Page 43 - MetalForming January 2014

P. 43

opportunity for U.S. tool shops to grow along with their OEM and Tier One customers, particularly in the south, but a lot of change must occur to allow this growth to happen.”

By 2020, vehicle production is pre- dicted to grow by nearly 150 percent in Mexico and the southern United States, from less than 2 million vehicles/yr. now to 3.4 million units in 2020. More importantly, stresses Harbour, will be the proliferation of new models.

“For example,” she says, “Mercedes will replace its M Class vehicle with five different models, signifying an overall trend toward lower-volume higher-mix

platforms. Similarly, the Honda plant in Alabama manufactures four models of light trucks, and every tool used there is unique. The existing tool-supply base cannot handle the resulting escalation in the number of tools needed. Of immediate concern is the need for local tool maintenance. Here lies significant opportunities for Midwest tool shops to establish satellite facilities in the south- east United States—to handle tool maintenance at first, then evolve to include tool-build capabilities.”

What about the labor shortage and the ability to support an expanding onshore tool base?

Tooling Technology

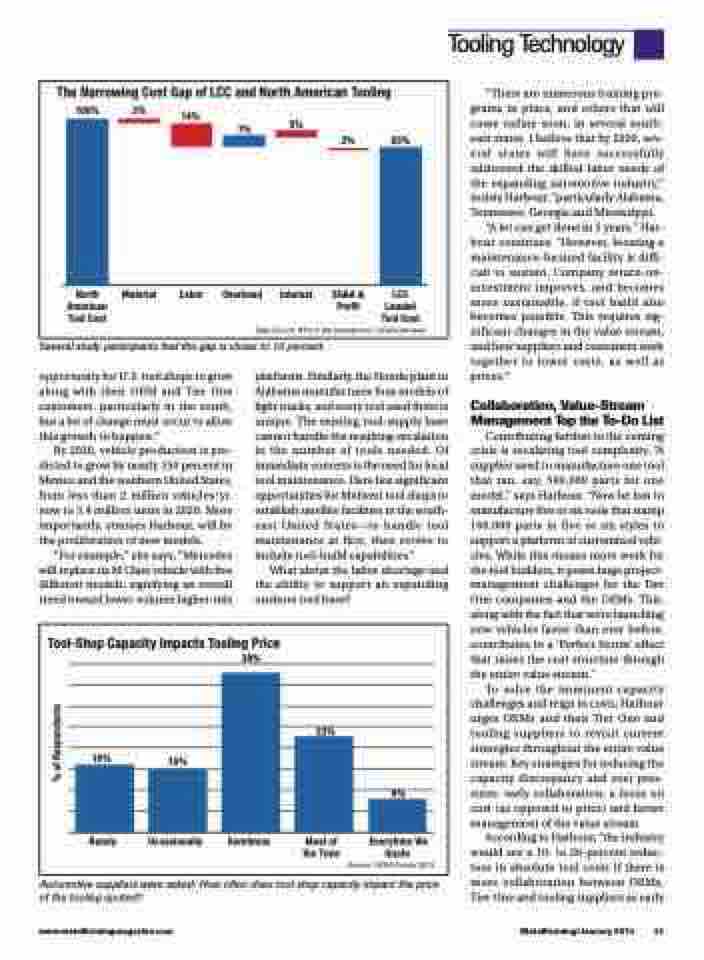

The Narrowing Cost Gap of LCC and North American Tooling

100%

3%

14%

7%

5%

2%

83%

North American Tool Cost

Material

Labor

Overhead

Interest

SG&A & Profit

LCC Landed Tool Cost

Data Source: 83% is the average from OEM interviews

Several study participants feel the gap is closer to 10 percent.

“There are numerous training pro- grams in place, and others that will come online soon, in several south- east states. I believe that by 2020, sev- eral states will have successfully addressed the skilled-labor needs of the expanding automotive industry,” insists Harbour, “particularly Alabama, Tennessee, Georgia and Mississippi.

“A lot can get done in 5 years,” Har- bour continues. “However, locating a maintenance-focused facility is diffi- cult to sustain. Company return-on- investment improves, and becomes more sustainable, if tool build also becomes possible. This requires sig- nificant changes in the value stream, and how suppliers and customers work together to lower costs, as well as prices.”

Collaboration, Value-Stream Management Top the To-Do List Contributing further to the coming crisis is escalating tool complexity. “A supplier used to manufacture one tool that ran, say, 500,000 parts for one model,” says Harbour. “Now he has to manufacture five or six tools that stamp 100,000 parts in five or six styles to support a platform of customized vehi- cles. While this means more work for the tool builders, it poses huge project- management challenges for the Tier One companies and the OEMs. This, along with the fact that we’re launching new vehicles faster than ever before, contributes to a ‘Perfect Storm’ effect that raises the cost structure through

the entire value stream.”

To solve the imminent capacity

challenges and reign in costs, Harbour urges OEMs and their Tier One and tooling suppliers to revisit current strategies throughout the entire value stream. Key strategies for reducing the capacity discrepancy and cost pres- sures: early collaboration, a focus on cost (as opposed to price) and better management of the value stream.

According to Harbour, “the industry would see a 10- to 20-percent reduc- tion in absolute tool costs if there is more collaboration between OEMs, Tier One and tooling suppliers as early

Tool-Shop Capacity Impacts Tooling Price 38%

16%

Rarely

15%

Occasionally

Somtimes

23%

Most of the Time

8%

Everytime We Quote

Source: OESA Survey 2013

Automotive suppliers were asked: How often does tool shop capacity impact the price of the tooling quoted?

www.metalformingmagazine.com

MetalForming/January 2014 41

% of Respondents