Don't Let the Auto Crisis Take You for a Ride

November 1, 2008Comments

How will the automotive industry shake out in 2009? Lost in the carnage of the mortgage-lending crisis that resulted in a massive government bailout is the now-seemingly meager $25 billion government-backed loan program for the automotive industry. Details are sparse and no one in the industry really knows exactly how the loan program will work or when it will kick off, but we do know that automotive suppliers are eligible for some of that program’s low-interest money. Funds are earmarked for dated operations looking to retool to produce more fuel-efficient vehicles—a nod to Ford, GM and Chrysler, domestic OEMs that tend to occupy older facilities than transplant OEMs—and the parts makers that supply them. (The Precision Metalforming Association was instrumental in inclusion of assistance for suppliers, lobbying vigorously on behalf of that provision.)

Never in my memory—I remember Ford introducing the Escort—has this venerable industry had so much thrown at it all at once. Just consider: Astronomically high gas prices; a climate-awareness movement; rising costs for labor, healthcare, raw materials and energy; leveling off of demand in the U.S. market along with increased competition; financial turmoil that squeezes credit available for capital improvement, and credit available for consumers who may have been in the market for new vehicles; unemployment at a 14-year high; a strengthening dollar that curbs exports, helping to shut off shipment of product to hotter markets around the globe. J.D. Power and Associates outlines the net effect of all of this in its just-released 2008 vehicle sales forecast.

“As the U.S. new-vehicle retail market continues to deteriorate, new-vehicle retail sales are projected to end 2008 at 10.8 million units, which is 2 million units below 2007 sales,” opens the report. And the depressing news continues, as J.D. Power “forecasts total new light-vehicle sales—which includes both retail and fleet sales—to drop to 13.6 million units in 2008, registering a 16 percent decline from 16.1 million units in 2007.”

So how will the industry end up next year—what will it even look like? We’ve all heard rumblings about mergers that may make the Big Three the Big Two. Whether that happens or other restructuring occurs, what we can be sure of is that the world of automotive supply will remain fierce and daunting.

The best we can do is remain positive—Brad Kuvin’s editorial on page 7 speaks to that—and be smart. ne Boeckman, PMA chairman for 2009, in the article beginning on page 18, counsels all of us to search out new opportunities and to diversify.

What 2009 brings is anybody’s guess, and that uncertainty demands that metalformers and fabricators be flexible. Chances are, if you are in automotive now, you’ve worked your tail off to be as efficient as possible while maintaining top-flight quality. That is a recipe for success in any market. Of course, metalformers set up for automotive supply have a unique structure, production method and system of documentation that doesn’t necessarily transfer easily to serving customers in other markets. But maybe there’s an opportunity to convene a team to explore new s to utilize your skills and equipment and perhaps create a small cell to do some piece work for customers in the markets you target, or to develop partnerships to expand your reach and capabilities.

Now it’s easy for me to sit here and think of s to spend your time and money—I should work for the government—but just waiting for automotive to shake itself out does not seem like the best option. You may be better off keeping your hands on the wheel and steering the winding course of automotive supply rather than just letting yourself get taken for a ride.

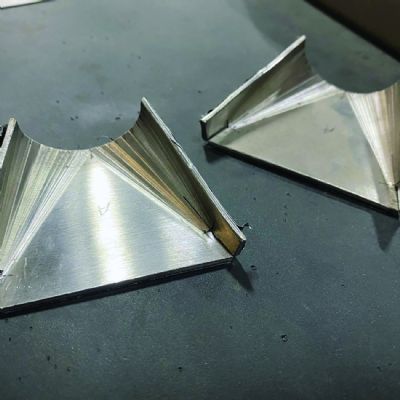

Technologies: Bending

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Bending

BendingSheet Metal Folding and Forming

Monday, July 7, 2025

Bending

BendingCutting, Bending and Welding Equipment Plus Related Software

Monday, August 5, 2024

Bending

BendingCreative Approaches to Common Press Brake Challenges, Part 1...

Justin Talianek Tuesday, April 30, 2024