Tier Ones: Both Competitors and Customers

“With many Tier Ones popping up to serve the automotive OEMs down here, most people would see them as our competition,” Anderson offers. “In a sense they are, but, interestingly, they also are our biggest customer base. As these Tier Ones maximize their production, they have overflow work. We sit in a good position because we are located near these plants. We take the overflow work from them, letting them feel comfortable about maximizing their production and seeing us as able to back them up.”

And as more automotive OEMs and their top-tier suppliers set up shop in the Southeast, “the pie gets bigger and bigger,” offers Anderson. “I have seen several automotive suppliers take that approach and look to outsource locally. In so many of those cases, we are just about in their backyard.”

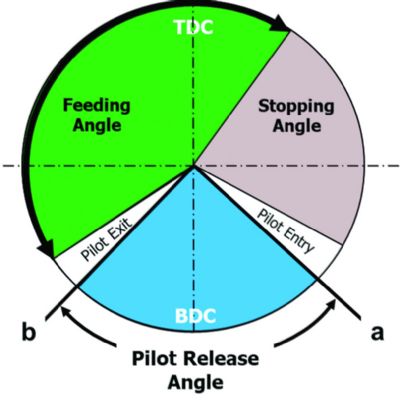

Presses and Feeds Meet New Requirements To provide that backup and continue to serve its customers’ changing needs, especially the greater emphasis on thicker parts of higher-strength materials, the company has invested in more robust presses and feed equipment.

To provide that backup and continue to serve its customers’ changing needs, especially the greater emphasis on thicker parts of higher-strength materials, the company has invested in more robust presses and feed equipment.

“ICE management has looked to the future, seeing the advent of stronger material, and has invested in equipment to help us capitalize,” Anderson says. “That is especially true with the feed equipment, critical to the entire part-production process. Without the feed system to make sure the material loads into the press correctly, stamping is a lost cause.”

One big addition at ICE Grenada: a 1000-ton blanking press and coil feeder.

“That press has added more to our versatility than anything,” Anderson says.

The company had been tying up its production presses to make blanks, or purchased them from outside, costly alternatives that hampered the part-production schedule and brought inventory concerns.

“With the addition of the blanking line, we produce 95 percent of our blanks inhouse,” Anderson says. “That saves us money and also allows us to control inventory flow—we can make the blanks only when we need to, with no storage or shortage issues.”

The company brought in another piece of equipment, a 600-ton high-speed Minster press, to service a customer that recently built a plant in the South. In late 2006, Raybestos Products opened a facility in Greenwood, MS, 35 miles from Grenada. Shortly thereafter, a chance meeting led to an agreement for ICE to provide Raybestos with parts for that company’s wet-friction operations, which supply wet clutches, wet brakes, torque converters, differentials and synchronizers used in off-high as well as automotive and truck and bus markets. The contract calls for ICE, employing the Minster press obtained from Raybestos, as well as a recently acquired 1500-ton Verson press and a new Perfecto coil feeder, to supply 4.4 million parts annually for the next three years.

“That work opened us up in a market—off-road—that we had not been in or even thought about entering,” says Anderson. “Again, location provided that opportunity, as did the financial resources of ICE.”

Equipment addition hasn’t ended there. Already with four five-press tandem lines in place, ICE Grenada is working with county and state officials—the county owns the building—on infrastructure improvements to bring a fifth tandem line onsite.

Future as Bright as the Southern Sun

With all of this action, Anderson sees a bright metalforming future for ICE Grenada and for the South and Southeast.

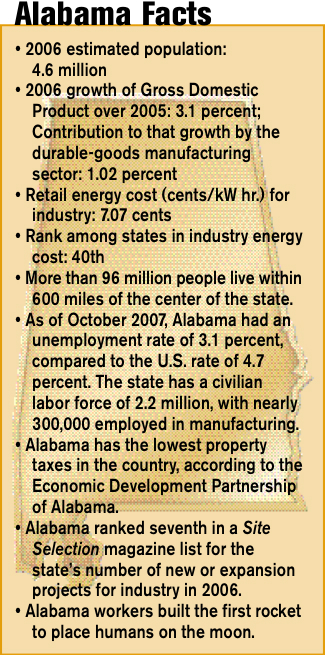

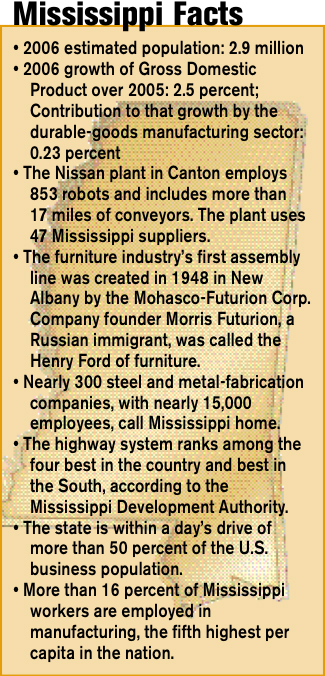

“I think the shift of manufacturing to this region is a permanent trend, begun years ago with automotive, appliance and other industries,” he says. “A big driver is the population base, considering high-growth areas like Georgia, Florida and Texas, and many companies want to be closer to the growing base. And the transplant automotive manufacturers in particular are looking for a business-friendly environment.

“Another factor is government cooperation,” Anderson continues. “Here in Mississippi, local, county and state governments are very cooperative when we go to them with a growth plan. Also, energy costs are lower in this region and the infrastructure is newer and expanding. And we are even seeing steel mills and material suppliers popping up.”

Material Suppliers Set Up Shop

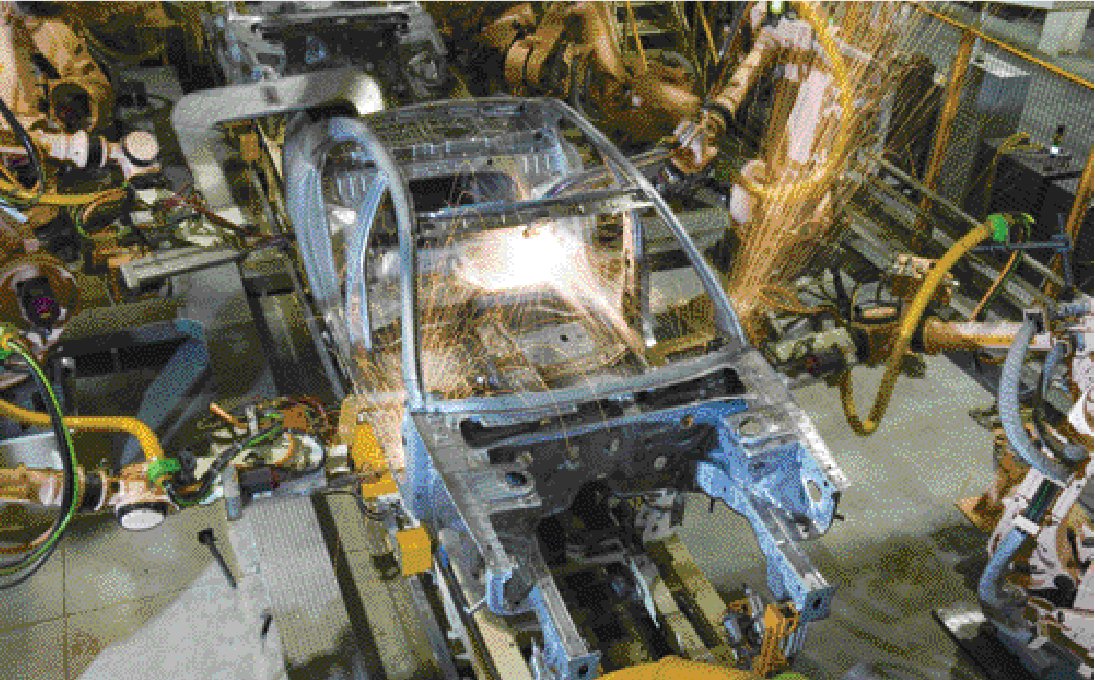

As an example, ThyssenKrupp has broken ground for a carbon- and stainless-steel processing plant in Calvert, AL. The huge facility, at a cost of $3.7 billion, will have an eventual annual capacity of 4.1 million metric tons of carbon-steel strip and 1 million mtons of stainless strip. The facility will include a hot-strip mill as well as cold-rolling and hot-dip-coating capabilities. A stainless melt shop onsite will produce slabs for processing on the hot-strip mill. For cold rolling the facility is designed to initially produce 350,000 mtons of cold strip, and 125,000 mtons of pickled hot strip annually.

“With material suppliers, metalformers and customers in close proximity, less inventory is needed,” notes Anderson. “We can get what we need and ship what we have pretty quickly since we are all within a few hours of each other. All of that makes for lower costs for metalformers opening up or relocating here.”

Appliance Work Pays Bills in Alabama

Of course, automotive is not the only game in the Southeast. Another metalformer, this one in Alabama, has seen much of its success come via the appliance market. T&C Stamping, Inc., is located in a 95,000-sq.-ft. building in Athens, AL, near Huntsville in the northern part of the state. Here, about 100 employees conduct nearly $20 million in business annually via stamping, assembly and welding, in addition to machining courtesy of the company’s full-service tool-and-die operation. The company taps local partners for services such as heattreating, plating and other finishing.

Of course, automotive is not the only game in the Southeast. Another metalformer, this one in Alabama, has seen much of its success come via the appliance market. T&C Stamping, Inc., is located in a 95,000-sq.-ft. building in Athens, AL, near Huntsville in the northern part of the state. Here, about 100 employees conduct nearly $20 million in business annually via stamping, assembly and welding, in addition to machining courtesy of the company’s full-service tool-and-die operation. The company taps local partners for services such as heattreating, plating and other finishing.

“We have not been able to benefit from a lot of the automotive that has moved into the area, as we are a 200-ton-and-under company in regard to press capacities,” says Mark Coleman, T&C president, noting that most of the newer automotive work is geared toward presses 400 tons and larger. “We have the money in the bank to buy a 400-ton press, but it’s a chicken-or-the-egg scenario: Do we buy the press first or do we get the business first? So we have quoted a good bit of business with customers’ understanding that we do not currently have a press, but we show them where we’d locate it in our plant and show them that we have the financing capability, but there seems to be a lot of large-press capacity in the Southeast. And the large-press business seems to be even more competitive than the 200-ton-and-under business.”

That said, the company still gets about 25 percent of its business from the automotive sector, “but a lot of our business involves appliance parts and control components, and that has become more competitive in recent years,” Coleman offers.

Competition Demands New StrategiesJust like anywhere else, Asian competition is driving pricing. Luckily, T&C can employ its inhouse tooling department, and its 18 tool-and-die makers, to stave off foreign competitors.

“Because potential customers can buy tools from Asia for one-fourth of the cost of the market price here in the United States, we have been forced to do things a bit differently,” says Coleman. “For example, in some cases we subsidize tooling—pay for some of a customer’s tool cost ourselves—allowing us to build the tooling and then get the stamping work from that customer. At the end of the day, we are after the manufacturing—that is what pays the bills. So, we may leverage our toolmakers, since they will be here any, and if we can build a tool and subsidize it a bit, then we’ll get the manufacturing work. That is one of our strategies.

In spring 2007, the Challenge X team from Mississippi State University’s Center for Advanced Vehicular Systems won first place in a national competition to redesign a fuel-efficient and environmentally friendly SUV. Here some of winning students pose with their entry, a hybrid Chevrolet Equinox running on an electric motor and diesel engine using biodiesel fuel.

“Even so, pricing has become very competitive, and we are selling stampings for less than what we were 15 or 20 years ago,” Coleman continues. “So we have had to find innovative s of doing things to bring productivity gains and allow our employees to operate multiple presses.”

For T&C, innovation means automation. The company employs technology for part detection and die protection, with heavily sensored tooling. In addition, its 60 presses, from 22 to 200 tons in bed sizes to 48 by 72 in. and shut heights to 24 in., are equipped with automatic feed systems. These improvements have allowed the company to gain greater part consistency and quality as well as improved production speed with less operator involvement.

“In parts without a lot of value-added, our productivity improvements allow us to compete with Asian stampers,” says Coleman. “With material cost basically the same, if we have a part that we can stamp with a minimal amount of labor, we can match their prices.

“Even with that, pricing continues to amaze me,” Coleman continues. “We can quote jobs dirt cheap and still not win the bids.”

Tooling Up for Value-Added

The influx of manufacturing, especially auto-related, puts a premium on a capable workforce. That has drawn the attention of the educational community, with many universities in Mississippi and Alabama offering degree programs tailored to automotive management, manufacturing and design, and working with OEMs on automotive research. In addition, local community colleges and vocational schools provide training programs to boost skill levels. Mississippi State University in Starkville is home to the Center for Advanced Vehicular Systems (CAVS), with a CAVS extension located in Canton near a Nissan assembly plant. Formed in 2001, CAVS seeks to unite research and development at the university and state level with the automotive manufacturing industry. The University of Southern Mississippi in Hattiesburg houses the Polymer Research Institute that includes one of the most advanced rapid-prototyping systems in the world. And the University of Mississippi is conducting research and development with Toyota. Providing training to companies located in Mississippi is the Center for Manufacturing Technology Excellence. That option, combined with programs available through the state’s community/ junior college system, according to state officials, has been successful at training workers at Tier One and Two automotive suppliers. The Alabama Technology Network of the Alabama College System, the state’s affiliate of the Manufacturing Extension Partnership, links two-year colleges, the University of Alabama System, Auburn University and the Economic Development Partnership of Alabama to provide hands-on assistance and training to smaller manufacturers. The Alabama Industrial Development Training (AIDT) program provides job-specific training to businesses and potential employees. AIDT also assists in job placement for employers, with program officials noting that the program currently is assisting 20 employers to fill more than 2500 jobs throughout the state. In addition, numerous state universities have adopted automotive- and other industrial-related degree programs and formed research/development partnerships with manufacturers.

Of course, Coleman notes, complex stampings and value-added processes that push the edge of the capability envelope have a greater chance of remaining in North America.

Banking on Knowledge

“Tooling is really the heart of our business, and we try to go after stamping work where our toolmakers can add some value to the process,” he says. “If a value-added operation can be accomplished through tooling design without increasing labor cost, there’s a good possibility it will remain at a domestic source. In addition, with value-added processes such as heattreating and plating, stamping often ends up being the simple part of the process. By working closely with our heattreating and finishing sources, we can optimize those processes and deliver a higher level of quality to our customers. Customers place a value on this service especially as their own inhouse design and process resources are reduced.

“In sum,” he continues, “the value-added processes are where we tend to excel as opposed to just banging out simple stampings.”

Lots of Work on U.S.-Mexico Border

Coleman estimates that 80 percent of T&C’s business ships to companies along the U.S.-Mexico border, including a significant number of mequilladoras, and cites that as a major reason for the company’s growth.

“About 10 years ago we noticed that companies transitioned from vertically integrated operations that performed nearly all processes inhouse,” he recalls. “As they prepared to move to lower-cost areas such as Mexico, they farmed out all of the discipline operations such as stamping, screw machining, casting, etc., and just moved the assembly to Mexico. So we picked up a lot of business through that transition.

“But we are finding that there is a lot less of that type of work out there now,” Coleman continues. “Typically, those types of jobs resulted in $2 to 3 million in business for us at one time. Now, we see much smaller part runs through such deals.”

State Gives Big Assist with Training

Also helping the company grow is the training provided to T&C employees with assistance from local and state programs. Coleman cited the excellent lean-manufacturing training his company received through a program provided by the University of Alabama-Huntsville, and recounted another major example of state training assistance.

See Southeast Metalforming at METALFORM BirminghamApril 1-3, the Precision Metalforming Association will once again present the METALFORM stamping and fabricating exposition and conference, this time in a new location, Birmingham, AL—the heart of the next generation of metalforming in the United States.

For attendee and exhibitor information, visit http://www.metalform.com/.

“We took on a job back in 1993 or 1994 that promised a $4 to 5 million sales increase and required 20 to 25 new employees,” he says. “With that growth, the State of Alabama and its Alabama Industrial Development Training (AIDT) program (see Banking on Knowledge sidebar) actually did the recruiting for us and prescreened potential employees, then conducted night training such as basic shop math for the prescreened applicants. We received some excellent employees through that program.”

We Can Still Make Things

These are just a few of the stories highlighting the new manufacturing power of the Southeast. There are countless more, originating from throughout the Sunshine Belt. These stories promise that we can still be a country that makes things—a simple concept but a complex mission. MF

View Glossary of Metalforming Terms

See also: Thyssenkrupp System Engineering Inc

Technologies: Coil and Sheet Handling, Materials, Pressroom Automation

The widespread use of air conditioning; increased mobility due to creation of the national high system and other modes of transportation; the weather. Any and all of these reasons, and many others, have contributed to steadily rising population in the Southeast United States over the last half century. Mirroring the population, economic fortunes also have risen in a region that at one time was the nation’s poorest. With city, county and state governments onboard, manufacturing has found a home in the Sunshine Belt, promising jobs, revenue and long-term economic stability for inhabitants.

The widespread use of air conditioning; increased mobility due to creation of the national high system and other modes of transportation; the weather. Any and all of these reasons, and many others, have contributed to steadily rising population in the Southeast United States over the last half century. Mirroring the population, economic fortunes also have risen in a region that at one time was the nation’s poorest. With city, county and state governments onboard, manufacturing has found a home in the Sunshine Belt, promising jobs, revenue and long-term economic stability for inhabitants.

Video

Video