Page 54 - MetalForming May 2016

P. 54

Blackman on Taxes

By Irving Blackman

Your Estate Plan Is Not Done Until You Have a Lifetime Plan

Recently, Peter read one of my columns about lifetime planning and it hit home. He immediate- ly e-mailed me, telling a bit about his family, his business, Quahog Co., and his current estate plan. Peter was frus- trated and is not comfortable with his plan. I called Peter and received more info, as he agreed to send me a con- sulting package that brought me up to speed on his current financial situa- tion. Included was a copy of his estate- planning documents completed 15 years ago, but amended twice.

What was Peter's estate plan? A typ- ical A/B trust with his wife Lois (age 64) and an irrevocable life insurance trust (ILIT) that owned a $4 million whole life insurance policy on Peter.

Like most of the plans I review, it would be implemented when the client dies. But the sad fact is that the typical A/B trust (like Peter's and Lois's and probably most married folks reading these words) cannot save you or your spouse even one dime in estate taxes.

Yes, an A/B trust, accompanied by a pour-over will, is a good start. But burn this into your mind: Such a trust, from a tax point of view, is a loser. The IRS always wins and your family loses. Peter is a poster child for a well-to-do busi- ness owner who can benefit big time from a lifetime plan to accompany his existing estate plan.

The following are Peter's current

Irv Blackman, CPA and lawyer, is a retired found- ing partner of Blackman Kallick Bartelstein, LLP and chairman emeritus of the New Century Bank (both in Chicago). Want to consult? Need a sec- ond opinion? Contact Irv:

tel. 847/674-5295

ir v@ir vblackman.com www.taxsecretsofthewealthy.com

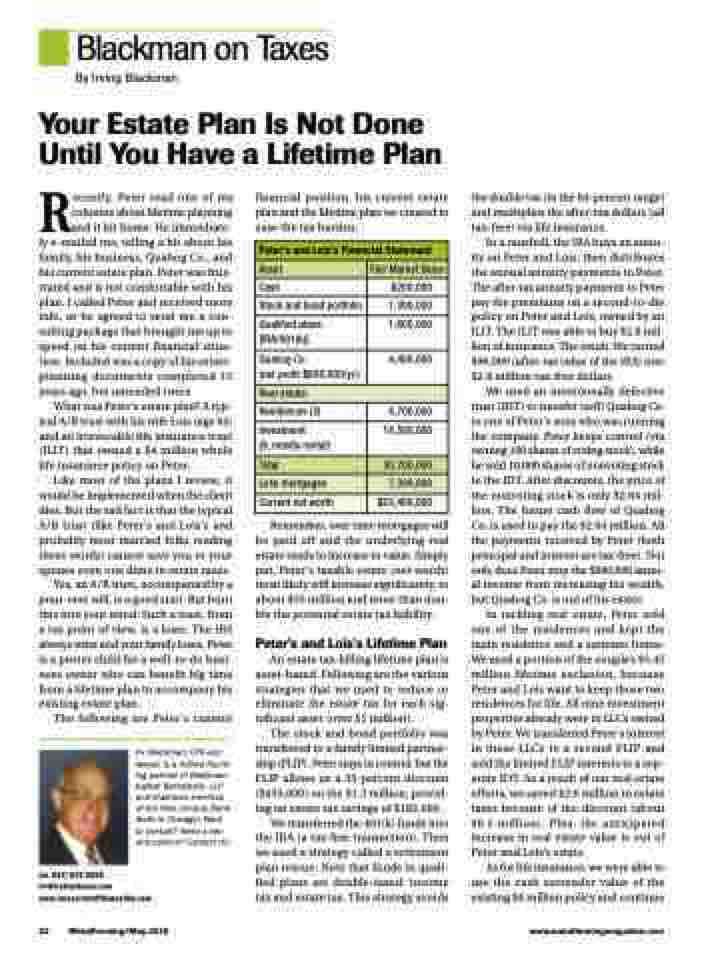

financial position, his current estate plan and the lifetime plan we created to ease the tax burden:

the double tax (in the 64-percent range) and multiplies the after-tax dollars (all tax-free) via life insurance.

In a nutshell, the IRA buys an annu- ity on Peter and Lois, then distributes the annual annuity payments to Peter. The after-tax annuity payments to Peter pay the premiums on a second-to-die policy on Peter and Lois, owned by an ILIT. The ILIT was able to buy $2.8 mil- lion of insurance. The result: We turned $96,000 (after-tax value of the IRA) into $2.8 million tax-free dollars.

We used an intentionally defective trust (IDT) to transfer (sell) Quahog Co. to one of Peter's sons who was running the company. Peter keeps control (via owning 100 shares of voting stock), while he sold 10,000 shares of nonvoting stock to the IDT. After discounts, the price of the nonvoting stock is only $2.64 mil- lion. The future cash flow of Quahog Co. is used to pay the $2.64 million. All the payments received by Peter (both principal and interest are tax-free). Not only does Peter stop the $800,000 annu- al income from increasing his wealth, but Quahog Co. is out of his estate.

In tackling real estate, Peter sold one of the residences and kept the main residence and a summer home. We used a portion of the couple’s $5.45 million lifetime exclusion, because Peter and Lois want to keep those two residences for life. All nine investment properties already were in LLCs owned by Peter. We transferred Peter's interest in these LLCs to a second FLIP and sold the limited FLIP interests to a sep- arate IDT. As a result of our real estate efforts, we saved $2.6 million in estate taxes because of the discount (about $6.5 million). Plus, the anticipated increase in real estate value is out of Peter and Lois’s estate.

As for life insurance, we were able to use the cash surrender value of the existing $4 million policy and continue

Peter’s and Lois’s Financial Statement

Asset

Fair Market Value

Cash

$200,000

Stock and bond portfolio

1,300,000

Qualified plans [IRA/401(k)]

1,600,000

Quahog Co.

(net profit $800,000/yr.)

4,400,000

Real estate:

Residences (3)

4,700,000

Investment

(9, mostly rental)

18,500,000

Total

30,700,000

Less mortgages

7,300,000

Current net worth

$23,400,000

Remember, over time mortgages will be paid off and the underlying real estate tends to increase in value. Simply put, Peter's taxable estate (net worth) most likely will increase significantly, to about $35 million and more than dou- ble the potential estate tax liability.

Peter's and Lois's Lifetime Plan

An estate tax-killing lifetime plan is asset-based. Following are the various strategies that we used to reduce or eliminate the estate tax for each sig- nificant asset (over $1 million).

The stock and bond portfolio was transferred to a family limited partner- ship (FLIP). Peter stays in control, but the FLIP allows us a 35-percent discount ($455,000) on the $1.3 million, provid- ing an estate tax savings of $182,000.

We transferred the 401(k) funds into the IRA (a tax-free transaction). Then we used a strategy called a retirement plan rescue. Note that funds in quali- fied plans are double-taxed: income tax and estate tax. This strategy avoids

52 MetalForming/May 2016

www.metalformingmagazine.com