Page 70 - MetalForming July 2012

P. 70

Blackman on Taxes

By Irving Blackman

Use the Tax Law to Boost

Annual Income and Create Wealth

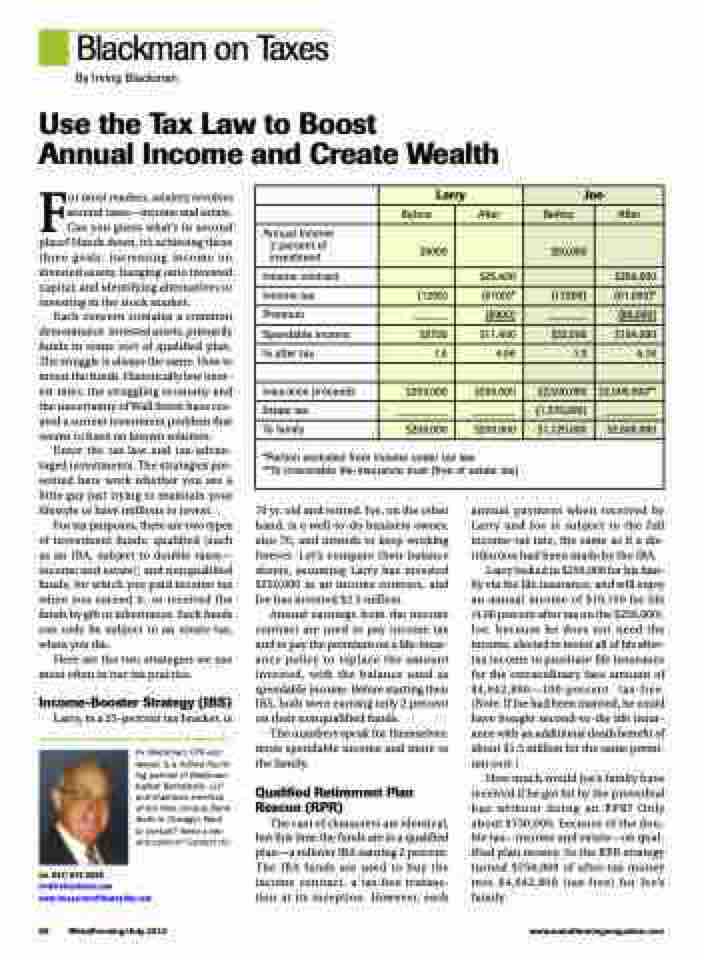

Larry

Joe

Before

After

Before

After

Annual Income 2 percent of investment

$5000

$50,000

Income contract

$25,400

$254,000

Income tax

(1250)

(5100)*

(17,500)

(61,000)*

Premium

______

(8900)

_______

(89,000)

Spendable income

$3750

$11,400

$32,500

$104,000

% after tax

1.5

4.56

1.3

4.16

Insurance proceeds

$250,000

$250,000

$2,500,000

$2,500,000**

Estate tax

_________

________

(1,375,000)

_________

To family

$250,000

$250,000

$1,125,000

$2,500,000

*Portion excluded from income under tax law

**To irrevocable life-insurance trust (free of estate tax)

For most readers, anxiety revolves around taxes—income and estate. Can you guess what’s in second place? Hands down, it’s achieving these three goals: increasing income on invested assets; hanging onto invested capital; and identifying alternatives to investing in the stock market.

Each concern contains a common denominator: invested assets, primarily funds in some sort of qualified plan. The struggle is always the same: How to invest the funds. Historically low inter- est rates, the struggling economy and the uncertainty of Wall Street have cre- ated a current investment problem that seems to have no known solution.

Enter the tax law and tax-advan- taged investments. The strategies pre- sented here work whether you are a little guy just trying to maintain your lifestyle or have millions to invest.

For tax purposes, there are two types of investment funds: qualified (such as an IRA, subject to double taxes— income and estate); and nonqualified funds, for which you paid income tax when you earned it, or received the funds by gift or inheritance. Such funds can only be subject to an estate tax, when you die.

Here are the two strategies we use most often in our tax practice.

Income-Booster Strategy (IBS)

Larry, in a 25-percent tax bracket, is

Irv Blackman, CPA and lawyer, is a retired found- ing partner of Blackman Kallick Bartelstein, LLP and chairman emeritus of the New Century Bank (both in Chicago). Want to consult? Need a sec- ond opinion? Contact Irv:

tel. 847/674-5295

ir v@ir vblackman.com www.taxsecretsofthewealthy.com

70 yr. old and retired. Joe, on the other hand, is a well-to-do business owner, also 70, and intends to keep working forever. Let’s compare their balance sheets, assuming Larry has invested $250,000 in an income contract, and Joe has invested $2.5 million.

Annual earnings from the income contract are used to pay income tax and to pay the premium on a life-insur- ance policy to replace the amount invested, with the balance used as spendable income. Before starting their IBS, both were earning only 2 percent on their nonqualified funds.

The numbers speak for themselves: more spendable income and more to the family.

Qualified Retirement Plan Rescue (RPR)

The cast of characters are identical, but this time the funds are in a qualified plan—a rollover IRA earning 2 percent. The IRA funds are used to buy the income contract, a tax-free transac- tion at its inception. However, each

annual payment when received by Larry and Joe is subject to the full income-tax rate, the same as if a dis- tribution had been made by the IRA.

Larry locked in $250,000 for his fam- ily via the life insurance, and will enjoy an annual income of $10,150 for life (4.06 percent after tax on the $250,000). Joe, because he does not need the income, elected to invest all of his after- tax income to purchase life insurance for the extraordinary face amount of $4,642,800—100-percent tax-free. (Note: If Joe had been married, he could have bought second-to-die life insur- ance with an additional death benefit of about $1.5 million for the same premi- um cost.)

How much would Joe’s family have received if he got hit by the proverbial bus without doing an RPR? Only about $750,000, because of the dou- ble tax—income and estate—on qual- ified plan money. So the RPR strategy turned $750,000 of after-tax money into $4,642,800 (tax-free) for Joe’s family.

68 MetalForming/July 2012

www.metalformingmagazine.com