Use the Tax Law to Boost Annual Income and Create Wealth

July 1, 2012Comments

For most readers, anxiety revolves around taxes—income and estate. Can you guess what’s in second place? Hands down, it’s achieving these three goals: increasing income on invested assets; hanging onto invested capital; and identifying alternatives to investing in the stock market.

Each concern contains a common denominator: invested assets, primarily funds in some sort of qualified plan. The struggle is als the same: How to invest the funds. Historically low interest rates, the struggling economy and the uncertainty of Wall Street have created a current investment problem that seems to have no known solution.

Each concern contains a common denominator: invested assets, primarily funds in some sort of qualified plan. The struggle is als the same: How to invest the funds. Historically low interest rates, the struggling economy and the uncertainty of Wall Street have created a current investment problem that seems to have no known solution.

Enter the tax law and tax-advantaged investments. The strategies presented here work whether you are a little guy just trying to maintain your lifestyle or have millions to invest.

For tax purposes, there are two types of investment funds: qualified (such as an IRA, subject to double taxes—income and estate); and nonqualified funds, for which you paid income tax when you earned it, or received the funds by gift or inheritance. Such funds can only be subject to an estate tax, when you die.

Here are the two strategies we use most often in our tax practice.

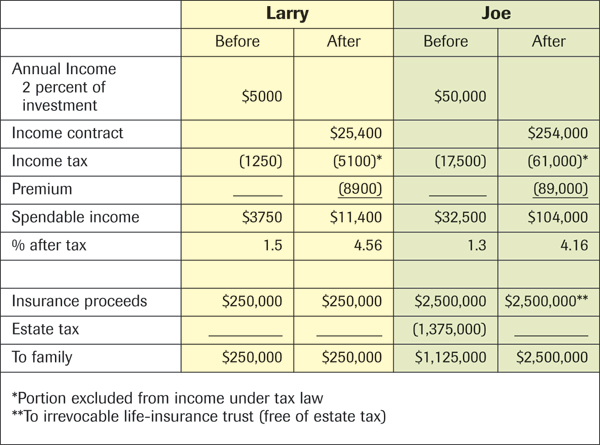

Larry, in a 25-percent tax bracket, is 70 yr. old and retired. Joe, on the other hand, is a well-to-do business owner, also 70, and intends to keep working forever. Let’s compare their balance sheets, assuming Larry has invested $250,000 in an income contract, and Joe has invested $2.5 million.

Larry, in a 25-percent tax bracket, is 70 yr. old and retired. Joe, on the other hand, is a well-to-do business owner, also 70, and intends to keep working forever. Let’s compare their balance sheets, assuming Larry has invested $250,000 in an income contract, and Joe has invested $2.5 million.