Tax-Reform Bill Introduced

April 1, 2014Comments

|

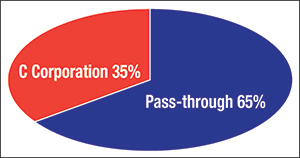

| *Data based on responses from 130 One Voice manufacturers surveyed in January 2014. |

Key provisions of the bill include a 25-percent tax rate for all manufacturers, regardless of whether the business is structured as a C-Corporation or a pass-through; and permanent extension of the R&D Tax Credit. It also makes permanent Section 179 Expensing—a top priority for manufacturers—at a limit of $250,000.

As expected, the proposal repeals bonus depreciation, transitions LIFO and gradually phases out the Section 199 Domestic Production Activity Deduction. Many manufacturers use these provisions and PMA is working with Congress on steps to reduce the impact that these changes would have on small businesses.

Should Chairman Camp’s proposal become law, small and medium-sized manufacturers will become more globally competitive.

“An overhaul of our tax code is long overdue and Chairman Camp deserves credit for having the leadership and courage to take on this important issue,” says PMA President Bill Gaskin. “This is more than just about lowering rates—it is about simplifying the code, making it globally competitive and creating certainty around provisions important for small businesses seeking to invest in the future of their companies.”

Tax reform will be a key issue manufacturers will discuss with members of Congress during the 2014 PMA/NTMA One Voice Legislative Conference, May 6-7 in Washington, D.C. Help bring common-sense solutions to Washington by joining industry peers at this event.

See also: Precision Metalforming Association

Technologies: Management

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Management

ManagementEWI President/CEO Dr. Cialone Retiring

Monday, June 30, 2025

Management

ManagementSiemens Develops Expedite—Skills for Industry Microcredentia...

Thursday, June 5, 2025