Page 16 - MetalForming July 2009

P. 16

Wind and Solar Energy

Says Garran, “Think aerospace. An excellent quality track record, high internal quality monitoring and controlled processes, and ISO 9001 certification are usually min- imum requirements.”

OEMs also place a premium on absolutely reliable and on-time delivery. OEMs usually face stiff penalties from wind-project devel- opers if they are late in delivering, installing and commissioning tur- bines. Thus, they impose strict deliv- ery schedules on suppliers, and will pass penalties on to suppliers at fault.

• Global competition. The large- wind industry is a well-established global industry, pitting U.S. manu- facturers against veteran compa- nies, many of which have been in the business for decades. OEMs are building U.S.-based supply chains to serve the large and growing U.S. market, yet U.S. firms go head-to- head with established suppliers that already have economies of scale.

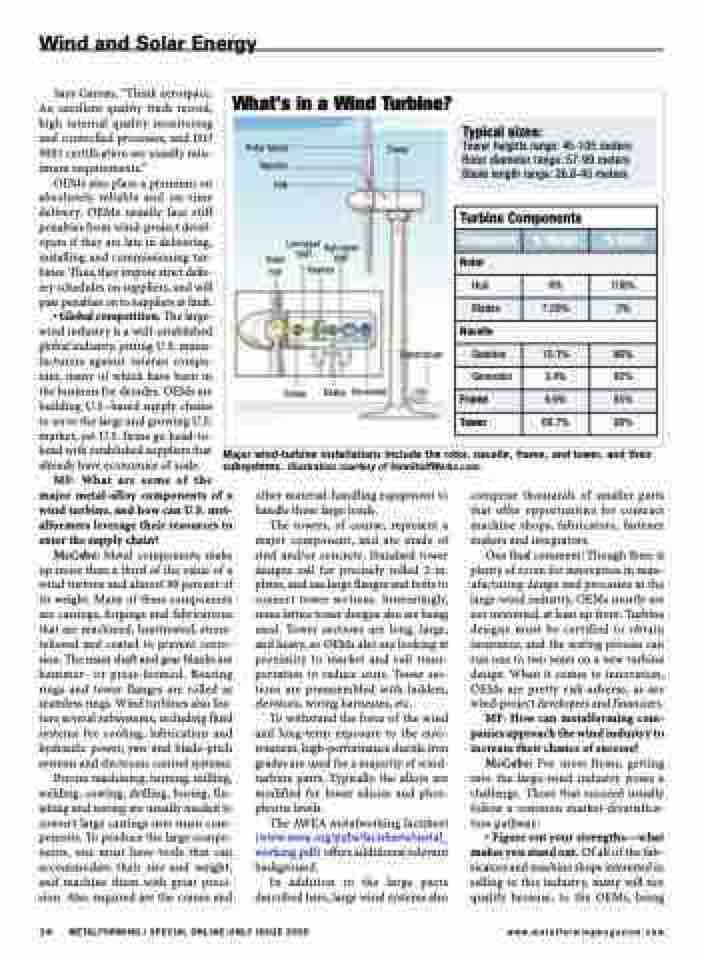

Major wind-turbine installations include the rotor, nacelle, frame, and tower, and their subsystems. Illustration courtesy of HowStuffWorks.com.

What’s in a Wind Turbine?

Rotor blade Nacelle Hub

Low-speed High-speed

Tower

Turbine Components

Component

% Weight

% Steel

Rotor

Hub

6%

100%

Blades

7.20%

2%

Nacelle

Gearbox

10.1%

96%

Generator

3.4%

65%

Frame

6.6%

85%

Tower

66.7%

98%

Rotor hub

shaft

Brake Generator

shaft Gearbox

Brake

Transformer

Typical sizes:

Tower heights range: 45-105 meters Rotor diameter range: 57-99 meters Blade length range: 26.8-45 meters

MF: What are some of the major metal-alloy components of a wind turbine, and how can U.S. met- alformers leverage their resources to enter the supply chain?

McCabe: Metal components make up more than a third of the value of a wind turbine and almost 90 percent of its weight. Many of these components are castings, forgings and fabrications that are machined, heattreated, stress- relieved and coated to prevent corro- sion. The main shaft and gear blanks are hammer- or press-formed. Bearing rings and tower flanges are rolled as seamless rings. Wind turbines also fea- ture several subsystems, including fluid systems for cooling, lubrication and hydraulic power, yaw and blade-pitch systems and electronic control systems.

Precise machining, turning, milling, welding, coating, drilling, boring, fin- ishing and testing are usually needed to convert large castings into main com- ponents. To produce the large compo- nents, one must have tools that can accommodate their size and weight, and machine them with great preci- sion. Also required are the cranes and

other material-handling equipment to handle these large loads.

The towers, of course, represent a major component, and are made of steel and/or concrete. Standard tower designs call for precisely rolled 2-in. plates, and use large flanges and bolts to connect tower sections. Interestingly, some lattice tower designs also are being used. Tower sections are long, large, and heavy, so OEMs also are looking at proximity to market and rail trans- portation to reduce costs. Tower sec- tions are preassembled with ladders, elevators, wiring harnesses, etc.

To withstand the force of the wind and long-term exposure to the envi- ronment, high-performance ductile iron grades are used for a majority of wind- turbine parts. Typically the alloys are modified for lower silicon and phos- phorus levels.

The AWEA metalworking factsheet (www.awea.org/pubs/factsheets/metal_ working.pdf) offers additional relevant background.

In addition to the large parts described here, large wind systems also

comprise thousands of smaller parts that offer opportunities for contract machine shops, fabricators, fastener makers and integrators.

One final comment: Though there is plenty of room for innovation in man- ufacturing design and processes in the large-wind industry, OEMs mostly are not interested, at least up front. Turbine designs must be certified to obtain insurance, and the testing process can run one to two years on a new turbine design. When it comes to innovation, OEMs are pretty risk-adverse, as are wind-project developers and financiers.

MF: How can metalforming com- panies approach the wind industry to increase their chance of success?

McCabe: For most firms, getting into the large-wind industry poses a challenge. Those that succeed usually follow a common market-diversifica- tion pathway:

• Figure out your strengths—what makes you stand out. Of all of the fab- ricators and machine shops interested in selling to this industry, many will not qualify because, to the OEMs, being

14 METALFORMING / SPECIAL ONLINE-ONLY ISSUE 2009

www.metalformingmagazine.com