Covidien Helping to Fortify its Supply Chain

Covidien’s Nisco says that to help its supply base improve and more consistently achieve its required minimum CpK of 1.33, the firm has increased its focus on supplier training, in areas such as six sigma and lean initiatives.

“Our suppliers are an extension of our business and we need the best of the best,” says Nisco. “And although we do not require six-sigma blackbelt certification from our suppliers, we do prefer to see our suppliers working toward achieving that level of excellence. As we look down the road at our supply chain, those are the types of suppliers we will require.”

Nisco explains that, “within Covidien, we don’t manufacture very much of the metallic components for our product. More than 95 percent of our metals-related purchases—raw materials and components—are done on the outside, primarily from about 50 core suppliers. We design here, and then rely on our suppliers to lend their expertise in manufacturability and methodology, to keep costs low and quality high.”

Covidien recently conducted a two-course training program in lean supply-chain management, attended by 25 employees from 13 Connecticut companies. According to an article in The Herald (published June 21, 2009), the training program was designed to “make the industry’s supply chain leaner and eliminate wasteful nonvalue-added activities… Participants focused on quality tools, evaluation and auditing, scorecards, metrics and organizational culture.”

Among the attendees at the Covidien training program was Allen Nadeau, supervisor of shipping, receiving and finishing from metalforming company Southington Tool & Manufacturing Corp., Southington, CT. The firm produces stampings, springs and wireforms from presses with capacity to 100 tons, as well as from fourslide stamping equipment and CNC wireforming equipment. Among the medical products it supplies are ligating clips, medulary pins, surgical staples and sutures, and stents.

Describing how the course helped him focus on s to identify bottlenecks that slow down the manufacturing process, Nadeau said: “On a skin staple, we discovered how to perform 100-percent mechanical inspection while increasing product quality… though we only have 40 employees, we’re expected [by our customers] to turn out work done by 100 people.”

New Metal-Fabrication Equipment Enables

Supplier’s Expansion into Custom Products

Thanks to increased production flexibility gained by the addition of a new CNC press brake and a new laser-cutting machine (from Trump Inc., Farmington, CT), the sheetmetal-fabrication department at Pedigo Products, Vancouver, WA, has improved its ability to develop and manufacture custom medical products, and slashed lead time by more than half. Pedigo designs and manufactures powder coated, chrome and stainless-steel products for doctors’ offices and hospitals—apparatus such as stretchers, stools, surgical case carts, instrument tables, IV stands and bassinets. Its 139,000-sq.-ft. facility hosts a 10,000-sq.-ft. sheetmetal-fabrication department (shearing, laser cutting, punch presses and press brakes); 9000 sq. ft. dedicated to welding; a 7000-sq.-ft. machine shop and finishing department; an 8000-sq.-ft. tube-cutting and forming department; and 32,000 sq. ft. for an assembly department. Another 38,000 sq. ft. serves as an inventory warehouse, because, says plant manager Bob Voitik, “We still must carry a large inventory of standard product ready for immediate delivery.”

That said, Voitik and the plant’s sheetmetal supervisor Raul Zuniga agree that more and more of its customers desire the development and manufacture of custom products, in order sizes down to just a few.

“Hospitals and doctors each have their own unique specifications for the sizes of the products they order from us,” says Zuniga. As an example, he cites the firm’s case carts, designed to hold a set of surgical instruments. The cleaning systems employed to sterilize the instruments can vary in size, and therefore Pedigo customers prefer the carts be custom sized to fit the capabilities of the wash systems.

Lead Times Lowered

“Fabricating sheetmetal parts in custom sizes challenged our department to meet lead time requirements,” shares Zuniga, “particularly because we were outsourcing our laser-cutting work, which added as much as five weeks to our lead time. Now, with laser cutting inhouse, we can start cutting within a day of the engineering release.”

Annually, Pedigo processes 1.1 million pounds of stainless-steel sheetmetal from 20 to 12 gauge, and another million pounds per year of plate and tubing. Its defining quality characteristic to customers is surface quality.

“We cannot tolerate even the tiniest of scratches or other surface defects,” says Voitik. And although Pedigo employs press-brake tools lined with an 0.015-in. layer of protective urethane, its manufacturing department does not use a vinyl protective layer on sheetmetal blanks processed in its laser-cutting machine (a Trumpf TruLaser 2030 machine with a 2-kW laser and automated sheet loader and unloader).

“While most laser shops would use a protective liner, we prefer to bring in our #4-finish polished blanks from our service center without a liner, so we can see first-hand, before we perform any operations on the sheet, the surface condition of the steel and inspect its quality,” says Juan Ceja, assistant sheetmetal supervisor. “This we avoid wasting time and resources laser-cutting a piece of sheetmetal only to find out later, after removing the liner, that the sheet surface did not meet our quality specifications. Also, adding a protective liner prior to cutting, and then removing it after cutting, just adds labor and cost to the equation.”

Along with its new laser-cutting machine, added in October 2008, Pedigo’s sheetmetal shop also added a Trumpf TruBend 5085 CNC press brake, and Trumpf’s TruTops programming system that integrates with Pedigo’s 3-D modeling software to automate press-brake as well as laser programming.

“The press brake’s six-axis programmable backgauge and profiled fingers allow solid, repeatable gauging for odd-shaped parts,” Voitik says, “and allows us to set up a series of bend stations along the bed of the brake. Our operators can complete a bend sequence in one material handling, much more efficient than making one bend on a set of parts, changing tools and making the next bend, etc. This also has helped us streamline our process and dramatically improve lead times—from 90 to 120 days to just four to five weeks.”

|

How One High-Speed Stamper Made the Move to Medical

Southington Tool & Manufacturing’s successful migration into the medical-product industry exemplifies that of numerous metalforming companies. The common thread weaving the successful formula for most: The development of the engineering and design know-how to help medical-product OEMs such as Covidien develop those perfect partnerships, where designs are turned into reality by creative process-development engineers.

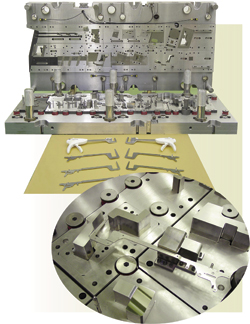

Case in point: Weiss-Aug Co., Inc., East Hanover, NJ, which manufactures surgical and drug-delivery devices. The firm specializes in new-program development, assisting OEMs early in the design stage to ensure quality and manufacturability and at the same time help control costs and prevent overruns.

Weiss-Aug is a high-speed stamper and injection molder, with Bruderer presses from 20 to 90 tons. Born in 1972, the firm was raised on supplying primarily the telecommunications and automotive industries, until it retrenched itself in the medical marketplace about five years ago.

“In 2001, to help us set our course in the medical industry, we hired someone from the industry to help us develop our sales team and make the proper contacts in the industry,” says Weiss-Aug president Dieter Weissenrieder. “We already had the quality track record the OEMs look for, with expertise in high-volume manufacturing and 100-percent parts inspection, to achieve PPM levels in the single digits. Any operational changes were minimal. But it did take us about five years to get a strong foothold in the industry and convince the customers to trust our ability to develop prototypes, consult on engineering changes and move into high-volume production.”

Developing “Strategic Customers”

Weiss-Aug’s approach for expansion in the medical arena focused on developing strategic customers—those that would generate at least $1 million in annual sales, says Weissenrieder. He finds that relationships between suppliers and customers are strong in the medical industry, dovetailing with the belief of Covidien’s Nisco that his firm’s suppliers are an extension of their company.

“Our medical customers appreciate our manufacturing expertise,” Weissenrieder says, “which allows them to focus resources on new-product development, their real opportunity to gain a critical competitive advantage in a very competitive environment. Then, our engineering and manufacturing expertise focuses not only on honing a process to ensure quality, but also on s to minimize costs, obviously a hot topic in the healthcare industry today. We do this by developing complex stamping dies that allow us to combine several parts into one, or to perform multiple operations in the die and eliminate secondary operations and the associated added part-handling operations.

“We also find,” continues Weissenrieder, “that when our company is allowed to engage in these types of partnerships with customers, and our voice is heard and plays such a major role in the success of a new product launch, that our people are inspired to go the extra mile to help the customers. Probably 75 percent of the projects we complete for our medical-industry customers include significant design input from our team of engineers, to optimize manufacturability, ensure a safe and quality product, and also minimize costs.”

The firm employs eight design engineers, up from three just a few years ago.

Cost-control requirements have medical-device suppliers focused on automation, and Weiss-Aug fits the bill. The firm has invested plenty to automate its assembly as well as its inspection functions, since many of the parts it manufactures require 100 percent inspection. And, its newest stamping presses, including a 60-ton Bruderer acquired last year, are long-bed (to 30 in.) models that, says Weissenrieder, “allow us to design and run more complex and longer dies. Our dies have as many as 30 to 35 stations, so that we can perform more functions in the die, such as in-die assembly. We have eight of these long-bed high-speed presses now, which allow us to eliminate secondary operations, driven by the medical industry’s need for cost reduction. It’s the best strategy for us to compete with low-cost countries.

“We also can no longer afford to sort parts,” continues Weissenrieder. “So, our processes need to be robust, ensuring zero defective parts shipped to the customer. This requires a robust design and robust tooling, with a manufacturing workforce that can run and troubleshoot our increasingly complex tools.” Weiss-Aug added 60 employees to its ranks within the last 2.5 years, and received a training grant from the state of New Jersey last years to help its expanding workforce meet the needs of its customers.

OEMs Banking on Lean to Control Costs

On the OEM front, Covidien and others are committed to helping their suppliers take waste out of the supply chain and become as lean as possible. “The industry is more cost-conscious than ever before,” says Nisco. “So we are pushing our suppliers hard to implement lean projects and take the waste out. We spend a lot of resources and time working onsite with our suppliers to implement best practices and lean initiatives. We’re focused on identifying those suppliers that share our goals and ideals, and developing them as partners.”

Can automotive suppliers get in the game? Nisco thinks there could be opportunities.

“While a lot of automotive suppliers make larger parts and we tend to source smaller parts,” he says, “certainly those companies come with a wealth of knowledge that cannot be discounted. They are used to working in high-production and high-quality environments, and the PPAP process requires significant attention to detail and quality control. That gives some of those suppliers a leg up on others competing in this arena. And, many automotive suppliers have a global footprint, which will become more important as we look to expand Covidien globally and develop a local supply base wherever we set up shop.” MF

Industry-Related Terms: 3-D,

Bed,

Burr Height,

Burr,

Case,

Center,

CNC (Computer Numerical Control),

Core,

Die,

Forming,

Gauge,

LASER,

Layer,

Lead Time,

Lines,

Manufacturability,

Plate,

Run,

Stripper,

SurfaceView Glossary of Metalforming Terms

See also: Nidec Press & Automation, Herr-Voss Stamco, TRUMPF Inc.

Technologies: Stamping Presses, Coil and Sheet Handling, Bending

Webinar

Webinar