How Much Does an Accident Really Cost You?

January 1, 2010Comments

Uninsured costs are difficult to measure, but its worth the effort because they can really hurt your bottom line.

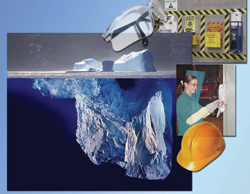

Many companies, while navigating the cold and perilous waters of workers’ compensation, fail to comprehend the complexity of their accident costs in the workplace. Accident costs

are similar to an iceberg—the visible part of the iceberg corresponds to the direct “insured costs” of an injury claim, while hidden from obvious view are the larger indirect and usually uninsured costs remain. It is these “uninsured costs” that can lead to devastating affects to a company’s bottom line.

Workplace accidents have obvious, direct financial ramifications, including medical, hospital, and rehabilitation expenses, lost wages, higher insurance premiums and, in some cases, a total loss of insurability. However, there are many indirect costs that are usually uninsured and can seriously affect a company’s profitability, and can be much greater than the insured loss.

These uninsured indirect workers’ compensation costs result from the marginal inefficiencies to the manufacturing or service process caused by a work-related injury.

Premiums Just a Small Part of Injury Costs

As an example, assume that one of your employees (unfortunately) suffers a serious injury on the job that requires surgery and eight weeks a from his job. It is relatively easy to measure the workers’ compensation benefits paid for this injury. In most states, your insurance carrier must pay, on your behalf, all medical bills associated with the injury and disability (wage-replacement) payments. Your workers’ compensation loss runs should give you a good idea of the total insured cost of an injury of this type.

However, traditional cost accounting typically fails to measure the additional uninsured costs related to these post-injury activities:

• The time spent by your supervisor(s) and human-resource staff responding to the injury, transporting the injured employee to the clinic or hospital, investigating the injury, and managing the claim throughout the entire process;

• Costs associated with the inactivity of manufacturing equipment or inventory as a direct result of the injured worker’s absence, if he is not replaced at least temporarily. This equipment or inventory would be idle and completely incapable of contributing to your production or delivery of services.

• The cost incurred by temporarily replacing the injured employee, which may take the form of overtime paid to existing employees, the hiring of a temporary worker or paying a job-placement firm.

• The direct cost of your operation being disrupted. While you may have temporarily replaced the injured employee, in many cases the replacement employee (either an existing employee or a temp) may not be as productive as the injured employee. The injured employee has been trained and is experienced, which might make them extremely difficult to replace in the short-term.

Rarely does the injured employee come back to work at 100-percent capacity. It takes time for him to become reacclimated to his job. This is further accentuated if the employee must be permanently assigned to a new job to accommodate some physical restrictions. During this readjustment period, you have a less than 100-percent productive employee.

Additional expenses will be incurred as a result of the worker injury. While these may vary depending on the injury and your type of business, here are a few examples:

• The cost of accommodating the employee’s work environment and resources to match his physical restrictions;

• The cost to train the replacement employee; and

• Extra cost to meet customer commitments. If the injured employee had been working to complete a rushed order, you may incur additional costs to ensure that customer commitments are honored.

Webinar

Webinar