditional brands will expand their areas of business, and new brands and competitors will attack traditional automobile companies.”

Welcome to the auto industry of 2030.

Knowledge Experts Up and Down the Agenda

APSC Speaker Lineup

|

Next to the stage will be Lauren Pryber, director–body and raw materials purchasing for FCA Chrysler. Having served in numerous roles over an 18-yr. stint at FCA, Pryber will speak on Common Issues Throughout the Supply Chain.

Following Pryber’s talk, attendees will make their way to the Detroit Athletic Club for an evening reception full of networking opportunities.Wednesday morning, beginning at 9 a.m., is the annual legal discussion with Dan Sharkey, co-founder and member of the law firm Brooks Wilkins & Turco PLLC. Sharkey, who concentrates his practice in business contracts and litigation, with a special emphasis on supply-chain issues, began speaking at PMA’s APSC meeting in 2006. His presentations on Contracts 101 and on Terms and Conditions were very well received. In 2016 he changed formats and went to an open Q&A forum.

“Essentially, the topics we cover include how contracts can hurt suppliers,” Sharkey says, “and how stampers can structure contracts to help themselves by minimizing or managing risk. We also discuss disputes and how to handle them—with customers as well as suppliers.”Every year it seems like APSC attendees have a lot of percolating issues, and Sharkey comes prepared to offer advice. Some common themes:

“Your typical stamper has to pay spot price for steel,” Sharkey says. “It might be monthly or quarterly, but not long-term. It always surprises me to learn that companies often do not have steel-price adjustment clauses in their contracts, leaving themselves exposed to radical price increases.”

Another common theme, says Sharkey, has stampers under-quoting poorly or over-designed parts that they may have been able to manufacture during prototyping but wind up being substantially more difficult to make at production quantities. “In these cases, stampers can get caught in what I call ‘Quote and Hope situations,’” says Sharkey. “When production ramps up, a supplier can run into huge problems meeting dimensional tolerances, and wind up losing money on a job. So, I recommend that when you see a design that causes you to go, ‘Hmmm, this might be difficult,’ make a note of it, deal with it and discuss it. Don’t keep it to yourself.”

What leverage do stampers have on design issues? “I think that they have a little more leverage than they think,” Sharkey says. “Just make sure that when you quote a job, include in the contract all of the conditions you need. Question design concerns up front, plan for them and follow-up as the program progresses.”

Other issues on Sharkey’s mind and up for discussion at APSC include:

- Contract length—“Some contracts appear to lock the stamper in long-term, but they actually are able to get out of them,” Sharkey says; and

- Part volume—“You’re supposed to make 50,000 parts/yr., but what if you only make 20,000, can you make money? Can you get a price adjustment? And, what if the job expands to 100,000 parts/yr.? This sounds good, but what happens when the tool wears out; how will this hurt you?”

The Evolving Automotive Landscape

Following Sharkey, a pair of automotive-OEM executives take the stage, first Leah Curry, president, Toyota Motor Manufacturing Indiana; then Doneen McDowell, manufacturing executive director, GMNA at General Motors. They’ll discuss how the changing automotive-manufacturing landscape has their companies tackling advanced technologies and workforce issues.

“GM CEO Mary Barra has said that the automotive industry will change more in the next five years than it has in the last 50 years,” McDowell says. “I will highlight the different drivers within our global society that inspire a need for different transportation solutions. As we strive to meet the current and future expectations of our customers, we remain focused on driving a culture of innovation and diversity of thought. It is inspiring to be in a position where we can positively impact so many lives—now and in the future.

“As GM drives toward our vision of a world with zero crashes, zero emissions and zero congestion,” McDowell adds, “our manufacturing organization’s responsibility is to deliver quality components and vehicles that satisfy our customers, at volume. I will discuss how our manufacturing teams are driving improvements in safety, quality and efficiency by taking an active role in executing our Global Manufacturing System (GMS). We’re motivating employees and raising the bar by continuing to push for a new level of performance.“Lastly, I will discuss the importance of innovation in our manufacturing processes,” she says, “including smart-manufacturing strategies to supplement the application of lean principles.”

The Role of Steel in Future Mobility

The 2020 APSC program wraps with a discussion led by John Catterall, vice president, automotive program, at the American Iron and Steel Institute, on the evolving role of steel in the automotive industry, including the impact of electrification.

“While electrification will certainly grow globally, growth may be slow in the United States,” Catterall says. “But we do need to understand what it means.”

Central to his talk are the four key mobility technologies collectively referred to as ACES—automated, connected, electric and shared. These technologies compel automotive engineers to reevaluate vehicle design, materials and manufacturing technologies. And, central to this is the continued development of new, advanced steels.

“Since the launch of the Ford F-150,” Catterall notes, “the last seven pickups have bodies made from steel. We like to say that the new steels making their way into pickup trucks, and into other vehicles, come from ‘innovation by collaboration’ as evidenced by development, jointly by steelmakers and automakers, of the ultralight steel auto body (ULSAB) and the Future Steel Vehicle (FSV).

“Future mobility will be no exception,” Catterall says, and he’ll explain how at APSC 2020, highlighted by an introduction to the newly expanded steel portfolio developed to meet evolving requirements for formability, styling, decreased mass, collision performance, reduced corrosion, sustainability and more. We’ll see you there—register to attend at www.pma.org/apsc. MF

See also: American Iron & Steel Institute

Technologies: Management, Materials

Event

Event