Slower Sales Pace Than 2016

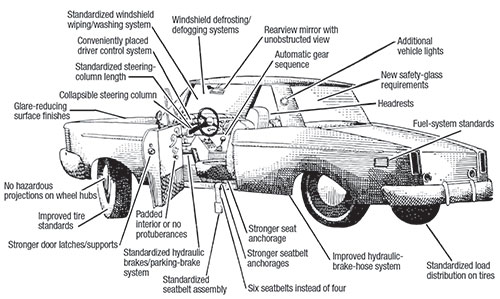

Safety Act of ‘66—Government and the Auto Industry Have Been Linked Ever Since Upon the Senate’s 76-0 vote to pass the act, President Lyndon Johnson remarked, “For the first time in our history, we can mount a truly comprehensive attack on the rising toll of death and destruction on the nation’s highways that last year alone claimed 50,000 lives…We can no longer tolerate such anarchy on wheels.” The safety standards became mandatory for automakers in their 1968 models, an incredibly short timeframe given that the standards would become finalized on January 31, 1967. That left little time to formulate them, and not much longer for their implementation in the 1968 models. In a sometimes-contentious process, the Automobile Manufacturers Association’s newly formed Safety Standards Committee assisted government officials in drafting and reviewing the standards, with the final result leaving both industry and safety advocates somewhat unhappy. Today, vehicle safety and the role of government in automotive-industry issues (trade deals and CAFÉ standards, for example) remain hot-button topics…and trends that most likely will forever keep trending.

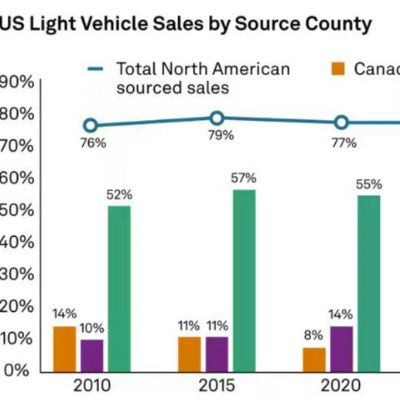

All of that said, at press time January 2017 sales have shown that a slowdown may be in the works. J.D. Power expects January new-vehicle retail sales to top out at 874,000 units, down 2 percent from January 2016, while total light-vehicle sales are expected to reach 1,125,900 units, a 1.8-percent decline.

Fifty years back, the pages of MetalForming’s predecessor, Metal Stamping, illustrated mandated safety standards for the typical 1968 passenger vehicle, a first for the automotive industry. The standards resulted from the National Traffic and Motor Vehicle Safety Act of 1966, enacted in a whirlwind manner after lawyer and consumer activist Ralph Nader the previous year published “Unsafe at Any Speed,” a critique of the U.S. auto industry. The act empowered the federal government to set and administer new safety standards for motor vehicles and road-traffic safety. Signed into law in September 1966, the act outlined the first mandatory federal safety standards for motor vehicles, and created the National Highway Safety Bureau (now National Highway Traffic Safety Administration).

Fifty years back, the pages of MetalForming’s predecessor, Metal Stamping, illustrated mandated safety standards for the typical 1968 passenger vehicle, a first for the automotive industry. The standards resulted from the National Traffic and Motor Vehicle Safety Act of 1966, enacted in a whirlwind manner after lawyer and consumer activist Ralph Nader the previous year published “Unsafe at Any Speed,” a critique of the U.S. auto industry. The act empowered the federal government to set and administer new safety standards for motor vehicles and road-traffic safety. Signed into law in September 1966, the act outlined the first mandatory federal safety standards for motor vehicles, and created the National Highway Safety Bureau (now National Highway Traffic Safety Administration).

“With sales posting impressive gains at the end of December, the slow start to January was not unexpected,” says Deirdre Borrego, senior vice president of automotive data and analytics at J.D. Power. “While this year will mark the first time that the industry has started off with a retail-sales decline since 2010, the seasonally adjusted annual retail rate remains robust. The challenges for the industry remain maintaining profitability while coping with high inventory levels and elevated incentives, which continue to rise year over year.”

IHS Markit predicts the U.S. auto industry will sell 17.37 million vehicles in 2017, revised from an earlier-predicted 17.5 million. This is due in part to rising inventories and automakers’ use of incentives.

More Info at APSC 2017

For the latest numbers and a look at trends shaping the auto industry and its supply chain, attend the Precision Metalforming Association’s Auto Parts Supplier Conference (APSC), April 25-26 at the Detroit Marriott in Troy, MI. Joe Langley will present the IHS Automotive Light Vehicle Production Forecast, spanning more than 50 countries, 600 plants and 2300 models over a 7-yr. forecast horizon. Also scheduled:

- Engaging Employees—Building a Culture of Continuous Improvement, a presentation on workforce development and its role in producing better products and a better company, by Alfredo Alonso of Dana Corp.

- The Clock-Speed Dilemma, exploring how different clockspeeds exist between the innovation and product development cycles of car hardware, information-and-communication-technology (ICT) hardware components and ICT software, and how that hampers the process, by Gary Silberg of KPMG.

- Top Legal Issues Facing Automotive Industry in 2017 and Beyond, focusing on legal and regulatory issues affecting the automotive supply chain, by Dan Sharkey of Brooks Wilkins Sharkey & Turco PLLC.

- President Trump, the Automotive Sector & NAFTA 2.0, assessing the effect of the current political and regulatory climate on the auto industry, by David Hamill and Birgit Matthiesen, Arent Fox LLP.

- AIAG NexGen of Core Tool Software, a discussion of industry-specific quality tools, by John Cachet of PeProSo LLC.

In addition, ERP-software provider IQMS will present a manufacturing case history. For details on APSC 2017, visit www.pma.org/apsc.

Blockchain—The Auto Supply Chain’s Future?

An industry-forecast discussion wouldn’t be complete without touching on a unique and somewhat mysterious development: a new trust protocol for the automotive supply chain? That is the promise of blockchain technology, according to its adherents. Get set to hear more and more about blockchain and its potential across the automotive spectrum. Blockchain is the technology that enabled the bitcoin Internet transaction model in 2009. Here, without any third-party institutions involved, transactions could take place anonymously and securely. The capabilities and performance demonstrated in the bitcoin setting have convinced many that blockchaining can work in any transaction/trade setting.

A blockchain, as defined by a recent article in Harvard Business Review, is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. The ledger itself can also be programmed to trigger transactions automatically."

Each transaction is a timestamped block that cannot be edited after the fact, resulting in verified transactions. One industry in particular, the automotive industry, has been identified as an ideal setting for blockchaining.

“If each auto part were assigned a unique code, blockchain would enable auto manufacturers to track each step of the production and transportation process through a secure database updated by suppliers in real time,” blogs Mahbubul Alam, with Movimento Group, a provider of over-the-air software lifecycle and data-management services to the automotive industry, and recently acquired by Delphi Automotive. “Each part with its robust digital identity is visible in this tracking system. The OEM and suppliers have encrypted records within the ledger, which makes it easy to identify an incorrect or fraudulent part. No other approach creates such an open, all-in-one system that establishes trust and identity without intervention.

“With blockchain,” he continues, “the murk of time and distance would be dispelled; the entire process all at once would become visible. Not only would manufacturers be able to respond more quickly to disruptions and streamline their supply processes with access to this information, they would also be able to guarantee that all of their parts are 100-percent safe as tested.” (Alam goes into detail on blockchaining in an article at www.eecatalog.com.)

Blockchaining, though not implemented as yet in the automotive supply chain, is coming under review by the industry. MF

View Glossary of Metalforming Terms

Technologies: Management, Pressroom Automation, Quality Control

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted.10 Best Practices for Assessing Manufacturing M&A Opportunit...

Michael Vaccarella November 26, 2024

Management

ManagementEWI President/CEO Dr. Cialone Retiring

Monday, June 30, 2025