Page 52 - MetalForming April 2013

P. 52

20th Annual

The State of the North American

Automotive Supply Base

BY DAVE ANDREA

The North American supply base is fundamentally strong, with great near-term opportunities. Sup- pliers have shown great fortitude through the recession of 2008 to 2009 and resilience through the Japanese and Thailand natural disasters, and must exhibit their resourcefulness in meeting light-duty vehicle-production projections for 2013. The challenge: Supporting the forecasted 15.9 million units of production in 2013, a 600,000 incremental increase over 2012.

How Do We Get There?

Through 2013, suppliers will face capacity constraints, labor issues, extraordinary operating costs, capital- expenditure requirements and other issues. In addition, overall corporate revenue and margins will be under pressure as regional markets, particu-

Dave Andrea is senior vice president, industry analysis and economics, at the Original Equipment Suppliers Associa- tion, Troy, MI, an affiliate of the Motor & Equipment Manufacturers Association: 248/952-6401; www.oesa.org.

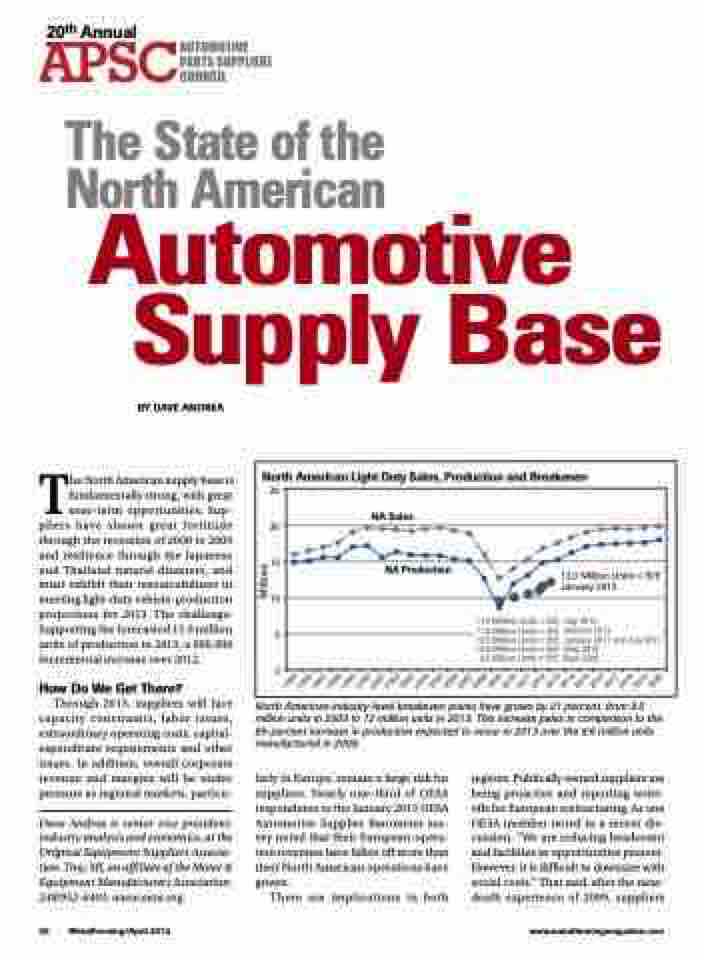

North American industry-level breakeven points have grown by 21 percent, from 9.5 million units in 2009 to 12 million units in 2013. This increase pales in comparison to the 85-percent increase in production expected to occur in 2013 over the 8.6 million units manufactured in 2009.

North American Light Duty Sales, Production and Breakeven

25 20 15 10

5 0

NA Sales

NA Production

12.0 Million Units = B/E January 2013

11.2 Million Units = B/E July 2012 11.0 Million Units = B/E January 2012

10.5 Million Units = B/E January 2011 and July 2011 10.0 Million Units = B/E May 2010

9.5 Million Units = B/E Sept 2009

larly in Europe, remain a large risk for suppliers. Nearly one-third of OESA respondents to the January 2013 OESA Automotive Supplier Barometer sur- vey noted that their European-opera- tion revenues have fallen off more than their North American operations have grown.

regions. Publically owned suppliers are being proactive and reporting write- offs for European restructuring. As one OESA member noted in a recent dis- cussion, “We are reducing headcount and facilities as opportunities present. However, it is difficult to downsize with social costs.” That said, after the near- death experience of 2009, suppliers

50 MetalForming/April 2013

www.metalformingmagazine.com

There are

implications

in both

Millions

1995 1996

1997 1998

1999 2000

2001 2002

2003 2004

2005 2006

2007 2008

2009 2010

2011 2012

2013 2014

2015 2016

2017 2018

2019 2020