We used an intentionally defective trust (IDT) to transfer (sell) Quahog Co. to one of Peter's sons who was running the company. Peter keeps control (via owning 100 shares of voting stock), while he sold 10,000 shares of nonvoting stock to the IDT. After discounts, the price of the nonvoting stock is only $2.64 million. The future cash flow of Quahog Co. is used to pay the $2.64 million. All the payments received by Peter (both principal and interest are tax-free). Not only does Peter stop the $800,000 annual income from increasing his wealth, but Quahog Co. is out of his estate.

In tackling real estate, Peter sold one of the residences and kept the main residence and a summer home. We used a portion of the couple’s $5.45 million lifetime exclusion, because Peter and Lois want to keep those two residences for life. All nine investment properties already were in LLCs owned by Peter. We transferred Peter's interest in these LLCs to a second FLIP and sold the limited FLIP interests to a separate IDT. As a result of our real estate efforts, we saved $2.6 million in estate taxes because of the discount (about $6.5 million). Plus, the anticipated increase in real estate value is out of Peter and Lois’s estate.

As for life insurance, we were able to use the cash surrender value of the existing $4 million policy and continue the same premium amount to buy $6.5 million of second-to-die insurance, resulting in an increase of $2.5 million in tax-free wealth, without any additional cost.

Almost 100 percent of the time, a lifetime strategy can be used to increase the value (usually tax-free) of each asset or reduce the potential estate tax liability of that asset. If you’ve completed an estate plan, go back and look at how a lifetime plan can increase your family’s wealth after you die.

How to Escape the Annuities Tax Trap

If you own annuities, this article is must reading. If you intend to buy annuities, read this article before you buy.

It should be noted that most insurance companies have many annuity products, each a bit different. There are literally thousands of possibilities, but in spite of that, the type of annuity most often sold is a deferred annuity, which we will explore in-depth.

Why do so many people buy deferred annuities? Because they are charmed by the annuity salesman's standard sales pitch. Remember, almost all American taxpayers hate paying taxes. Knowing this, the insurance industry teaches its sales people to highlight that earnings, on the amount invested in the annuity, are tax-deferred. This means that when the value of your annuity account increases, no tax is due on those profits until you actually take the funds.

Sounds great, but two sad facts haunt every deferred annuity: 1) you bought a lousy insurance policy; and 2) you created a tax trap.

According to Ken Fisher, longtime author of the "Portfolio Strategy" column in Forbes, “The vast majority of annuities are really complicated insurance policies that make it very difficult to fully understand the implications and unintended consequences. And once you buy into an annuity, it can be a very difficult, and potentially, very costly investment decision to reverse."

Let's explore the two sad facts, one at a time, using Carol as an example.

The Lousy Insurance Policy

Carol, a healthy 60-yr.-old, buys a $500,000 deferred annuity. When Carol dies, the annuity is worth $960,000, including a $460,000 profit. The beneficiary of Carol's annuity is her daughter Jan. Yes, Jan gets the full $960,000. But wait, if Carol had purchased a life insurance policy with that $500,000 as a single premium, the death benefit, free from income tax and estate tax, would be in the $2-million range.

Worse yet, the entire $960,000 is subject to estate tax in Carol's estate, and the $460,000 profit is taxable income in the year that Carol dies—a double-tax. Studies show that more than 90 percent of all deferred annuities are held (never annuitized) until the owner's death, as in Carol’s case.

A Real-Life Example

Scott (a real-client) is 75 years old and in good health. He owns an annuity that cost him $734,916 and has a current value of $2,015,749, with a deferred profit of $1,280,833. Scott passes away. Because of new income tax rates, income from annuities are subject to a top unearned income tax rate of 39.6 percent and an additional "surcharge" of 3.8 percent. That's a total tax rate of 43.4 percent on the $1,280,833 deferred profit. So, the income tax burden is $555,882.

But there's more to this tax horror story. The value of the annuity, less the income tax burden, is subject to a 40-percent estate tax. The tax liabilities, income and estate, will only get worse as time goes by as the value of the annuity continues to grow. Simply put, the double tax liability, $1,139,829, will never go away; it will only increase. You are in a tax trap.

Escape the Double Tax and Create Tax-Free Wealth

The following strategy is a simple two-step process:

Step 1—Annuitize the annuity value ($2,015,749). The insurance company agreed to pay Scott $170,968 (annual annuity) every year, for as long as he lives.

Step 2—By law a portion of Scott's annual annuity is subject to income tax. We used the after-tax annuity amount ($123,461) to pay the annual premium on a life insurance policy on Scott for $2,681,166. This amount is tax-free. No income tax according to the Internal Revenue Code, and no estate tax because the policy is owned by an irrevocable life insurance trust. And as long as Scott lives, he is guaranteed to collect the annuity and will always have funds to pay his insurance premium.

A few important things you should know:

• Scott's tax-free insurance proceeds: $2,681,166; after-tax value of deferred annuity: $875,920; increase in after-tax amount: $1,805,246.

• In a 43.4-percent income tax bracket and 40-percent estate tax bracket you must earn $2,944,641 to leave your family $1,000,000. So, you can see that the above-stated increase of $1,805,246 gives about the same after-tax results as earning about $5.4 million.

This strategy works for one life (you are single or, if a couple, only one spouse is insurable) or two lives (second-to-die insurance for husband and wife).

My insurance guru has agreed to review possibilities for readers of this column who own annuities. Just two rules: 1) You should own $500,000 or more in annuities (current value) that have not been annuitized; and 2) if single you are insurable or if married, at least one spouse (or both) is insurable.

If interested, provide me with the full name and birthday for those to be insured; your address and phone numbers (business, cell, home) where you can be reached; and a list of your annuities (name of insurance company, original cost and current value). Send this information to Irv Blackman, Annuity Strategies, 4545 W. Touhy Ave., #602, Lincolnwood, IL 60712. MF

Technologies: Management

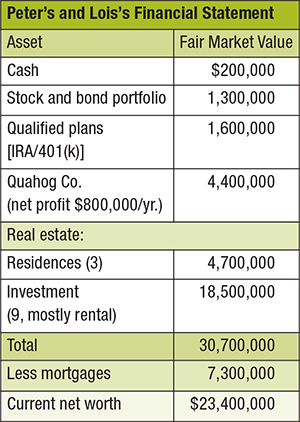

Remember, over time mortgages will be paid off and the underlying real estate tends to increase in value. Simply put, Peter's taxable estate (net worth) most likely will increase significantly, to about $35 million and more than double the potential estate tax liability.

Remember, over time mortgages will be paid off and the underlying real estate tends to increase in value. Simply put, Peter's taxable estate (net worth) most likely will increase significantly, to about $35 million and more than double the potential estate tax liability.