Talan Products also has focused for a long time on workforce development. Its training dollars invested per employee is three times the industry median, says Peplin, and its training hours per employee are four times the median, according to benchmarking studies conducted by the Precision Metalforming Association (PMA).

|

Bill Adler, president, Stripmatic Products, Inc.

“Finding people willing to work second shift, and then training them, has always been a challenge for us. Our alternatives are to increase productivity and/or add machine capacity on one shift to meet our order demands.”

Chris Fagnant, president, Qualtek Manufacturing Inc.

“There’s simply no way to inspect every part without automation. We no longer have the option to train and hire people for this.”

Hale Foote, president, Scandic Springs, Inc.

“It seems to me that everyone wants to complain about the workforce issue rather than being proactive.Here, we have 10 percent of our employees actively undergoing their apprenticeship training right now.”

Steve Peplin, CEO, Talan Products

“It comes down to metrics when measuring your company’s performance. Our sales per employee is $700,000, which is crazy high when compared to the median for PMA members, which is around $190,000.”

Chris Zuzick, vice president, sales and marketing, Waukesha

Metal Products

“The need for zero PPM and 100-percent verified quality has driven us to automate much of our visual inspection processes to detect or find any type of bad product.” |

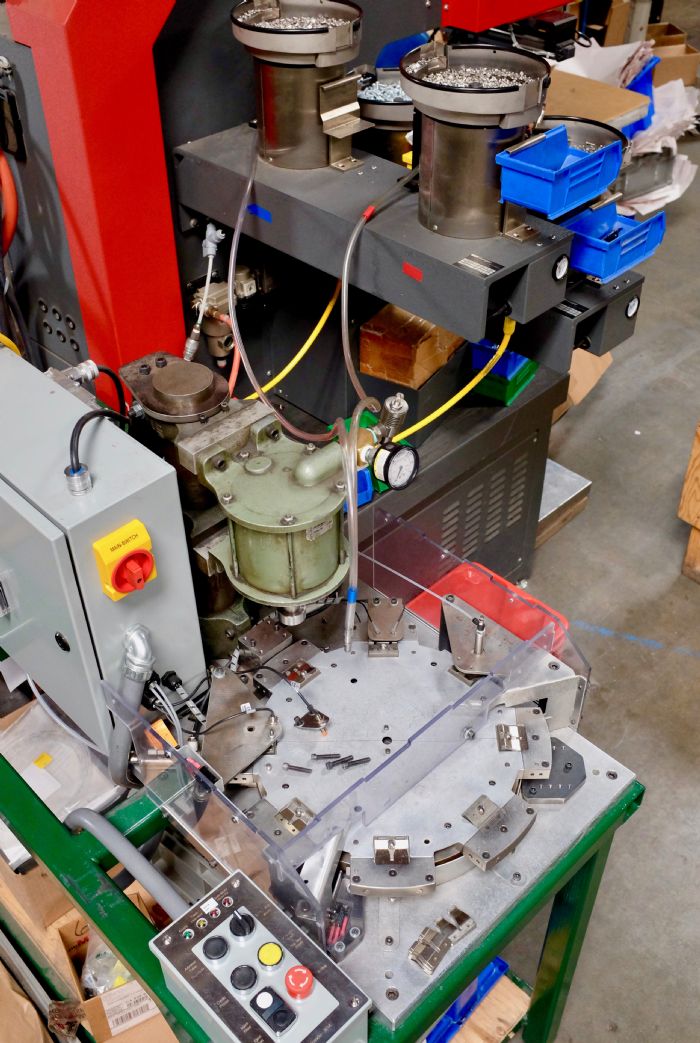

On the automation front, Peplin describes a current project to perform value-added machining operations on a high-volume stamped extrusion. An inhouse-designed and built turntable setup replaced the work being performed by 12 people, and now turns out thousands of completed parts/hr., up by a factor of 10 compared to the manual process.

“That automated setup,” Peplin says, “performs drilling, tapping, deburring and machining operations, and even packages finished parts, allowing our workers to focus less on repetitious manual labor and more on higher-value operations.”

Peplin views automation as driving his company’s future success, but notes that along with automation comes a responsibility to train people to program and—most importantly—service and maintain the automated equipment. “We don’t even bid on jobs that require a lot of manual work," he says, “such as hand-fed press work or manual assembly operations. But, with increased use of automation comes a commitment to develop a strong maintenance department. Even best-in-class automation and robotic operations, we feel, will experience a 95-percent operational efficiency, and we certainly don’t count on that. But we strive to get there, and include with every pro-forma for new automated projects the hiring or training of a new automation-maintenance technician.

“Further, the need for highly skilled maintenance techs,” Peplin adds, “is not just for keeping the equipment running. It’s for continuously tweaking the equipment to decrease cycle times. It takes a long time for an automated process to settle into its optimum run rate, and we’re always looking to improve.”

Minimizing Touches

“We are pledging to minimize the times that our operators have to touch the parts, by using automation,” explains Hale Foote, president of Scandic Springs, a stamper and fourslide spring manufacturer in San Leandro, CA. “When we tell our people that, they also know that no one has lost a job here because we added automation. Our employees are happy to let go of the more mundane or repetitive jobs, and take on higher-skilled jobs instead. We invest in our employees by investing in that higher-skilled training, and they then can earn more pay—as operators of waterjet and laser cutting machines, for example.”

When it comes to dealing with the shortage of skilled labors, don’t count Foote as one of the hand-wringers.

“Yes, it’s hard to find good people,” he says, “which is exactly why we commit a significant portion of our budget to training and workforce development. We don’t sit around and complain about workforce issues, we take action.”

Some 10 percent of the Scandic Springs workforce actively is undergoing apprenticeship training, says Foote. “That might sound expensive,” he says, “but in the grand scheme of things, it pays off big time, especially with younger people who are motivated to learn and grow, and to earn more money.”

Some 10 percent of the Scandic Springs workforce actively is undergoing apprenticeship training, says Foote. “That might sound expensive,” he says, “but in the grand scheme of things, it pays off big time, especially with younger people who are motivated to learn and grow, and to earn more money.”

Foote counts die design and toolmaking among the areas where Scandic Springs needs additional skills, and points to this as an opportunity to invest in automation. Specifically, he’s looking to upgrade the die-development process from using SolidWorks and AutoCad to a more advanced 3D software product such as Logopress.

“While this won’t replace an experienced toolmaker,” Foote admits, “I’m hoping that it will allow someone with 3 or 4 years of die-design experience to step up and be able to design particularly complex progressive dies, where they might not be able to do so using more basic software tools. This is the type of automation where I am happy to invest.”

Other areas at Scandic Springs ripe for automation, according to Foote: “We perform a lot of assembly operations here, value-added work as do a lot of metal stampers, and we definitely look to automate assembly where we can. For example, last year we took on an automotive job requiring assembly of 3.4 million rivets to stamped parts. We initially had rows of operators performing the work manually, but we invested in automation using bowl feeders to remove the labor expense from that job.”

Foote also expresses interest in automated machine and press tending, particularly using cobots, “a much more affordable and flexible option than using traditional robots,” he says. “I am particularly interested in looking at cobots for tending electric press brakes, as well as some of our straightside stamping presses. My only concern is that we tend to be a high-mix shop in those departments, with lot sizes typically under 10,000 parts. I’m not sure that cobots make sense on lower part volumes, but we’re looking at it.”

Automating the Quality Process

“In a tight labor market, we certainly do not want our production employees bogged down in non-value-added work, such as inspection and quality control.” So stresses Bill Adler, president of Cleveland, OH-based Stripmatic Products, primarily a fabricator of tubular metal products. Stripmatic specializes in stamping and wrapping tubes, and then completing the tubes with a highly automated laser seam-welding process.

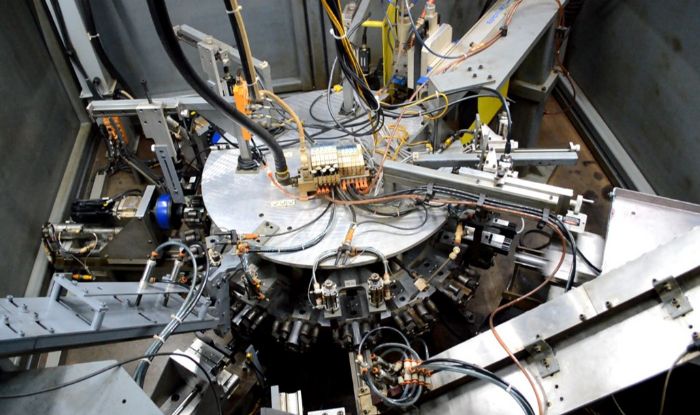

“We’re continually challenged to get more productivity out of our machines,” says Adler. In particular, the firm’s 18-station rotary indexing tube laser-welding machines employ feed hoppers, bowl feeders and conveyors to move materials, and the company has automated the fault-detection process using sensors.

“The most complex stations,” Adler explains, “are where we must precisely locate the weld seams using vision systems, and then verify weld quality. Automating part-quality inspection allows us to redirect our skilled workers back to performing real value-added work, to help us boost productivity in other areas of the plant.”

Adler calls automated visual inspection a “huge win” for the company, and offers up another example: inspecting tubes coming off of a custom end-finishing machine. “That machine simultaneously machines both ends of a welded tube, and employs pick-and-place automation,” he says. “Every so often, about four pieces per 10,000, the automation either drops a tube or otherwise damages the part, and the tube would pass through the end-finishing machine not properly machined.”

Rather than task his staff with visually inspecting every part, Stripmatic’s engineers developed an automated inspection setup using a feed hopper, conveyor, rotary bowl feeder and a pneumatic actuator. Every part leaving the finishing machine now moves through the inspection setup and is measured using sensors to ensure proper machining to spec, ensuring 100-percent good parts.

Rather than task his staff with visually inspecting every part, Stripmatic’s engineers developed an automated inspection setup using a feed hopper, conveyor, rotary bowl feeder and a pneumatic actuator. Every part leaving the finishing machine now moves through the inspection setup and is measured using sensors to ensure proper machining to spec, ensuring 100-percent good parts.

“Continuing to find areas where we can add automation will be a key driver for long-term growth and viability,” Adler adds.

More on Automated Inspection

Out west, in Colorado Springs, CO, we find metal stamper Qualtek Manufacturing, where company president Chris Fagnant also has set his sights on automating the inspection process, “not to only reduce labor costs,” he says, “but also to increase our inspection capacity and capabilities. This has proven critical, and will continue to be so, as we take on more work for the medical and aircraft industries.”

The overriding challenge for Fagnant comes in the area of legacy parts that Qualtek has been stamping for several years. Some parts have been in production for 15 yr. or longer, and when launched, the vision technology needed to enable 100-percent inspection didn’t exist. Now Qualtek finds itself having to retrofit new automated inspection technology to these jobs, challenging Fagnant and his team to develop a cost-justification model that it, and its customers, can live with.

“For example,” offers Fagnant, “I’ve recently been working with an integrator on a part we’ve been stamping for 14 years, at 1 million parts/yr. The challenge is to agree on a pricing strategy that allows us to justify the investment we need to add the inspection equipment. In another case, for an aerospace customer, we’ll be investing more than $1 million in fixed and robotic inspection equipment, for a job where there’s simply no way to inspect every part without automation. We must be able to recover that investment. So while our customer may not realize an immediate cost savings as we pay for and implement the technology, long term they will definitely see the benefit.”

Fagnant, along with the rest of the executives interviewed for this article, has invested in the relatively new METALFORM EDU online training system introduced in 2019 by PMA, and he’s committed to finding ways to use the training system to grow his team’s skill sets. “We have a solid on-boarding process,” he says, “using some of the PMA products. Beyond that, though, we’re trying to find the best way to integrate MEALFORM EDU into our apprenticeship program. And, we’ll use METALFORM EDU to train our existing workers and expand their skill sets.”

Automation to Drive Quality

Customer requirements for process efficiency also have been driving automation projects at metal stamper and fabricator Waukesha Metal Products, Waukesha, WI. For several years the firm has been leveraging robots to automate its arc-welding operations, and, according to Chris Zuzick, vice president of sales and marketing, more recently the firm has been leveraging automated visual inspection to meet, similar to Qualtek, customer requirements for zero PPM and 100-percent verified quality.

“While we still, in some cases, manually inspect parts coming off of our presses,” says Zuzick, “the robotic-welding process can result in somewhat unpredictable results when it comes to dimensional tolerances on completed assemblies. Here we automated inspection to verify quality.”

Zuzick also notes that while the firm employs robots to perform arc-welding operations as much as possible, the firm still needs skilled workers knowledgeable in troubleshooting the welding cells, and that can perform manual welding tasks—gas-metal-arc and gas-tungsten-arc welding—when required.

“While automation remains important to our company, our managers often discuss the importance of developing sound process plans before looking at automation solutions,” he stresses. The management team at Waukesha Metal strictly adheres to an advanced planning and scheduling regimen to ensure that its processes optimally allocate raw materials and production capacity.

“One we have assurance that we’ve established a strong foundation in a process,” Zuzick shares, “only then do we consider automation. We want to avoid the temptation to use automation as a shortcut or a Band-Aid. Then, when we do invest, we seek to train and up-skill our workers to program and maintain the equipment. This gives them another notch in their belts, and adds value to our company and to our customers. And, it enhances our employee satisfaction and retention. All of that serves to line an ongoing path to operational excellence.” MF

View Glossary of Metalforming Terms

See also: Waukesha Metal Products, Scandic Springs, Inc.

Technologies: Bending, Cutting, In-Die Operations

Of course, all of that may be moot right now, in lieu of the

COVID-19 pandemic. Duly noted, yet as we eventually emerge from this

once-in-a-generation crisis, and we will, improving shop-floor productivity will

remain front and center. Yet another recent industry survey, called Shop Floor

Productivity Investments That Drive Manufacturing Growth and conducted by Decision

Analyst and IQMS/Dassault Systemes, finds improving shop-floor productivity to

be 1.4 times more important to manufacturers than making marketing improvements

to drive more sales leads.

Of course, all of that may be moot right now, in lieu of the

COVID-19 pandemic. Duly noted, yet as we eventually emerge from this

once-in-a-generation crisis, and we will, improving shop-floor productivity will

remain front and center. Yet another recent industry survey, called Shop Floor

Productivity Investments That Drive Manufacturing Growth and conducted by Decision

Analyst and IQMS/Dassault Systemes, finds improving shop-floor productivity to

be 1.4 times more important to manufacturers than making marketing improvements

to drive more sales leads.