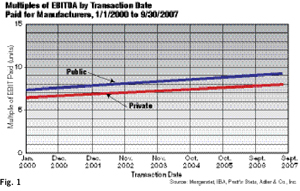

Provided they are profitable, most private manufacturing companies are valued by applying a multiple to their historic cash flow, or EBITDA (earnings before interest, taxes depreciation and amortization). We collected manufacturing transaction data from 2000 through September 2007, including manufacturers with SIC codes from 2200 to 3999 and with transaction values between $2.5 and $200 million, omitting transactions with negative EBDITA multiples. The data showed that the average EBITDA multiple for sellers being acquired by private buyers was 6.52 over the entire study period. The average paid by public buyers was 8.04. The red and blue trend lines in Fig. 1 clearly illustrate an upward progression of EBITDA multiples since 2000.

What’s interesting is the effect that multiples for 2006 and 2007 have had upon the averages. The average combined (public and private) EBITDA multiple from 2000 to 2005 was 7.3. The average for 2006 was 7.83, an increase of 7 percent. The average multiple paid so far this year has been 8.58, a jump of 17.5 percent over the 2000 to 2005 period. It is unlikely that this multiple creep is the result of inflation—inflationary pressure would have an effect on cash flows themselves, but not the multiples, unless buyers and sellers were trying to offset the effects of high expected inflation rates, which they aren’t.

These multiples do not include, or are paid in addition to, lucrative compensation packages that are a part of many acquisitions by PE firms.

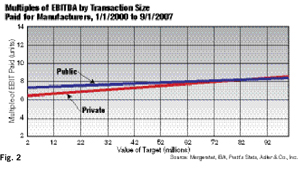

Second, data illustrated by the trend lines in Fig. 2 reveal that as deal size increases, so do transaction multiples. The fact that smaller deals greatly outnumber larger deals keeps the average trend line from becoming steeper. Although exceptions abound, companies worth less than $10 million command multiples of only four to five times EBITDA, on average. The lesson here is clear: It pays to be bigger.

So why has the value of manufacturing companies increased so much since 2000? Three reasons:

1) Private equity funds are flooded with cash.

2) Their favorite sellers are niche manufacturers.

3) Many manufacturers are coming off of several consecutive profitable years.

Have More Money to Spend

Cash has poured into PE funds over the last two years. In July, the publication Private Equity Analyst reported that “U.S. Private Equity firms raised a total of $137 billion in 199 funds during the first half of 2007, a 42-percent increase over the $96 billion raised in 147 funds during the first half of 2006, and on pace to best the record total $261 billion raised last year.”

Not surprisingly, acquisition activity is up. According to Factset Mergerstat, a merger and acquisition information provider, 2006 saw 5744 acquisitions of privately owned companies with a total transaction value of $110.5 billion. This represented a 5-percent increase in the number of deals, and a 9.7-percent increase in transaction value.

What Are PEs Looking For?

Although acquisition criteria vary widely among PE firms, many are interested in buying or investing in niche manufacturing companies with EBITDA of at least $2 million, good profit margins, a defensible market position and a diverse customer base. Geography and industry focus are less important. Niche manufacturers represent attractive investment opportunities because they usually have developed considerable barriers to entry and boast tangible assets that can be used to secure financing.

PE firms look for companies that can continue to grow profit, and that have the ability over time to become best in class. Some PEs are leveraged-buyout firms, and use debt to fund their acquisitions, others avoid debt and use mostly cash. After paying owners for their companies, PE firms also normally offer substantial employment contracts to owners to continue running their companies for several years following a sale.

PE firms make their money in three s:

1) Taking distributions from the acquired company’s current cash flow;

2) ‘Scaling’ or growing the company’s profits; and

3) Selling the acquired company after three to seven years at a profit.

To the extent that the PE firm has succeeded in scaling its acquisition, it can make money on the sale due to the fact that companies with greater EBITDA trade for substantially greater cash-flow multiples.

PEs Changed the Buy/Sell Process

PE firms represent a universe of buyers of middle-market companies that didn’t exist 15 years ago. Since then, their importance as buyers has gown steadily. PE firms arguably are the best kind of buyers a seller can have—typically well-funded, experienced and unemotional buyers in the business of structuring win-win transactions. They often contract with hundreds of ‘buy-side’ intermediaries, such as my firm, to bring them deals. By working with buy-side intermediaries, sellers avoid having to enter into expensive, restrictive and time-consuming ‘sell-side’ listing agreements.

As an example, in a recent transaction the owner of a $20 million precision metal-fabrication company contacted me for assistance in selling his company. After introducing him to several of my clients, all PEs, one group, Kachi Partners, expressed an interest and visited the company. Four months later the transaction closed. This owner didn’t have to hire anyone or pay anything, since our fees were paid by our client, the PE firm. Neither did the owner have to participate in a lengthy search for qualified buyers.

Timing is Everything

PE firms now are flush with cash and sales and profits are strong for most manufacturers—many I talk with project year-over-year increases for 2007. These factors taken together are important: Buyers are comforted that they are not acquiring companies in decline, and sellers are comforted that they are not selling ‘at the bottom.’ So for many manufacturers, this is an excellent time to consider raising equity or selling. MF

Technologies: Other Processes