Aluminum-intensive beverage packaging, the largest sector for Novelis, is entirely consumer-driven in terms of packaging appeal and preferences in consuming beverages, according to Greco, with material suppliers acting off of major sector players such as Coca-Cola.

Focusing on Strength and Formability

End products with the most-complex requirements, such as those associated with automotive and aerospace, are an important focus of aluminum-product development at Novelis, Greco reports. Strength and formability represent very important criteria for automotive aluminum, thus material development often prioritizes these properties.

“Considering the strength side of the equation over the last few years, material providers have launched several new alloys in the 6000-series category and have begun to push beyond,” Greco says. “Our S615 and S650 aluminum products surpass 300 MPa and represent products dedicated to strength-driven applications. When we think about strength for automobiles, we mean crash-relevant areas. For heavier EVs, crash loads continue to increase. Therefore, aluminum materials must address these challenges and move forward in these areas.”

While the company’s 5000-series portfolio addresses formability, Greco reports higher-forming alloys in the 6000 series as well.

“Newer alloys in the 6000-series family,” he says, “deliver improved exterior surface quality and finish, required by the automotive industry, and deliver higher degrees of formability normally achievable with some 5000-series alloys.”

“Newer alloys in the 6000-series family,” he says, “deliver improved exterior surface quality and finish, required by the automotive industry, and deliver higher degrees of formability normally achievable with some 5000-series alloys.”

Novelis’s newest entry in its high-strength 6000 series: Advanz 6HS s650. This tailor-made alloy, specifically designed for high-strength requirements without compromising forming characteristics, reportedly provides a 15 to 20-percent T6 strength advantage over current high-strength 6000-series alloys, coupled with good crash behavior and corrosion resistance. Predominantly an alloy for structural parts that require formability and high strength after paint bake, typical applications include A- and B-pillars, roof traverses, rockers, inner and floor panels, bumpers, and battery cases.

“The 7000-series alloys developed within the last several years for aerospace,” Greco continues, “slowly have been tweaked and evolved, and within the last 5 yr. the aluminum industry has offered higher-strength 7000 series, which we call ultra-high-strength alloys.”

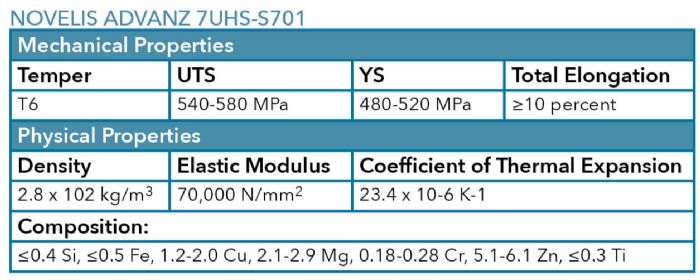

For its part, Novelis offers S701, a 7000-series alloy that reaches into the 400-MPa strength zone. Given the strength to density ratio, “these 7000-series products compete with ultra-high-strength steels,” he says.

One recent 7000-series offering, Novelis Advanz 7UHS-s701, reportedly provides the highest T6 strength among current aluminum alloys, with significantly higher strength than current 6000-series alloys. It offers potential for lightweighting of structural parts such as A- and B-pillars and door beams and provides an alternative to advanced-high-strength steels without compromising performance requirements, according to company officials. And, the alloy-temper reportedly can be optimized to provide good balance between strength, crash performance and corrosion resistance.

Interest Related to Hot Forming, Roll Forming and Joining

Hot and warm forming continue as areas of intense interest, with Greco reporting work with several partners on employing higher-strength aluminum alloys in these processes. Another process ready to take advantage of stronger aluminum alloys: roll forming, especially in the crash structures.

“Novelis is developing roll forming process technology with partners,” Greco says. “It offers advantages for metal formers in applications such as door-guard beams and other strengthening devices such as crash-bumper beams.”

Suffice to say the aluminum industry has a lot going on in developing alloys for automotive applications. This also includes materials for EV battery enclosures, which drive additional requirements beyond strength and formability, including fire resistance.

Welding and joining is fundamental to nearly all aluminum end markets, according to Greco, who explains that joining processes have evolved within the last 10 years to complement materials’ higher strength levels and application requirements.

“The higher material gauges necessary in certain applications has brought a broad suite of solutions such as high-speed riveting, self-piercing riveting and even an evolution in aluminum spot welding from automotive OEMs,” he says. “These complementary developments ensure that new materials can be integrated into manufacturers’ end products.”

Getting the Word Out on Sustainability

For aluminum-alloy providers and users alike, beyond challenges related to joining, formability and strength come more recently voiced concerns as to recyclability and sustainability.

“Recyclability and sustainability represent the third leg of the stool, in addition to the strength and formability legs,” Greco says. “Our markets are paying attention to the impact of the materials that they select or might be asked to utilize. Fundamentally, aluminum is a completely circular (think lifecycle) and reusable product. But to maximize the benefit, scrap must travel in a closed loop, where tiers and metal formers understand the value of that scrap, particularly with higher grades. With that knowledge they can derive an economic value in recycling it or returning it into the value chain and not downgrading it or sending to landfills.”

On priority for the aluminum industry: Ensure that users understand the value in scrap recycling, and also understand how to form and join aluminum alloys properly in given applications. Thus, according to Greco, the industry takes technology and knowledge transfer seriously.

The larger tiers and OEMs maintain intimate relationships with companies such as Novelis, Greco reports, which assists greatly in disseminating technical information and strategies for working with newer aluminum alloys.

Novelis is part of Alumobility, a global ecosystem for leading aluminum and downstream technology partners that supports automotive manufacturers in creating lighter, safter, smarter and more sustainable vehichles.

Alumobility maintains focus on keeping recycling and sustainability front and center for aluminum stakeholders. Here’s an Alumobility fact: More than 90 percent of aluminum contained in a scrapped vehicle can be recycled. Toward that end, the consortium has just released a lifecycle analysis tool, “largely publicly available, and enabling those metal forming companies evaluating different aloys to case-study their applications,” Greco says. “This tool will provide them with a better understanding of the levers associated with their footprints, and the sustainability aspects of their products.”

Novelis, Greco reports, also develops white papers and other information, available through its website, www.novelis.com. MF

View Glossary of Metalforming Terms

See also: Novelis Inc

Technologies: Materials

Comments

Must be logged in to post a comment. Sign in or Create an Account

There are no comments posted. Materials

MaterialsSurvey: North American Metals-Industry Outlook

Wednesday, March 20, 2024

Materials

MaterialsHot-Stamped Steel and Aluminum Drive Autobody Changes

Daniel Schaeffler, Eren Billur Thursday, February 8, 2024

“The automotive industry is going through a tremendous transformation,” explains Mario Greco, director of strategy and marketing-global automotive at Novelis, producer of flat-rolled aluminum products and the world’s largest recycler of aluminum, “including experimentation with new business models, and the shifting of some revenue toward services rather than product.”

“The automotive industry is going through a tremendous transformation,” explains Mario Greco, director of strategy and marketing-global automotive at Novelis, producer of flat-rolled aluminum products and the world’s largest recycler of aluminum, “including experimentation with new business models, and the shifting of some revenue toward services rather than product.” “Last-mile delivery vehicles,” Greco continues, “through reduced weight, can carry more payload and, as these types of vehicles are electrified, they not only reduce the overall cost the vehicle, but also provide an immediate total-cost-of-ownership payback for fleets.”

“Last-mile delivery vehicles,” Greco continues, “through reduced weight, can carry more payload and, as these types of vehicles are electrified, they not only reduce the overall cost the vehicle, but also provide an immediate total-cost-of-ownership payback for fleets.” Video

Video