Productivity Measurements

The annual PMA Benchmarking Report tracks several measurements related to productivity, the three most important of which are:

• Sales per employee;

• Sales per employee;

• Value-added per employee; and

• Capacity utilization.

The 2010 Benchmarking Report (based on 2009 fiscal year-end data) shows that the first two metrics remain at strong levels throughout the industry, while capacity utilization continues to decline. More importantly, the report, which tracks the performance of the industry on average along with the performance of the most profitable companies (based on their operating income), reveals that performance in these three metrics is closely tied to profitability. In nearly all cases, the most profitable companies outperform the rest of the industry in productivity.

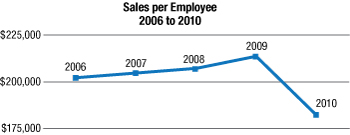

Sales per Employee

Sales per employee, computed by taking a company’s annual sales divided by its total employees, relates to a company’s efficiency. Since 2006, the metalforming industry has averaged a sales-per-employee ratio of $201,000, with a high of $213,000 in 2009. This high level of productivity has resulted from streamlined operations, successful lean-manufacturing implementations and effective use of outsourcing.

Sales per employee, computed by taking a company’s annual sales divided by its total employees, relates to a company’s efficiency. Since 2006, the metalforming industry has averaged a sales-per-employee ratio of $201,000, with a high of $213,000 in 2009. This high level of productivity has resulted from streamlined operations, successful lean-manufacturing implementations and effective use of outsourcing.

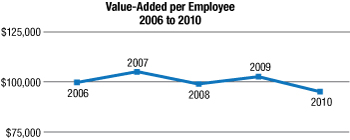

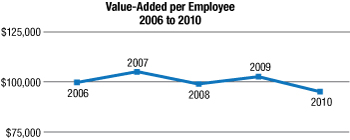

Value-Added per Employee

Another measure of manufacturing productivity, value-added is defined as the difference between total sales and the cost of materials plus outside services. Some consider this a better measure of productivity, since it gauges only the output within the four walls of a company and removes outsourcing from consideration. Value-added per employee has averaged approximately $100,000 during the last five years, with $105,000 (in 2007) at its peak.

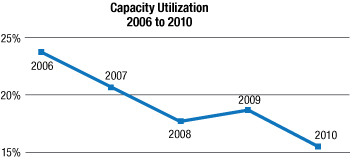

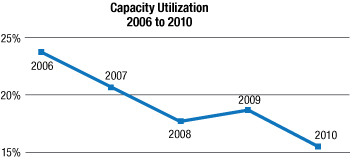

Capacity Utilization

In contrast with the first two performance metrics, capacity utilization has shown a steady decline since 2006. While there are many different s to calculate this metric, the PMA Benchmarking Report uses the following formula to measure uptime against 24 hr./day, seven days/week:

In contrast with the first two performance metrics, capacity utilization has shown a steady decline since 2006. While there are many different s to calculate this metric, the PMA Benchmarking Report uses the following formula to measure uptime against 24 hr./day, seven days/week:

Machine hours utilized/(no. of machines x 8760 hr.) x 100

Capacity-utilization rate has decreased from a high of 24 percent in 2006 to a low of 15 percent in 2010, suggesting that a significant amount of excess capacity remains within the industry. While higher utilization rates generally are preferred, let us not analyze them in a vacuum.

“They should be examined in the context of a company’s overall plan,” says sales, marketing and operations manager, Joseph Carrizales, of PSB Company, Columbus, OH. “Measuring utilization rate is okay,” Carrizales adds, “however the focus for long-term profitability and sustainability is continually improving return on capital and labor utilized, to generate free cash flow. Some executives fall into the trap of maximizing their equipment and people utilization. But this may or may not improve their ability to generate free cash flow.”

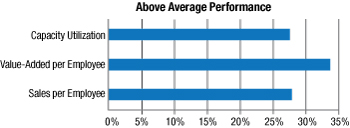

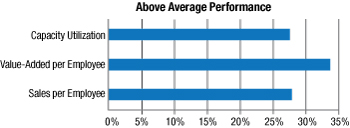

High Performance, Higher Profits

Whether industry performance has improved or declined, one consistent outcome evident from the survey data is that the most profitable companies were more productive—25 percent to 35 percent more productive—than the rest of the industry.

With the ability to do more with less, companies are poised to take advantage of the revival in manufacturing. Tracking productivity and making improvements along the will continue to be essential for success. MF Technologies: Management

Robert Dobrowsky

Robert Dobrowsky Others share this view. According to a Wall Street Journal article titled, “World Revs Up U.S. Profits—Manufacturers Boom on Global Demand, Spurring Stocks to Three-Year High” (April 21, 2010), growth in manufacturing output is very strong compared to the rest of the overall economy.

Others share this view. According to a Wall Street Journal article titled, “World Revs Up U.S. Profits—Manufacturers Boom on Global Demand, Spurring Stocks to Three-Year High” (April 21, 2010), growth in manufacturing output is very strong compared to the rest of the overall economy.

Podcast

Podcast