Innovative Research

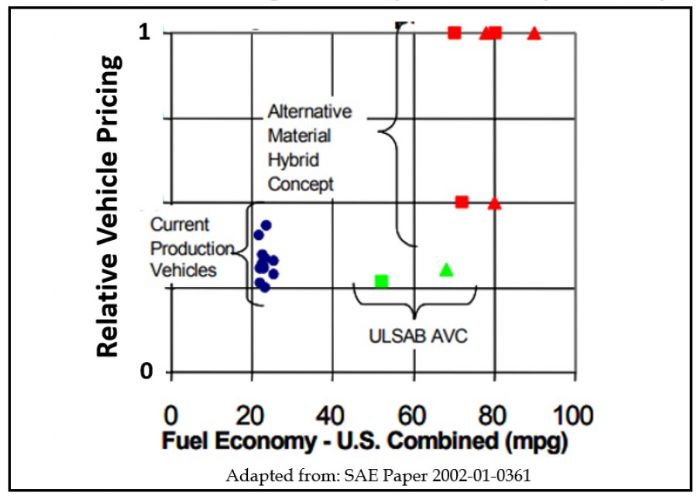

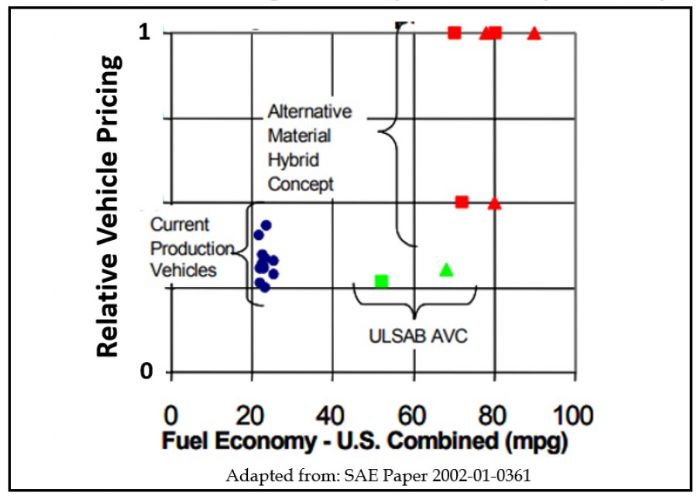

In the first decade of the 21st

century, when the automotive industry needed materials to support

lightweighting initiatives, achieve aggressive fuel-economy targets and

maintain passenger safety, the American steel industry collaborated with global

consortia to create the Ultra-Light Steel Autobody (ULSAB) design project. That project, using a current-model sedan as

the basis for study, resulted in a design that optimized the vehicle structure

and projected significant weight reductions using available and current advanced

high-strength steel (AHSS) grades. ULSAB

led directly to a larger, more comprehensive project called ULSAB-Advanced

Vehicle Concept (ULSAB-AVC), which fully demonstrated achievable 20-percent body-in-white

(BIW) mass-reduction using existing manufacturing infrastructure with new steel

grades and at a competitive market price (Fig. 1). These projects signaled the beginning

of close cooperation of the engineering organizations within both industries.

Following the initiatives centered around

the ULSAB and ULSAB-AVC achievements, seven American steel industry producers participated

in a global initiative to illustrate even further opportunities for advanced

steel grades in automotive design. Partnering

with global steelmakers via WorldAutoSteel, the project known as

FutureSteelVehicle (FSV) demonstrated a feasible automotive architecture

utilizing 95-percent high-strength and AHSS steel with more than half of that

being grades more than 1000-MPa tensile strength. FSV highlighted a steel-body

structure that achieved more than 35-percent weight reduction over a benchmark vehicle

and reduced total life-cycle emissions by nearly 70 percent. The FSV project clearly

demonstrated a feasible automotive design with significant use of newer AHSS

steel grades and highlighted

the use of many recent forming and joining technologies not yet mainstream. For more

information, visit www.worldautosteel.org/futuresteelvehicle-reports.

Following the initiatives centered around

the ULSAB and ULSAB-AVC achievements, seven American steel industry producers participated

in a global initiative to illustrate even further opportunities for advanced

steel grades in automotive design. Partnering

with global steelmakers via WorldAutoSteel, the project known as

FutureSteelVehicle (FSV) demonstrated a feasible automotive architecture

utilizing 95-percent high-strength and AHSS steel with more than half of that

being grades more than 1000-MPa tensile strength. FSV highlighted a steel-body

structure that achieved more than 35-percent weight reduction over a benchmark vehicle

and reduced total life-cycle emissions by nearly 70 percent. The FSV project clearly

demonstrated a feasible automotive design with significant use of newer AHSS

steel grades and highlighted

the use of many recent forming and joining technologies not yet mainstream. For more

information, visit www.worldautosteel.org/futuresteelvehicle-reports.

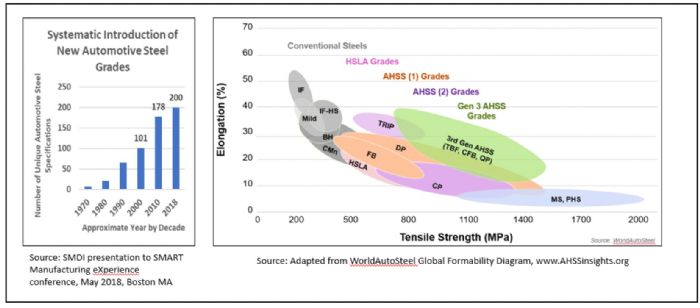

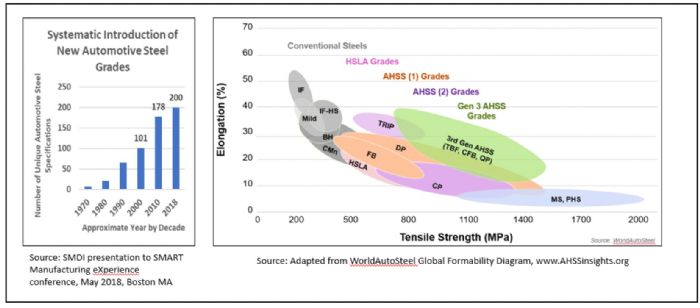

FSV

paved the way for further and continuing cooperation of the steel and automotive

industries as more advanced steel grades became available. Innovations in steel-grade development to meet the automotive industry’s needs were leveraging steel’s metallurgical potential to produce even higher-strength formable grades for automotive applications. This effort and progress is evident in the increasing number of commercialized steel grades, which grew from just slightly more than 100 variants in the early 2000s to well over 200 grades in 2018.

The technological development of new steel grades hasn’t stopped, and recent advancements in steel-mill processing capabilities support the development and full-scale production of 3rd Gen AHSS grades capable of 1500-MPa tensile strength with more than 20-percent total elongation. Fig. 2 illustrates this progress in the determination and introduction of new steel grades along with strength and ductility relationships. The combination of high strength and improved ductility in the mechanical properties of 3rd Gen AHSS grades offers a comprehensive advantage for cost efficiency in the automotive industry as they provide the required materials for forming complex automotive geometries via cold forming.

The technological development of new steel grades hasn’t stopped, and recent advancements in steel-mill processing capabilities support the development and full-scale production of 3rd Gen AHSS grades capable of 1500-MPa tensile strength with more than 20-percent total elongation. Fig. 2 illustrates this progress in the determination and introduction of new steel grades along with strength and ductility relationships. The combination of high strength and improved ductility in the mechanical properties of 3rd Gen AHSS grades offers a comprehensive advantage for cost efficiency in the automotive industry as they provide the required materials for forming complex automotive geometries via cold forming.

Comprehensive Modeling

Beyond

the development and commercialization of new, advanced steel grades that meet

automotive requirements, the industry also coordinates constitutive and

fracture modeling of new steels to enable accurate manufacturing (stamping) and

crash simulations. These activities

reduce costs related to tooling design for new automotive parts and improve

performance predictability prior to hardware build. Comprehensive modeling, led by the American

steel industry, of high strain-rate deformation and energy absorption for 3rd

Gen AHSS grades is allowing the automotive industry to reduce costs associated

with component- and vehicle-design validation.

As new and higher-strength steel grades enter

the market, it is sometimes necessary to enhance related technologies to

support wide adoption. Examples include optimized tooling materials and die-surface

coatings, effective die repair and maintenance procedures, and stamping

lubrication. In response, the steel industry applied organizational collaboration via AISI’s Automotive Applications Council (AAC) and the Auto/Steel Partnership to bring together engineering resources in relevant areas to build the processes and technologies that addressed these manufacturing challenges. When welding and joining challenges were recognized, the steel industry coordinated R&D efforts to define and confirm optimized welding parameters and new joining technologies to develop robust assemblies consisting of various combinations of 3rd Gen AHSS, steel coatings and grades with even higher steel strength levels, to 2000 MPa. Much of this work will be discussed at GDIS.

Improvements in Steelmaking and Finishing Processes

Awareness and implementation of technological developments to enhance competitiveness through innovation provides another example of the supportive relationship between the automotive and steel industries. American steelmakers take leading roles in academic and industrial research to provide robust process controls and methods along with state-of-the-art instrumentation for their steelmaking and finishing processes. For example, technological modeling and fluid-flow modeling of buoyant nonmetallic oxides in liquid steel have generated novel slag control and refractories that reduce the potential for surface defects and enable reliable production of high-quality, critical exposed automotive sheet. Automated surface-inspection systems also have been implemented in many rolling and coating operations and are coupled with defect-removal processes using “maps” created by the detailed monitoring and recording of every square inch of steel surface on both sides of the strip. The application of this downstream guidance enhances customer quality assurance by highlighting nonstandard situations for removal from the process and defect-free consumption in subsequent automotive-manufacturing processes.

Rolling technology in the steel industry also benefits from significant technology improvements with new steel rolling mills operating in continuous mode, and automated, laser-based high-speed thickness measurement and control algorithms in place. All of this contributes to a significant improvement (reduction) of centerline-thickness variation and improves on-gauge performance along the length and at the coil extremities, reducing cost and yield losses. Thickness variation of one-quarter to one-third of formerly established full standard tolerances are a current expectation of automotive sheet-steel requirements, and now routinely are achieved by the steel industry. Inline strip-shape monitoring is implemented to produce coils with uniform end-to-end flatness and across the width that exceeds the uniformity and precision of results from years ago. This effectively has eliminated the incidence of unrepairable “out-of-flat” shape excursions.

All

of this equipment and technology implementation within the American steel

industry provides the automotive industry with consistently predictable and uniform-performing

steel within each coil and from coil to coil. These process improvements help

to ensure high productivity and yield with superior reliability.

Commitment to the automotive market also is evident in the fact that the American steel industry has established itself as a global leader in achieving low GHG emissions during steel production. This includes continued investment in the research, development and implementation of facilities that produce low-emission iron alternatives by substituting less carbon-intensive reductants. Recently commissioned facilities produce direct-reduced iron and hot-briquetted iron for use as low-carbon substitutes in steelmaking. Additionally, the steel industry is preparing facilities to utilize hydrogen as it becomes commercially available, and is pursuing other globally identified decarbonization initiatives that further reduce emissions in steel production.

Modernization

of Facilities

The

American steel industry further supports its relationship with the auto industry

by investing in new steel-producing operations to meet supply requirements from

an increasingly modern family of 3rd Gen AHSS steel grades. The evidence of this support and commitment

can readily

be observed in multiple, comprehensive. modern automotive steel-producing facilities

that recently have come online. Within these massive and modern complexes are state-of-the-art

production equipment and technologies that include a significant level of artificial

intelligence working to control the process and enhance product quality.

These advanced control technologies include the use of lasers, noncontact instrumentation, high-speed data analytics and the reality of wireless-sensor communications. They also are being applied as upgrades to equipment in existing mills, ensuring sufficient capacity to support the automotive industry’s needs for AHSS. All of these initiatives collectively raise the available level of strength, ductility and overall steel quality and uniformity, because they automate and standardize the process adjustments inherent to the metallurgical “recipes” for precise speed and temperature control while running at rate.

Moving

beyond its walls, the steel industry also participates in the advancement of stamping

technology for AHSS grades by participating in research activities on advanced

sensors, automation and methods to monitor key forming-process variables. Modern

stamping and forming technologies, supported by the steel industry, allow for

improved tool development and process optimization and monitoring, enabling the

increased use of AHSS grades while improving productivity.

Additional

Support to Steel-Based Automotive Use

The steel industry’s record of creating new and more formable AHSS brings many opportunities for automotive vehicle lightweighting that support improvements in efficient and more sustainable steel-intensive automotive designs. The transition to the latest AHSS grades has positively impacted the role that steel plays in modern automotive structures, and also has identified improvement opportunities that the steel industry has responded to with an effectively robust and response in partnership with the automotive industry.

AISI’s member companies that comprise the AAC understand that the unique aspects of new AHSS steel grades generate the need for a more coordinated educational effort to support their safe and profitable consumption in the processing and tiered stamping community. As a result, the AAC is preparing to serve this layer of automotive steel supply with an interactive website that will identify competent training and educational opportunities by topic relevant to AHSS materials. This will be a new and robust level of support to the auto industry by steel producers and will enhance further the longstanding relationship between the American steel and automotive industries. MF

See also: American Iron & Steel Institute

Technologies: Materials

Following the initiatives centered around

the ULSAB and ULSAB-AVC achievements, seven American steel industry producers participated

in a global initiative to illustrate even further opportunities for advanced

steel grades in automotive design.

Following the initiatives centered around

the ULSAB and ULSAB-AVC achievements, seven American steel industry producers participated

in a global initiative to illustrate even further opportunities for advanced

steel grades in automotive design.  The technological development of new steel grades hasn’t stopped, and recent advancements in steel-mill processing capabilities support the development and full-scale production of 3rd Gen AHSS grades capable of 1500-MPa tensile strength with more than 20-percent total elongation. Fig. 2 illustrates this progress in the determination and introduction of new steel grades along with strength and ductility relationships. The combination of high strength and improved ductility in the mechanical properties of 3rd Gen AHSS grades offers a comprehensive advantage for cost efficiency in the automotive industry as they provide the required materials for forming complex automotive geometries via cold forming.

The technological development of new steel grades hasn’t stopped, and recent advancements in steel-mill processing capabilities support the development and full-scale production of 3rd Gen AHSS grades capable of 1500-MPa tensile strength with more than 20-percent total elongation. Fig. 2 illustrates this progress in the determination and introduction of new steel grades along with strength and ductility relationships. The combination of high strength and improved ductility in the mechanical properties of 3rd Gen AHSS grades offers a comprehensive advantage for cost efficiency in the automotive industry as they provide the required materials for forming complex automotive geometries via cold forming.

Webinar

Webinar