Working Through the Challenges

(Reprinted with permission from the January 2014 issue of Automotive Supply Chain magazine)Multiple, simultaneous vehicle launches and the pipelining of hot sellers create manufacturing capacity challenges, but the supply base is highly resilient says Chrysler’s Sig Huber. He spoke with Sam Ogle.

The automotive market in the United States is enjoying a period of unforeseen growth following the despondency created by the 2008/2009 recession. Analysts are already predicting a return to pre-downturn sales levels within the next two years. Every silver lining has a cloud, of course, and there have been reports of capacity shortages in the manufacturing supply base. Sig Huber, director of supplier relations at Chrysler Group LLC, believes that the challenge has not been insurmountable.

“One thing we have learned in recent years is that the supply base is very resilient,” he says. “We have seen this as a result of the bankruptcies in 2008 and 2009 and the Japanese tsunami and other natural disasters. The supply chain has shown an ability to be very flexible. We have been challenged with capacity over the past year and a half and we have been spending quite a bit of time working with our suppliers on the issues.”

The industry is seeing a plethora of new model launches and these, says Huber, are creating capacity challenges, as is the tendency for OEMs to fill their dealer pipelines with “hot” vehicles for which consumer demand is high. Even if a supplier has planned well it can reach a point where several of its customers are asking for more and more components and the supplier only has so much capacity.

“We have had a few issues where suppliers were a little slow to make capital investment, not believing that the volumes were going to recover as strongly as they have,” says Huber. “By and large, the supply base has been able to work its through the challenges.”

Sig Huber joined Chrysler in April 2008 having previously spent nine years with Toyota. His team is responsible for improving supplier and industry relationships, communications and events, supplier risk management, supplier assessments, supplier diversity, contract administration, training and development, audit compliance and various other strategic areas within global sourcing at Chrysler. Huber also oversees the procurement of all parts and services for MOPAR, Chrysler’s aftermarket parts and performance parts division. Huber was actively involved in Chrysler’s restructuring activities in 2008 and 2009 and in that capacity he worked closely with the U.S. Treasury Auto Taskforce and Fiat due diligence and integration teams.

The Chrysler purchasing operation is headed by Scott Kunselman, who has several direct reports, notably the commodity directors who purchase parts and services by category. One is responsible for metallic commodities such as chassis parts, one for powertrain, including transmissions and engines purchased from other companies, one for chemical commodities, basically parts made from plastic or rubber such as tyres or spoilers. Another has responsibility for electrical components including navigation systems, radios and computers and there is also a director responsible for indirect materials such as products used in Chrysler’s plants including lubricants and protective wear. This latter category also includes services such as IT, consulting, advertising and capital equipment.

The Chrysler purchasing operation was one of the first groups to integrate globally following the acquisition by Fiat in 2009. Some of the commodity directors are global leads for their category and could be located either in Europe, Latin America or the United States. The chemical director, for example, is the global lead for chemical around the world and all the chemical buyers globally report through him.

“There is a global head of purchasing for Fiat/Chrysler, who is Scott Garberdine,” explains Huber. “He is the global lead and Scott Kunselman is the Chrysler lead. Each of the global directors is in a matrix organization and wears a global hat to report to Scott Garberdine and a regional hat to report to whoever their regional head of purchasing is. For example, the global chemical lead is located in the United States but, depending on the commodity, the senior manager under him could be located in Latin America. The lead buyer for a commodity, oil for example, could be located in Europe.

“These groups at the commodity level are completely integrated globally; they have their own staff meetings and their own sourcing tables. We started this process several years ago and it is well-established and gives us a lot of ability to create common global strategies for our suppliers and for commodities.

“One of the key functions of our buyers is to create commodity strategies. They work in conjunction with engineering counterparts and supplier-quality specialists to create, for example, a global strategy for glass. They identify the glass suppliers we are using globally and determine whether we have the right number, too many or too few and whether the ones we are using have the right geographic footprint. Then, collectively as a global team, they determine the global strategy for that commodity. The buyers, wherever they are in the world, source according to that strategy.”

One of the concepts that Chrysler has really embraced since the Fiat acquisition is World Class Manufacturing, Fiat’s production system, which is similar in some s to the Toyota Production System with its emphasis on waste elimination and continuous improvement.

“We train suppliers in the s of World Class Manufacturing in an effort to create true cost reduction and not just price reduction with our suppliers,” says Huber. “From a raw material standpoint, we haven’t seen huge issues in the past year or so in terms of cost escalation.”

OEMs will als hope to ensure that their suppliers are bringing innovation to them before they bring it to anyone else. One of the chief complaints from the supplier side, however, concerns the length of time it can take before the OEM evaluates and finally decides whether or not to implement the new idea. According to Huber, Chrysler has accelerated the process.

“We have developed a system by which suppliers can submit innovations to us through the purchasing department. Before, it might have been a little bit of a convoluted process for suppliers to know how to bring our attention to their innovations and so we created what is basically a funnel through purchasing where suppliers can submit their ideas and, very quickly, there is a purchasing and engineering taskforce that reviews them and responds promptly with a yes or no answer. If we are interested, it will lead to a presentation by that supplier to a group of our senior vice presidents with responsibility for product development, engineering and purchasing. It is a really interesting and unique opportunity for suppliers to get their ideas accepted through this portal.

“We also have created a specific team within engineering whose one and only charter is innovation and the development of innovative features and attributes for our vehicles. We have been working very hard to make ourselves more receptive to innovations and to have suppliers bring them to us because they believe that we are equipped to bring them to market quickly.”

One of the attributes that Chrysler expects from its suppliers is that they abide by what the automaker calls its foundational principles. These include factors such as transparency, acting with a sense of urgency, commitment to a long-term relationship, acting with integrity and being advocates for Chrysler.

“We would expect all our suppliers to act in accordance with those principles,” affirms Huber. “From the ones that we consider strategic, we expect a heightened level of commitment to those foundational principles. Only through the two- utilization of that behavior are you going to be able to unlock the inherent inefficiencies that could exist in a relationship between a supplier and a car company.”

With a selected number of suppliers Chrysler has initiated a process called pre-sourcing. Basically, this is a non-competitive bid situation where the OEM starts working with the supplier very early in the development stage of a project and they jointly develop parts and the target pricing for them as the project moves along. According to Huber, this requires a tremendous amount of trust on both sides.

“They have to trust that we will come to a fair, negotiated price because they are going to be investing a lot of their own resources up front on a project like that. We have to have the same level of trust that we will have full transparency in the cost drivers so that we know we’re paying a fair price if we’re not going to competitively bid it. Our most strategic suppliers are ones with which we would like to be able to do more and more pre-sourcing and, in order to do this, we need very, very strong commitment to the foundational principles.”

Ford Motor Company’s new purchasing head, Hau Thai-Tang, recently announced a targeted reduction of 40 percent in the company’s ranks of suppliers and Ford is not the only OEM to be thinking along these lines. Huber, however, refutes the suggestion that Chrysler has such a specific target.

“We have, right now, around 1250 production suppliers at Chrysler. There are efficiencies to be gained by having fewer suppliers because you are able to manage them more easily. With the same number of internal resources, if we have fewer suppliers to manage, we can visit their plants more frequently, have more frequent meetings with their executive team and foster a greater degree of collaboration. Moving forward, we have stated that we would like to reduce the number of suppliers in our supply base but we do not have a stated number because that really needs to be generated not as a top-down arbitrary figure but by each of the teams which have developed their global commodity strategies.”

Chrysler speaks frequently to its supply base about a concept it calls meritocracy, something that is also important within the automaker’s internal culture.

Chrysler speaks frequently to its supply base about a concept it calls meritocracy, something that is also important within the automaker’s internal culture.

“It means that those who do well and whose performance is high will be rewarded,” explains Huber. “In order to have a system of meritocracy among our suppliers where the strong ones are able to grow their businesses, that business needs to come from other suppliers or from incremental growth. We have a scorecard system and those suppliers that do well will be growing their business with us and those suppliers that don’t do well will be losing business.”

It is important to understand that all OEMs spend the large majority of their purchasing budgets with the top 100 or so companies in their supply base. In Chrysler’s case, that means that only around 10 percent of its annual spend is spread amongst roughly 1150 companies. Yet those suppliers have to be managed and that takes a lot of resources.

“What will happen over time in all the car companies is that those suppliers that are in the tail, especially the tip of the tail, will see their business awarded to those companies higher up in the value stream which have performed well,” says Huber.

“We have many factors that determine our choice of suppliers in any particular case. The most important is supplier commodity strategies. Once the suppliers start looking at the business, our engineering teams and our supplier quality team create criteria to analyse the suppliers and rate them in terms of technical competence and plant readiness. We also consider their scorecard performance over the past year or so and we even look at things such as their supplier diversity performance. We have a very strong program where we encourage our Tier One suppliers to use minority-owned businesses for a certain percentage of their work. Cost is, of course, very important but what’s also important are quality, innovation, technical competence, the design capability and the engineering resources. We have quite a large spreadsheet that we use when we make sourcing decisions.

“We look at total landed cost of parts as a criterion. Whether they are sourced in China or the Philippines or Mexico or Canada or the United States is not as significant a factor for us as the total landed cost. That said, there is a very strong trend toward regional purchasing; buying the parts in the regions where we are manufacturing the vehicles.”

One of Huber’s areas of responsibility is risk management. His group carries out financial reviews of all Chrysler’s production suppliers and its largest indirect suppliers.

“If we find a problem, we have a group which gets involved with work-out situations where we are dealing with banks or private equity firms or other customers through legal processes or out-of-court deals. I also have a group in my risk-management area which is responsible for onsite technical support of suppliers where they might be having throughput issues or major quality spills. My group works hand-in-hand with the people on the floor to get the plants up and running and get parts out the door so that our production is protected.”

The other aspect of risk management that has been thrown into focus over the last few years is how to mitigate the potential disruption to supply caused by natural disasters around the world.

“There has been increased activity in this area ever since the Japanese tsunami,” says Huber. “People have been trying to figure out how to get better visibility deep into the tiers of the supply chain. We know who our Tier One suppliers are and where all their plants are located and we have a warning system that tells us, if there is a tsunami or tornado or whatever, what Tier One suppliers are in its footprint. Where it gets very murky is in the subtiers.

“A lot of industry consultants are trying to figure out how to gain visibility into the subtiers and how to keep that visibility current. It is very difficult as an automaker to know who is down there in the subtiers, where they are located and to fully comprehend what the risk profile is. This still is very much a work in progress in the industry.

“I’m not sure that having international reach gives visibility in the lower tiers. What we depend on is for our Tier One suppliers to tell us who the suppliers in their subchain are. They have to collect that data from their subsuppliers. It becomes a very large database to manage because, as soon as you get down a couple of levels, there are tens of thousands of companies. The industry has proved that it is extremely resilient and, after some of the recent natural disasters it came together and was able to come up with solutions either through engineering changes or alternative materials. None of the disasters really resulted in any significant loss of production, at least not for the North American OEMs.”

Automotive Supply Chain

A Tier Supplier of Metalformed Parts and Assemblies Weighs In

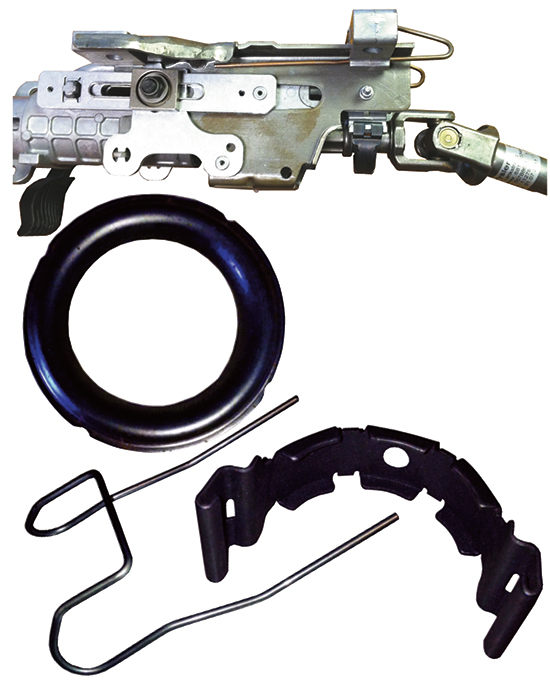

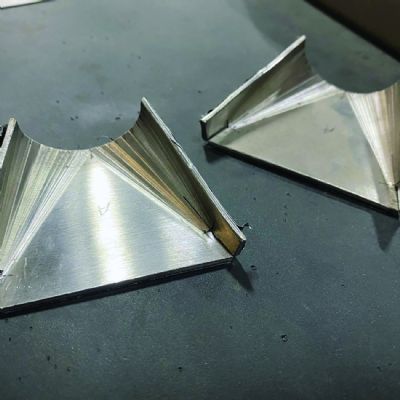

Wire-form and metal-stamping provider Clips and Clamps has been a Chrysler supplier since inception, in 1954, beginning with a host of “simple clips and fourslide parts,” says vice president and general manager Jeff Aznavorian. “Since then we’ve matured into supplying a full portfolio of stampings, assemblies and weldments in various areas of the vehicles, including the chassis and powertrain.”

Chrysler supplier Clips and Clamps supplies these parts for the steering column assembly (left) built by Toledo Machining.

Clips and Clamps, like other long-term Chrysler suppliers, has been on a “roller coaster” with the OEM, explains Chrysler account manager Mike Olszewski, referring to its relationships with Daimler-Benz, Cerberus and now Fiat. “Along the , we’ve seen a continued focus on improving supplier relations, which really came into focus when Dan Knott became senior vice president of purchasing and supplier quality (in 2009). With Dan’s passing in 2012, Scott Kunselman stepped into his ‘big shoes’ and hasn’t missed a beat. The level of transparency through the supply chain in the last 5 or 6 years has been a tremendous asset to us and other suppliers.”

Chief among the “open-book communications” Olszewski appreciates: Chrysler’s monthly townhall meetings, geared toward Tier One suppliers. These 90-min. sessions allow Chrysler executives, including Kunselman and his department heads, to update the supply chain on new-product developments, changes to supplier scorecards and other topics.

The Measuring Stick Keeps Evolving

Much is made of the supplier scorecards used—and frequently adjusted—by Chrysler and other OEMs. Every 2-3 years it seems suppliers face new measuring sticks. Aznavorian, who sees this as a means preventing complacency amongst suppliers, notes less emphasis on cost-downs in recent years. Instead, scorecard weighting has shifted toward quality measures (PPM etc.) and the ability to meet expedited delivery dates.

“This is where transparency and communication really becomes an asset,” Aznavorian says.

Also evident to Clips and Clamps executives is the Worldclass Manufacturing initiative discussed by Zigler in the Automotive Supply Chain article. “We see it when we act as a supplier to Toledo Machining, for example,” explains Olszewski. “We supply five parts for a steering column they manufacture—two wireforms, a fourslide part and two stampings. Ergonomics plays a key role in Toledo Machining’s worldclass focus, and it’s our responsibility to support their processes. That means working closely with their engineers to develop packaging that fits their assembly sequence, presenting our parts to line workers to optimize the assembly process.”

Collaboration the Supply Chain’s Vitamin Punch

It’s this type of collaboration and support that makes an automotive supply chain strong, allowing the creation of added capacity without any accompanying quality or safety concerns. And when supply successes occur, kudos from the OEM goes a long toward building morale—also strengthening the supply-chain’s links. For its part, Chrysler has become great at heaping praise onto its suppliers to recognize success, say Aznavorian and Olszewski.

“For example,” recalls Olszewski, “we were called in to provide a solution to problems Chrysler was having with steering-column security lock boxes. Quality problems with boxes provided by another supplier threatened to shut down the assembly line. In one day we engineered a solution to salvage the faulty boxes, produced prototype parts and delivered them to Chrysler. As soon as word made it to Chrysler’s executive team, we received notes of thanks from several people at various levels of the purchasing organization. That type of appreciation and communication goes a long toward strengthening relationships, building teamwork and boosting morale up and down the supply chain.” MFTechnologies: CNC Punching, Coil and Sheet Handling, Cutting

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Bending

BendingSheet Metal Folding and Forming

Monday, July 7, 2025

Bending

BendingCutting, Bending and Welding Equipment Plus Related Software

Monday, August 5, 2024

Bending

BendingCreative Approaches to Common Press Brake Challenges, Part 1...

Justin Talianek Tuesday, April 30, 2024